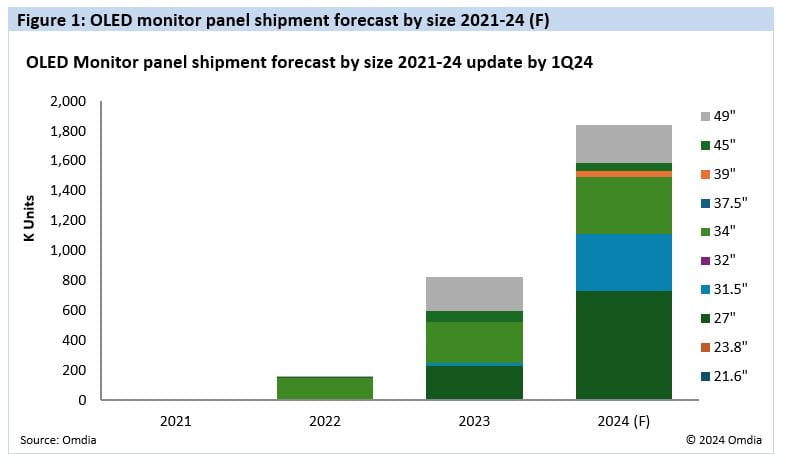

In 2023, OLED monitor display shipments surged by 415% year-over-year (YoY), according to Omdia. This growth is expected to continue, with a forecasted 123% YoY increase in 2024, reaching 1.84 million units. This upward trajectory is driven by industry leaders Samsung Display and LG Display.

OLED monitors, primarily used for gaming, have gained significant traction following the inclusion of esports in the 2023 Asian Games in Hangzhou, China. Nick Jiang, Principal Analyst in Omdia’s Displays research practice, highlighted this milestone as a key factor in transforming esports from a grassroots event into a recognized sporting event.

The COVID-19 pandemic has influenced consumer behavior, leading to trends such as increased multiscreen interactions and higher demand for monitors with advanced specifications, including high resolution and refresh rates. With the typical three-year product management cycle and after-sales service period for monitors, Omdia anticipates a replacement cycle starting from 2024.

The market downturn in 2022 and 2023 posed significant challenges for the monitor supply chain. However, brands have focused on reducing inventory through various supply chain operations, and the industry is now entering a recovery phase. After hitting a two-year low, the overall monitor market is expected to recover gradually in 2024, presenting opportunities for the expansion of OLED monitor products.

As consumer demand for better specifications and larger monitors continues, there is an anticipated rise in LCD monitor panel prices. This price increase will narrow the gap between LCD and OLED monitors, making OLED technology more accessible. Leading monitor brands, including Dell, HP, Lenovo, Samsung, LG Electronics, AOC/Philips, Asus, Acer, MSI, and Gigabyte, are increasingly incorporating OLED displays into their 2024 product lineups. This trend is beneficial for the supply chain, helping to reduce costs for both OEM and panel companies. The increased production of OLED monitors allows for cost distribution among multiple brands, resulting in lower production costs and more competitive pricing for OLED technology.