Hayase-san of Omdia is a very well respected analyst in the display market and I finally caught up with a post that he published on the Omdia blog a few weeks ago. In the article, he forecast that the small/medium display market could contract by as much as 11% this year.

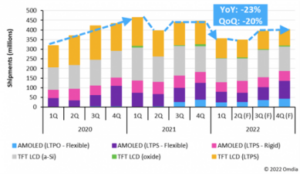

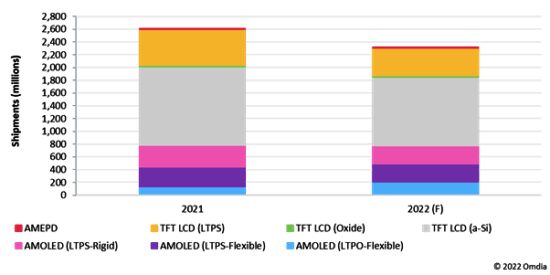

The forecast was based on the results from earlier in the year. Smartphone display shipments were 355.4 million in Q2, down 20% on Q4 2021 and down 23% compared to the same quarter in 2021. The Covid lockdowns in Q2 significantly impacted handset production and Hayase-san said that there was a concern that macroeconomic issues, including the Russian attack on Ukraine, were having a big influence. The industry needed to ‘digest inventory’ so the hope of better shipments in the second half were weak and he thought that the market was unlikely to recover.

The forecast was based on the results from earlier in the year. Smartphone display shipments were 355.4 million in Q2, down 20% on Q4 2021 and down 23% compared to the same quarter in 2021. The Covid lockdowns in Q2 significantly impacted handset production and Hayase-san said that there was a concern that macroeconomic issues, including the Russian attack on Ukraine, were having a big influence. The industry needed to ‘digest inventory’ so the hope of better shipments in the second half were weak and he thought that the market was unlikely to recover.

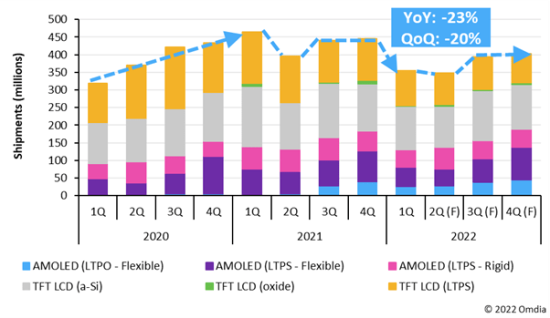

Over the year, Omdia thought that smartphone display shipments could contract by 16% for the whole of 2022.

Positive News from Other Markets

In contrast, there was some positive news from other markets. Smartwatch displays are forecast to reach 255 million units this year as buyers have become even more health conscious than in previous years and are using them as fitness trackers. Automotive displays are expected to reach 197 million units – representing 5% growth on 2021.

Near-to-eye AR & VR display shipments should reach 18.1 million units, up 58% year on year. The boost in foldable smartphone shipments means a bigger demand for smartphone sub-displays which should rise to 14.8 million units.

EReaders are also still a growth category and volumes should rise 5% to 14.8 million for 2022.

On the other hand, small/medium displays for mobile PCs could drop to 88.1 million, down 16%. For other applications:

-

Amusement: 16.0 million units (3% YoY decrease)

-

Multifunction printers: 12.9 million units (5% YoY decrease)

-

Digital still cameras: 8.1 million units (3% YoY decrease)

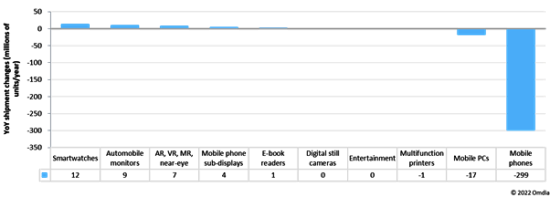

In summary, smartphones are so important that changes there more than wipe out changes elsewhere. Overall, Omdia was forecasting a drop in overall small/medium TFT LCD shipments for 2022 to 1.82 billion, down 16%.

OLED as a whole is expected to decline to 780 million units (down 1%) this year. There is a difference, though between flexible and rigid OLEDs. Flexible AMOLED with LTPO continues to boost its production which should reach 206 million units in 2022 and that would represent year on year growth of 63%. LTPO has been a significant technology for the high end of the smartphone market as it enables low and variable refresh rates.

There are still a lot of potential headwinds for the business caused by geopolitical and macroeconomic issues and that kind of issue could still impact the demand for devices even further. (BR)