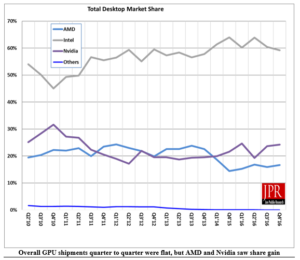

Jon Peddie Research said that the GP market was flat from Q3 to Q4 in 2016, in line with normal seasonality. In graphics, Q2 is the trough, Q3 is the peak, Q4 is flat to a little up and Q1 is flat to a little down. Both AMD and Nvidia increased in share, by 1.4% and 1.5% respectively over 2015, and both companies also saw their shares increase from Q3. Intel’s share fell back on a quarterly and annual basis. On the year, the overall market was down 1.9%, with desktops down 3% and notebooks down 1%.

The Gaming PC segment was up.

Quick highlights

- AMD’s overall unit shipments increased 10.49% quarter-to-quarter, Intel’s total shipments decreased 4.01% from last quarter, and Nvidia’s increased 9.52%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 141% which was down 5.52% from last quarter.

- Discrete GPUs were in 35.92% of PCs, which is up 1.23%.

- The overall PC market increased 3.96% quarter-to-quarter, and decreased 3.55% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 5.60% from last quarter.

- Q4’16 saw an increase in tablet shipments from last quarter.

By Brand:

- AMD’s shipments of desktop heterogeneous GPU/CPUs, i.e., APUs, for desktops increased 16.9% from the previous quarter. AMD’s APU shipments were up 23.9% in notebooks. Desktop discrete GPUs increased 4.3% from last quarter, and notebook discrete shipments increased 3.2%. AMD’s total PC graphics shipments increased 10.5% from the previous quarter.

- Intel’s desktop processor embedded graphics (EPGs) shipments increased from last quarter by 10.7% and notebook processors decreased by 6.7% while total PC graphics shipments decreased 4.0% from last quarter.

- Nvidia’s desktop discrete GPU shipments were up 6.1% from last quarter; and the company’s notebook discrete GPU shipments increased 13.8%, and total PC graphics shipments increased 9.5% from last quarter.

Total discrete GPUs (desktop and notebook) shipments for the industry increased 7.6% from the last quarter, and increased 12.0% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the CAGR from 2014 to 2017 is now -5%.

Ninety nine percent of Intel’s non-server processors have integrated graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).