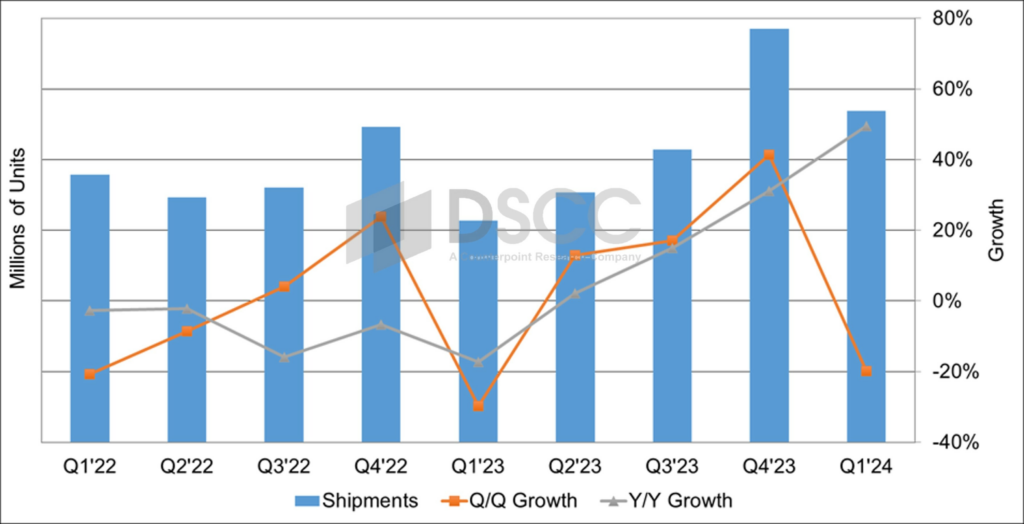

OLED panel shipments saw a significant year-over-year (YoY) increase of 50% in the first quarter of 2024, bolstered by strong demand across various applications such as monitors, tablets, smartphones, TVs, and smartwatches, according to the latest data from DSCC. Despite a seasonal quarter-over-quarter decline, OLED smartphones and TVs still recorded year-over-year growth.

Overall, OLED panel shipments fell 20% quarter-over-quarter even as they jumped 50% YoY in Q1 2024. This follows a strong showing in the previous quarter, where shipments increased 41% quarter-over-quarter and 31% YoY. OLED monitor panel shipments rose 35% quarter-over-quarter and 189% YoY, while OLED tablet panel shipments surged 54% quarter-over-quarter and 113% YoY. The ongoing YoY growth across several OLED applications reflects a market recovery that began in the second half of 2023, following a challenging 2022 and early 2023.

Smartphones continued to dominate as the largest OLED application, capturing 84% of the unit share in Q1 2024, up from 79% in Q4 2023, driven by a 25% quarter-over-quarter growth in rigid OLED smartphone panels. Brands such as Huawei, Samsung, and Oppo achieved double-digit quarter-over-quarter increases, with Samsung leading the charge at 56%, including 82% growth in rigid OLED smartphones and 32% growth in flexible OLED smartphones.