Cumulative shipments of foldable smartphones distributed worldwide by the end of 2021 recorded 11.5 million units for the first time since the first foldable smartphone was launched in 2019 according to Omdia‘s 4Q21 smartphone model market tracker.

Due to the high price barrier, sales of early foldable smartphones were limited. However, from the second half of 2021, sales volume increased rapidly with annual foldable smartphone shipments reaching 9 million units in 2021, up 309% year-on-year. Of these, 8 million units were sold in the second half of 2021, accounting for 89% of the total shipment in 2021.

Samsung is the largest original equipment manufacturer (OEM) in the foldable smartphone market. To date, Samsung has shipped over 10 million units, accounting for more than 88% of the foldable smartphone market, which is also the only brand in the market with over 10 million foldable smartphones. Samsung has released a total of nine foldable smartphone models, and the foldable smartphones currently on sale are Samsung’s 3rd generation models.

“Shipments of Samsung’s flagship smartphones, such as the Galaxy S and Note series have been declining year on year. To compete with the rapid progress of Chinese OEMs and Apple within the premium market, Samsung chose to bet on its foldable smartphones; a decision which has taken it is far ahead of its rivals in the number and sales of foldable smartphones” said Zaker Li, Principal Analyst within Omdia mobile devices team.

Zaker continues, “In terms of supply chain, Samsung has a clear advantage in the foldable smartphone market as it owns Samsung Display, the world’s number one foldable display maker.”

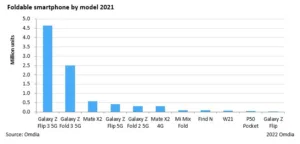

With 4.6 million shipments, Samsung’s Galaxy Z-Flip 3 5G became the world’s largest foldable smartphone model, which accounted for 52% of the foldable smartphone market in 2021. The Galaxy Z-Flip 3 5G has been upgraded in design from its predecessor, compared with Galaxy Z Flip 5G and released at $999, $380 cheaper than its predecessor. Through hardware upgrades and price cuts, Samsung shipped 3.5 million units more Galaxy Z-Flip 3 5G in 2021, compared to the predecessors Z-Flip (LTE and 5G combined) in 2020.

The second most shipped foldable smartphone in 2021 was the Galaxy Z Fold 3 5G at a total of 2.5 million units of. The launch price of the Galaxy Z Fold 3 is $1,800, which is a $200 cheaper than the 2020 model, the Galaxy Z Fold 2. However, shipments in the year of release surpassed the 0.7 million units of the Z Fold 2 in 2020 primarily due to significant improvement to the quality of the product over the generations and related content using stylus support and foldable form factors.

Huawei is the second largest OEM in the foldable smartphone market, with shipments of 0.9 million units accounting for 10% of the market in 2021. Huawei launched its foldable smartphone in China earlier than other manufacturers and to date has recorded cumulative sales at 1.2 million. As the company is still subject to US sanctions, Huawei can only sell 4G smartphone models which have been shipped to China’s domestic market. Although the price of Huawei’s mate X2 is still very high, 0.6 million units were shipped in 2021. Huawei introduced a new foldable smartphone phone, P50 Pocket, following the same form factor of Samsung Galaxy Z-Flip 3 5G priced at $1,400, and still only available in China.

Other brands have also tentatively introduced foldable smartphones. Xiaomi debuted its Mix Fold in the first half of 2021 and although Xiaomi broke the price bottom of the product at that time, sales did not meet expectations. Xiaomi plans to release the second-generation foldable smartphone in the first half of 2022.

OPPO also joined the foldable smartphone market with Find N released in Q4 2021. Following a positive consumer reaction to the launch of Find N, demand exceeded supply. Oppo has attempted to differentiate itself from competitors’ foldable smartphones by changing the display ratio. The Find N is the most compact foldable phone with a 7-inch inner display. However, it was released at a high price point from 8,699CNY (US$1,377).

More OEMs are continuing to join the competition. Honor released Honor Magic V in January 2022, starting at 9,999 CNY (US$1,582 USD) and Vivo will launch its first foldable smartphone in the first half of 2022.

While mainstream brands are entering the foldable smartphone market, sales opportunities will be limited for most of Chinese OEMs. Foldable smartphones from Chinese OEMs are expected to be sold mainly in the Chinese domestic market this year as well. To increase sales volume, the most important task for Chinese companies is to overcome the image of low-end brands in overseas markets.

As more companies launch foldable smartphones, the diversity of designs and the use of new form factors will increase. However, since foldable smartphones are expected to occupy the highest position in the smartphone lineups of all manufacturers in the future, the possibility that foldable phones will become a mainstream market in the future is very low.

This year, the global foldable smartphone market is expected to grow significantly compared to last year with 14 million units. Furthermore, it is expected to grow steadily every year increasing to 61 million units by 2026 and accounting for 3.6% of the total smartphone market.