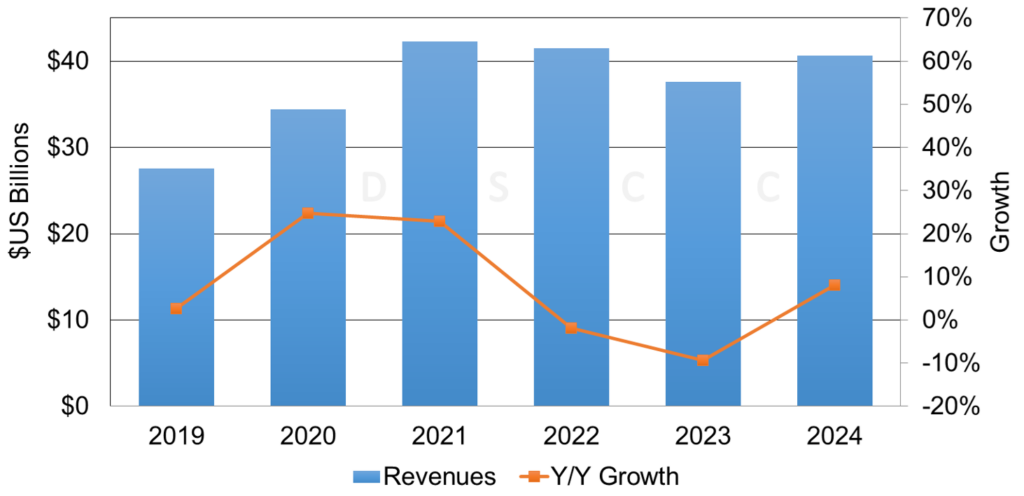

DSCC is reporting that OLED panel revenues are projected to experience a 9% YoY decline in 2023, settling at $37.6 billion. This figure, however, marks an improvement over initial forecasts, which predicted a steeper 13% drop. The revision is attributed to a 2% increase in unit sales, spurred by a second-half-year resurgence in demand and inventory adjustments across various applications.

OLED smartphones witnessed a 9% increase QoQ and a significant 22% jump YoY. Similarly, OLED tablets recorded a staggering 61% and 103% rise in quarterly and yearly comparisons, respectively. Other applications also demonstrated growth, contributing to an overall 37% rise in the latter half of 2023 compared to the same period in 2022.

Looking at specific OLED applications in 2023, the market saw mixed results:

- OLED smartphones are expected to see a 6% YoY increase in units but a 9% decrease in revenue, despite significant growth in both flexible and foldable OLED smartphone units. This paradox is partly due to significant declines in panel average selling prices (ASPs).

- OLED TVs faced a downturn, with predictions indicating a 29% drop in units and a 26% decline in revenues.

- OLED notebook PCs also struggled, with a forecasted 26% decrease in units and a 33% fall in revenue. This trend was largely impacted by inventory challenges and broader economic factors in the first half of the year, although a rebound was observed in the second half, driven by seasonal demand.

The report also anticipates growth in other OLED applications, including augmented/virtual reality (AR/VR), automotive, monitors, and tablets. Looking ahead to 2024, the sector is expected to see an 11% increase in units and an 8% rise in revenue. This growth is anticipated to be fueled by substantial YoY increases in AR/VR and IT applications, with the entry of major players into the OLED tablet market.

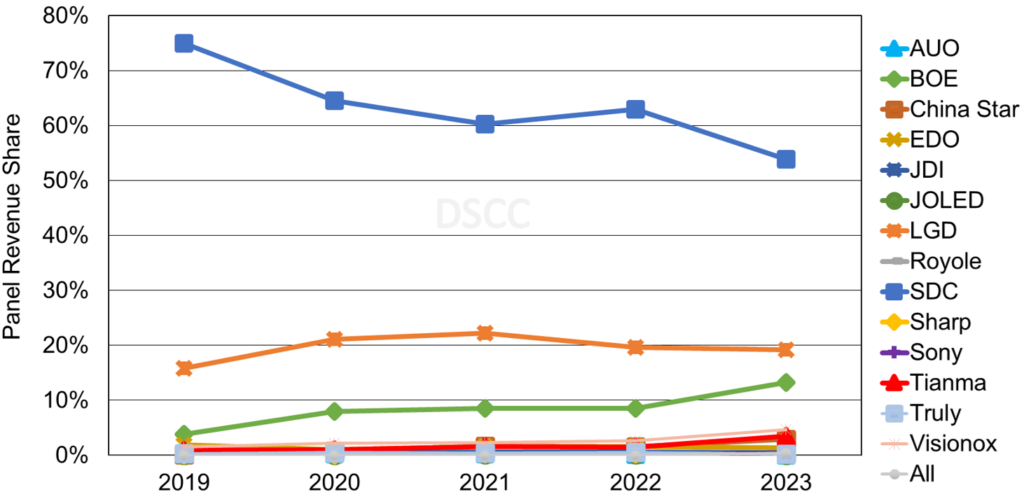

In the context of market shares among panel suppliers, certain trends were noted for 2023:

- SDC is expected to dominate the panel revenue share, driven by robust growth in monitors, automotive, and tablets. Notably, SDC is projected to command a 76% share in iPhone 15 series panel shipments.

- LGD’s revenue share is anticipated to be 19%, a slight decrease from the previous year. LGD’s significant contributions are in supplying panels for various iPhone models and leading in OLED monitors and TVs.

- BOE is projected to be the third-largest panel supplier, with its revenue share increasing to 13%, up from 9% in 2022. This growth is credited to a surge in smartphone units and substantial advancements in automotive applications.

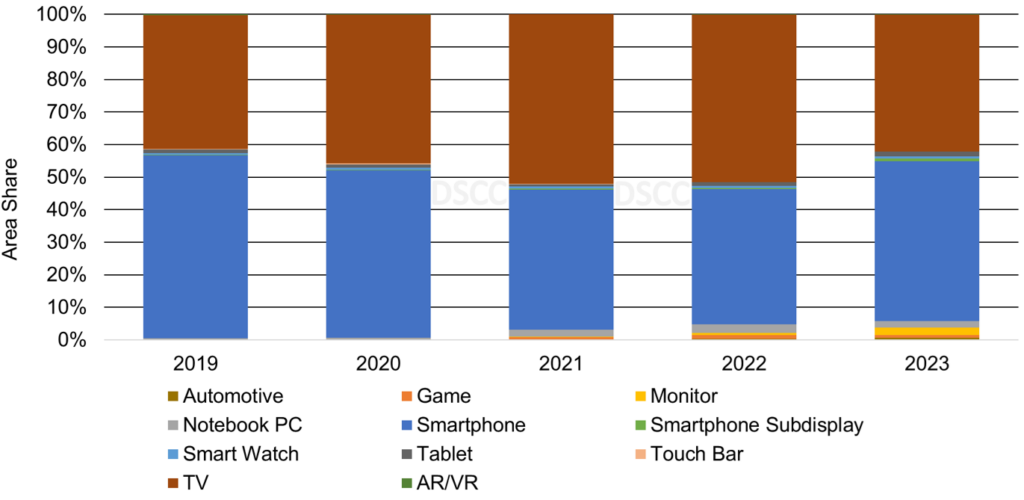

On an area basis, OLED TVs are expected to see a decrease in market share, while smartphones, tablets, automotive applications, and monitors are projected to gain ground. OLED smartphones, in particular, are forecasted to expand their area share significantly.