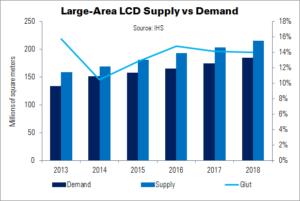

The oversupply issue currently affecting the LCD industry – exacerbated by China’s aggressive investment in production capacity and high fab utilisation – will continue well into 2016, says IHS. Large-area LCD supply is forecast to be 14% higher than demand this year, compared to 12% higher in 2015.

Partly thanks to Chinese government subsidies, LCD suppliers in the country are maintaining high manufacturing targets and expanding capacity. However, LCD TV demand – particularly in emerging countries – has not risen as expected. This is largely due to currency depreciation and slow economic recoveries.

“Panel prices have declined to the degree where the break-even point for manufacturers was reached in the fourth quarter of 2015”, said IHS’ displays director, Yoshio Tamura. Because of declining currency values in emerging markets, demand for higher-priced LCD TVs is not expected to rebound this year. “Even so, Chinese panel makers are not planning to lower fab utilisation any time soon to expand market share”, Tamura added, “which means large-area LCD manufacturers will be in the red in 2016.”

IHS expects Chinese LCD suppliers to adjust fab utilisation in mid-2016, and oversupply will be eased in the second half of 2017. However, if this does not happen then LCD suppliers’ profit margins will suffer even further this year.