Italy’s DBCI fell slightly from the January/February survey, down 3.7 points to 19.99. The index developed upwards until last summer, but began to fall from then onwards. Despite this, the Italian DBCI has remained positive, and is still 3 points higher than March/April 2014. However, the outlook for Q2 and Q3’15 has become much more conservative.

Italy’s volatile economic climate has had a slowing effect on the IT market. OVAB believes that signage vendors can still build on 2014’s ‘robust’ earnings to achieve low double-digit growth this year.

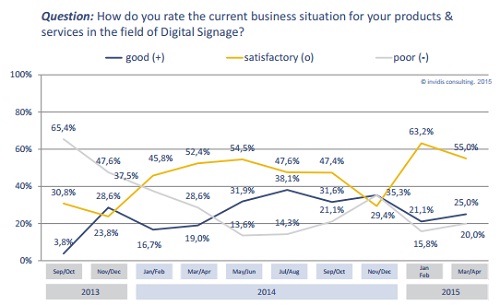

More than half of Italian companies report that their current business situation is good, while 25% call it satisfactory; however, 20% regard it as poor. This is an increase from January/February (15.8%) and is one of the most divided market sentiments seen so far in the March/April survey.

Going forward, fewer companies now expect the next six months to improve. From 47.4% in January/February, the number is now down to 35%. Those expecting no change is up from 47.4% to 65%. However, no companies expect the market to get worse (5.8% predicted this in the earlier survey).

Going forward, fewer companies now expect the next six months to improve. From 47.4% in January/February, the number is now down to 35%. Those expecting no change is up from 47.4% to 65%. However, no companies expect the market to get worse (5.8% predicted this in the earlier survey).

Like other European markets, SMBs are important to signage in Italy, generating 90% of revenues. Retail, corporate communications and shopping centre verticals generated 65% of total revenues last year.

90% of all signage projects in 2014 consisted of fewer than 50 displays; 9% were larger than 100 displays.

The DOOH sector is expected to grow over the next 36 months, taking a 10% – 15% OOH market share in 2018. Most growth is expected to come from cross-media campaigns, but new networks are also predicted to generate a respectable amount.

OVAB has also announced that it will begin to cover the Scandinavian region. Scandinavia is the fourth-largest signage market in EMEA, with revenues more than half of that of the DACH region, despite a much smaller population. Signage penetration is relatively high, and the two largest markets – Sweden and Denmark – had double-digit growth of 20% – 25% last year.