With the third quarter results mostly in, it is a good time to look at the position and trends of the market leaders to see in what direction the display industry ship is sailing.

Samsung Display

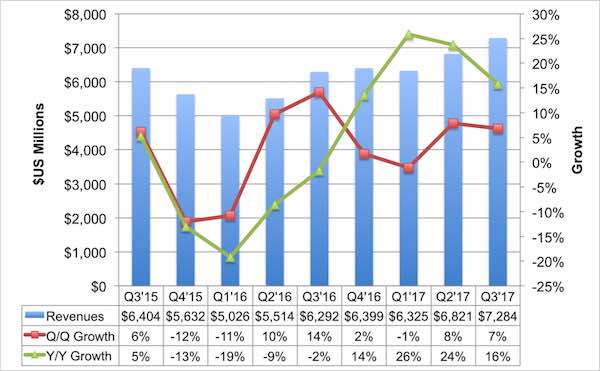

According to the article ‘Samsung’s OLED Margins Stumble in Q3’17 on Lower Utilization‘ by the DSCC (Display Supply Chain.Com) we see a continued increase in overall display revenue as shown in the first chart below.

DSCC – Samsung Q3’17 Display Growth

DSCC – Samsung Q3’17 Display Growth

The chart shows how Samsung has been growing its display business continuously since the beginning of 2016. Revenues have grown from $5 billion in the first quarter of 2016 to about $7.2 billion in Q3 of 2017. This represents an almost 50% increase in a year and a half. The more disturbing part of the picture is the decreasing growth rates not only QoQ but also YoY.

In the article DSCC, points to the importance of the OLED business for Samsung as is demonstrated by the split between OLED and LCD business.

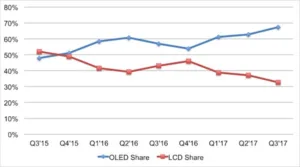

DSCC – Samsung Q3’17 OLED – LCD share

The chart shows that since the end of 2015, Samsung’s OLED revenue outpaced the LCD revenue. Since last year, this trend has increased with only about 32% of the Samsung display revenue coming from LCD panels in the last quarter. This trend is partially due to their early focus on small OLED display panels where the success of the Samsung phones helped them in both the Samsung Display and Samsung Electronics businesses. Of course. we cannot forget that this early focus also resulted in a technological leadership in OLED over the last two years.

As DSCC points out, there is a second component to this development that has to do with an oversupply of large LCD panels resulting in price pressure and decreasing street pricing for LCD panels. Based on this development, the revenue from LCD panels decreased slightly over the last two years which made the OLED panel revenue increase more pronounced. According to their data, LCD revenue declined from about $3 billion to about $2.3 billion in the last quarter, while OLED revenue increased from around $3 billion to about $5 billion in the same time frame.

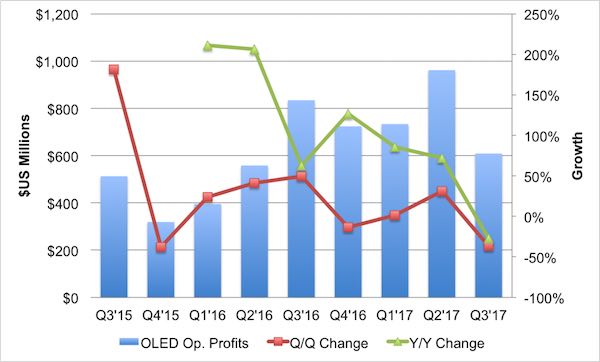

More importantly DSCC hints at a declining profitability for OLED at Samsung as shown below.

DSCC – Samsung Q3’17 OLED Operating Profit

DSCC – Samsung Q3’17 OLED Operating Profit

While the OLED market segment is still profitable, the profit development is not as glamorous as the revenue growth. One could argue that the OLED operating profit is on a decline for the last year, with the exception of the second quarter of 2017. DSCC points out that there are two major issues driving this development in the third quarter. First, there is the delay of the iPhone X release based on a delay of face recognition chips (not Samsung’s fault) as well as some yield issues with a new cover glass process. Both issues should go away in the fourth quarter making DSCC believe that the fourth quarter will see improved operating profit again.

From a long term perspective, one could come to the conclusion that the split between OLED and LCD will continue to develop in the favor of OLED, as the next year will see increased price pressure form large Chinese LCD plants entering into production.

LG Display

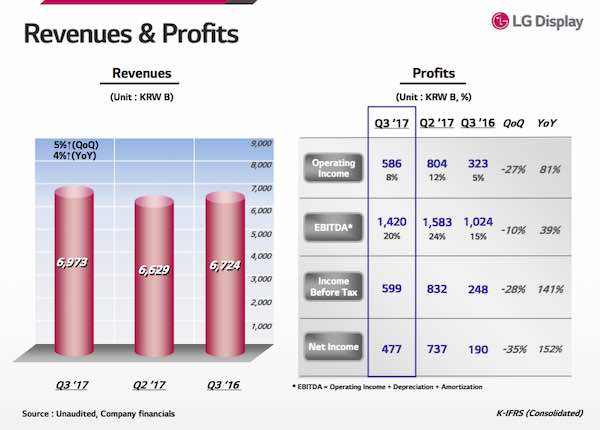

The results at LG are also very positive, with display revenue increasing 4% and 5% QoQ and YoY respectively. As they show in following chart, their display revenue has been increasing over the second quarter 2017. At the same time they also show a decrease in operating profit for the third quarter compared to the second quarter. At least they show an increase in the operating profit YoY.

LG: Q3’17 Revenue and Profit

LG: Q3’17 Revenue and Profit

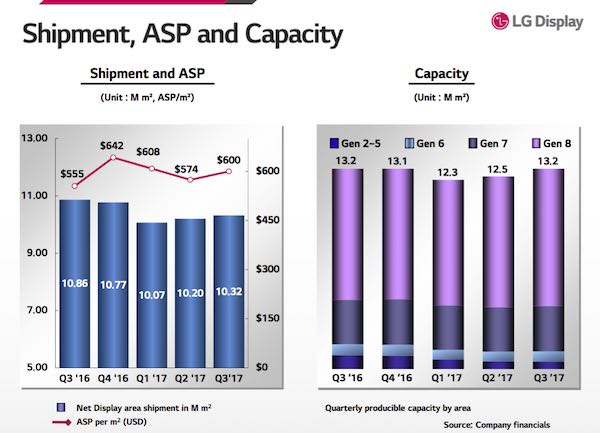

Interestingly, DSCC show a different picture for their ASP. While Samsung seems to be suffering from a price decrease in large LCD panels, LG showed an increase in the average sales price compared to the second quarter. Looking at the increased shipments and capacity, the capacity utilization is just under 80%.

The interesting part of their presentation is the fact that the ASP increased in the third quarter and Samsung argues that the declining street prices for large panels caused a decrease in LCD revenue. Of course, we have to point towards an increase of large OLED and QD panels as the driver behind the sales price increase. In other words, LG is already moving towards higher end panels to avoid the price fight with Chinese suppliers.

So far, this strategy seems to be working for LG. Also, LG is more heavily geared towards larger panels (40% of revenue comes from TV panels) even though this ratio has also changed in the third quarter. In the second quarter, the TV revenue share was still at 46%, while small panels have increased their revenue share from 22% in Q2 to 27% in Q3. This indicates that LG is moving more to a product mix comparable to Samsung and away from the large panel LCD business. Nevertheless, LG has still along way to go before they catch up with Samsung in the small OLED business and from a technology standpoint the Google Pixel 2 display issues will not help in that development, even if LG is not responsible for these issues.

Overall, I believe that the trend towards using OLED panels in the display industry continues to develop. However, with large LCD Chinese fabs entering the market we can assume a further decline of large panel pricing in the market and consequently lower TV set prices as well.

Consequently TV prices with advanced display technologies (QD or OLED) may stay at today’s prices, while standard LCD TVs may sell at a discount. Another interesting development is the use of LCD panels for the latest low cost VR headsets. Ever since Oculus Rift used OLED panels in their headsets, VR was seen as a domain for OLED. This seems not to be true any more, and, in general, the lower LCD pricing may funnel the use of LCD in this market segment. This makes the LCD development somewhat dependent on the market development of a new product category. Who would have thought this just two years ago? – NH