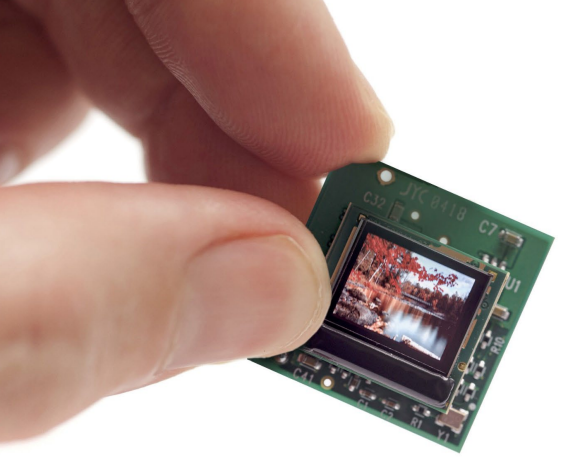

eMagin, the only U.S.-based manufacturer of Active Matrix OLED microdisplays for high-resolution, AR/VR and other near-eye imaging products, saw a 17% increase in 2022 YoY sales.

Fourth Quarter and Full-Year Highlights

- Fourth-quarter 2022 revenue of $8.4 million, a 17% increase over the fourth quarter of 2021

- Full-year 2022 revenue of $30.5 million, a 17% increase over full-year 2021

- Achieved positive EBITDA for the fourth quarter and the full year of 2022

- As of December 31, 2022, strong backlog of open orders of $14.8 million, up 7% from the end of 2021

“We achieved near-record revenues of $8.4 million in the fourth quarter and full-year 2022 revenues of $30.5 million,” said eMagin CEO Andrew G. Sculley. “This represents significant growth relative to the fourth quarter and full year of 2021. We ended 2022 with robust shipments of displays used in the Enhanced Night Vision Goggle–Binocular (ENVG-B) program, along with displays for thermal weapons sights and medical applications.

“Bookings for the fourth quarter were strong, including a $1.7 million order for the F-35 Helmet Mounted Display System and more than $2 million in medical applications. Our backlog of open orders as of December 31, 2022, shippable within 12 months, was $14.8 million.

“2022 included a number of contract wins and operational highlights. In June, the U.S. Army’s Program Executive Office for Simulation, Training, and Instrumentation (PEO STRI) awarded us a $2.5 million, two-year development contract to secure a U.S. source for high-performance microdisplays that provide high brightness and visual acuity, even in bright daylight conditions. Upon completion, this contract has the option of a follow-on production agreement.

“In October, we achieved AS9100 REV D and ISO 9001:2015 quality certifications. These were important milestones for eMagin because these certifications are required by most customers in the aerospace, aviation and defense industries.

“Throughout 2022, we improved our positioning as a supplier of choice to address the rapidly expanding AR/VR market with our patented direct-patterned technology dPd. In April, we announced several patents related to our dPd technology. In May, our dazzling, full-color 10,000 cd/m2 WUXGA display with dPd technology, won the People’s Choice award for ‘Best New Display Technology’ at Display Week, the annual tradeshow of the Society for Information Display (SID).

“Additionally, we designed an improvement to the R&D chamber for our existing OLED deposition tool that will enable us to further enhance this technology. This improved R&D chamber was delivered in December and is currently being set up for our dPd runs. The production-capable dPd organic deposition tool that we purchased last year under Title III funding has passed acceptance testing at the vendor’s facility and will be delivered to our newly expanded cleanroom this April to begin the installation and qualification processes.

“We continue to be the only U.S. manufacturer of OLED microdisplays and our manufacturing operations in New York’s Hudson Valley are benefiting from equipment installed under our Defense Production Act Title III and IBAS funding grants. We are seeing increases in manufacturing yields, throughput, and efficiencies, and anticipate continued improvements as we take delivery and qualify the remaining tools under the program, including the new dPd-capable, organic deposition tool. We appreciate the continued support provided by these programs and we remain on track and within the requirements of the Title III and IBAS funding grants.

“The fourth quarter of 2022 was the fifth consecutive quarter in which eMagin achieved year-over-year growth in product revenues and exceeded $7.0 million in quarterly product revenues. Thanks to our improved performance, we generated $1.9 million of positive EBITDA for the fourth quarter and $2.2 million in positive EBITDA for full year 2022.

“In 2023, we will be presenting our next set of dPd technology-based products to customers building consumer devices as well as starting the qualification process for our new production tool.”

Fourth-Quarter Results

Total revenues for the fourth quarter of 2022 of $8.4 million, increased 17%, from $7.2 million in the prior-year period, and a sequential increase of $0.8 million from revenues for the third quarter of 2022. Total revenues consist of both product revenues and contract revenues.

Product revenues for the fourth quarter of 2022 were $7.8 million, an increase of $0.7 million from product revenues of $7.0 million reported in the prior-year period, and an increase of $0.7 million compared with the third quarter of 2022. The year-over-year quarterly increase in product revenue was due primarily to increased military market revenues, including shipments of displays used for night vision and thermal weapon sights, as well as increased industrial and commercial market revenues.

Contract revenues were $0.6 million, compared with $0.2 million in the prior-year period, due to development associated with a high-brightness display design for PEO STRI, and a proof-of-concept display for a tier-one consumer company.

Total gross margin for the fourth quarter was 41% on gross profit of $3.4 million, compared with gross margin of 24% on gross profit of $1.8 million in the prior-year period. The increase in gross margin was due in part to the successful qualification and sale of reclaimed displays that were previously written off due to an initial quality issue that was subsequently resolved. Total gross profit and total gross margin do not reflect costs associated with the production of such reclaimed displays. As such, costs were recorded in prior quarters. Sales of previously written-off reclaimed displays had a positive effect on total gross profit in the amount of approximately $0.6 million. Excluding gross profits attributable to such previously written-off products, total gross profit would have been $2.8 million and total gross margin would have been 34%. Although, in the future, the Company may sell additional previously written-off products, the gross margin and yields may vary from current-quarter levels.

Operating expenses for the fourth quarter of 2022, including R&D expenses, were $3.3 million, compared with $3.5 million in the prior-year period. Operating expenses as a percentage of sales were 39% in the fourth quarter of 2022, compared with 49% in the prior-year period. R&D expenses as a percentage of sales were lower in the fourth quarter of 2022 due to higher costs allocated to cost of goods sold for contract programs. SG&A expenses were higher in the fourth quarter versus the prior-year period due primarily to an increase in legal costs.

In the fourth quarter of 2022, the operating loss narrowed to $0.1 million, compared with $1.8 million in the prior-year period.

Net income for the fourth quarter of 2022 was $0.8 million, or $0.01 per share, which includes $0.8 million of other income related to a claim for an employee retention credit filed in the fourth quarter of 2022. Excluding the impact of the change in the warrant liabilities, net loss was $2.2 million, or $0.03 per share, in the prior-year period.

Adjusted EBITDA for the fourth quarter was positive $2.0 million, compared with negative $0.8 million in the prior-year period.

As of the end of 2022, the Company’s backlog of open orders scheduled for delivery over the next year was $14.8 million, which represented a 7% increase from the end of 2021.

Full-Year Results

Revenues for 2022 increased 17% to $30.5 million, from $26.0 million in 2021. Product revenues increased 19% to $28.8 million, from $24.2 million in 2021, primarily due to higher military revenues, including shipments of displays used for the ENVG-B program, and higher revenue contributions from medical customers.

Contract revenues totaled approximately $1.7 million, representing a 10% decrease from $1.9 million in 2021. Contract revenues primarily reflected development associated with a high-brightness display design for the Department of Defense and a proof-of-concept display for a tier-one consumer company. Contract revenues are milestone-based and are not uniformly distributed through the duration of the project.

Gross margin for 2022 increased to 34%, compared with 18% in 2021. Gross margin for 2022 was positively impacted by the above-mentioned qualification and sale of reclaimed displays. Total gross profit and total gross margin do not reflect costs associated with the production of such reclaimed displays. These costs were recorded in prior quarters. Sales of previously written-off reclaimed displays had a positive effect on total gross profit in the amount of approximately $1.3 million. Excluding gross profits attributable to such previously written-off products, total gross profit would have been $9.0 million and total gross margin would have been 30%. Although, in the future, the Company may sell additional previously written-off products, the gross margin and yields may vary from current-quarter levels.

Operating expenses for 2022, including R&D expenses, were $13.3 million, compared with $14.6 million in 2021. The majority of the decrease was in R&D expenses due to significant investments in the prior-year periods related to the development and qualification of high-brightness XLE and dPd processes. SG&A expense increased compared to 2021, reflecting increases in legal costs and non-cash compensation.

Operating loss for 2022 narrowed to $2.9 million, versus $10.0 million in 2021. Net loss for 2022 narrowed to $1.1 million, or $0.01 per share. This compares with a net loss of $5.2 million, or $0.07 per share, in 2021. Excluding the impact of the non-cash change in the fair value of the warrant liability for both years, net loss for 2022 was $0.03 per share, versus a net loss of $0.12 per share in 2021.

Adjusted EBITDA for the year was positive $2.2 million, compared with negative $4.1 million in the prior year.

As disclosed in its Form 10-K for the year ending December 31, 2022, the Company received an audit opinion with a going concern qualification.

Balance Sheet Highlights

The Company’s financial position as of December 31, 2022 reflects a total of $4.3 million in unrestricted cash and cash equivalents, representing a year-over-year decrease of $1.4 million. This is in addition to $0.3 million of cash restricted for purchases of equipment under Title III and IBAS government grants. The Company had $1.0 million in outstanding borrowings and $1.8 million in credit availability under its revolving credit facility as of year-end 2022. This compares with outstanding borrowings of $2.0 million and borrowing availability of $2.3 million at year-end 2021.

During the year, the Company realized $5.8 million in net proceeds from the sales of common shares under its ATM program.