A couple of weeks ago, Norbert looked at the recent results from Samsung and LG’s OLED businesses. Since then, DSCC has released some data from its Japan OLED event at the end of October that looks ahead to OLED and LCD developments.

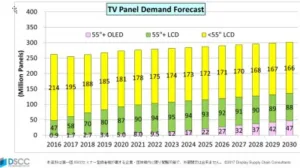

Yoshi Tamura, a highly respected analyst in the display industry, presented a very long forecast for OLED vs LCD and it highlights the view I’ve had of the future of TV for a long time. Tamura presented a chart that showed what a limited impact will OLED will have on the volume TV market and forecasts that it will reach just 15.6% by volume by 2030. That’s a long way ahead of today, but shows that OLED will not make it to become the volume TV display technology, despite the huge hype and interest in OLED TV at the moment and despite the apparent promise of new production technologies such as inkjet printing.

Yoshi Tamura, a highly respected analyst in the display industry, presented a very long forecast for OLED vs LCD and it highlights the view I’ve had of the future of TV for a long time. Tamura presented a chart that showed what a limited impact will OLED will have on the volume TV market and forecasts that it will reach just 15.6% by volume by 2030. That’s a long way ahead of today, but shows that OLED will not make it to become the volume TV display technology, despite the huge hype and interest in OLED TV at the moment and despite the apparent promise of new production technologies such as inkjet printing.

DSCC doesn’t expect any kind of radical change in TV, by the look of the numbers and expects market growth from just around 255 million this year to 301 million, a CAGR of just 1.28%, so not very exciting growth. The firm also doesn’t expect much growth in very large LCD screens (>55″ LCD) after a boost between now and 2023 from and with most of the growth in large sizes (55″ +) in OLED after that period.

The forecast confirms something I have been saying for more than 10 years (I wrote it first in my CES 2007 report). “OLED has my heart, but LCD has my head”. What I meant by that is that although the visual performance of OLED is fantastic and the form factor amazing, the sheer level of investment in LCD already made and planned in new fabs (still true today) means that OLED will not be able to break out of the premium market segment that it is in.

In a Display Daily in 2016 (Checking the Flavour of the Kool-Aid), I explained a long term view I have had that ‘OLED is the Trinitron of FPDs’. In the days of CRT TVs, Sony won its premium position in the market because its Trinitron CRTs looked better in the store than competing technologies. It was more expensive, but those that cared were prepared to pay. At the moment, this is exactly the same for OLED. It remains more expensive to make than LCD.

Why is this Important?

The key point of this positioning for OLED is that if it continues to dominate the premium segment (and despite Samsung’s protestations, I believe it is), TV makers will want to use it as the only place that you can really stand any chance of making money by making TVs is in the premium segment. Being restricted to the mainstream or entry level market makes it impossible to make a profitable business, unless you just focus on cost.

Samsung’s TV business is at something of a crossroads if it can’t continue to command a good share of the TV business. On that basis, I’m really looking forward to what it will show at CES. The company has to be technically aggressive to hit back at LG and I would be surprised if Samsung’s engineers disappointed! I’m looking forward to seeing some really, really good looking QD-based LCDs.

OLED Can Still Reduce Cost

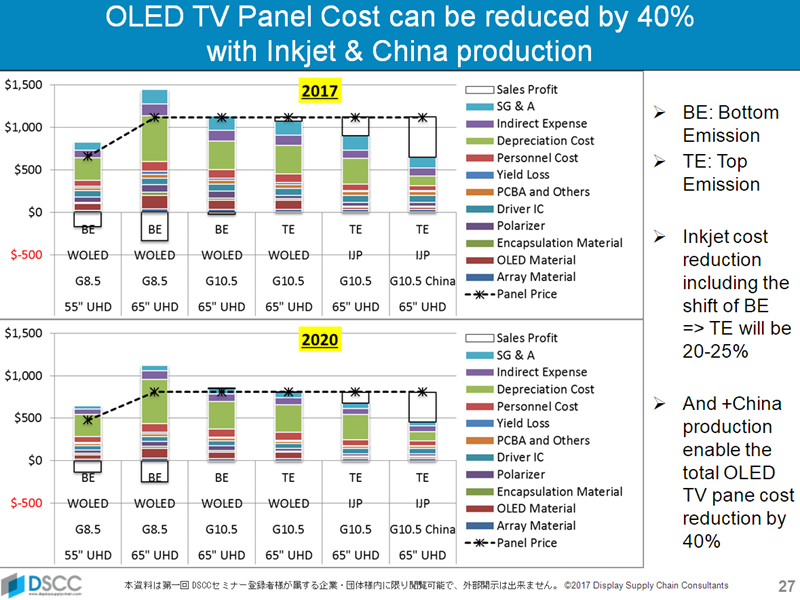

Tamura looked at several ways of reducing cost in making OLED:

- Moving production to China to reduce the financial cost by exploiting the support for the capital expenditure

- Changing to Multi Mother Glass technology to make different sizes on the same G8.5 substrate to use more of the glass and reducing the need to move to G10.5 to make bigger panels (I plan a further Display Daily on this topic)

- Moving from bottom emission to top emission – today’s OLED TV panels lose some of the light created because the transistors are on the top of the stack and block some of it. Moving the transistors to the bottom helps to get more of those precious photons out to the viewer (this also assumes RGB OLEDs although LG was very clear at its OLED day a few weeks ago, that it would stay with White OLED)

- Switching to Inkjet production

Overall, he believes that OLED panel cost can be reduced by up to 40% by moving to China and adopting inkjet. Inkjet printing has been a target for a long time, and Kateeva claims it can do it, but until I see someone doing it with good yield in a production environment, I will remain cautious.

The key point, however, is that even if costs come down that much, there would have to be huge investment in OLED fabs to allow the technology to take a share that is very different from the DSCC forecast. – Bob Raikes