PC shipments in EMEA were slightly above expectations in Q2’16, says IDC, at 16.1 million units shipped – although this still represented a 4.7% YoY fall. Western Europe stabilised at -0.8%, while CEE and MEA continued downwards (-8.5% and -13.3%, respectively).

Notebooks in EMEA were down 1.7% in the quarter. This was the first time the annual comparison was not affected by Windows + Bing shipments. Shipments were actually up in Western Europe (4.1%), thanks to the commercial segment, which climbed 10.5%. This brought the overall EMEA commercial notebook space to 3.7% growth. Consumer shipments continued to fall, however. Desktop PCs were down 10%, in line with forecasts, across the region.

Volatile exchange rates, changing oil prices and macroeconomic and political developments affected the EMEA region throughout Q2. While Windows 10 failed to drive large renewals, Intel’s Skylake platform was generating strong interest and supporting new form factors.

Notebooks outperformed desktops across EMEA. This was driven by multiple factors; for instance, back-to-school shopping in the Nordics, as well as the above-mentioned Skylake and Windows 10.

IDC expects Brexit to deliver additional challenges to the PC market in Western Europe, although it is still to early to blame market contraction on the referendum. It is thought that some PC makers will review their 2017 plans due to uncertainty. At least three vendors (Dell, Asus and HP) have already committed to raising their UK prices, and ‘many’ have said that they may revise their price strategy, says IDC.

Higher prices will affect consumer behaviour and encourage consumers to hold on to PCs longer than they may otherwise have done. In enterprise, IT budgets and plans are likely to be reviewed as companies become more cautious. Compromises are likely to be made, as price increases cannot all be absorbed.

Currency fluctuations in the UK and surrounding areas are affecting channel stock intake. Some vendors have pushed more shipments in June, seeking to optimise their channel position ahead of price increases; on the other hand, clearing inventories is still a key focus in some countries. Trends are different within EMEA, especially in Western Europe: the UK & Ireland and Mediterranean regions contracted in Q2, while DACH and the Nordics were up.

IDC analyst Malini Paul, speaking about Western Europe, said, “After several quarters of decline and a stabilisation last quarter, Q2’16 marked the return of commercial notebooks to positive double-digit growth. In the absence of Bing comparisons, the consumer segment returned to almost normal market conditions. However, inventory levels in some channels remained high. This could have an adverse impact on shipments in the next couple of quarters if products are not moving as fast as expected.”

Moving eastwards, the CEMA PC market was held back by low public spending, weak currencies, political uncertainty and a slowing economy.

In CEE, commercial PCs performed badly, down 10.5%. The consumer space was supporting by gaming PCs, although volumes remained limited, and consumer desktop PCs were flat compared with notebooks (dropping in the high single digits). The MEA market continued to suffer, although some key markets like Turkey and Egypt experienced some relief. Egypt was boosted by a continued large-scale PC project. However, other key markets were down. Nigeria and Saudi Arabia, in particular, saw their shipments halved.

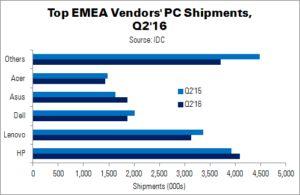

| Top Five EMEA Vendors’ PC Shipments, Q2’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q2’16 Share | Q2’15 Share | YoY Change |

| HP | 4,086 | 3,921 | 25.4% | 23.2% | 4.2% |

| Lenovo | 3,130 | 3,366 | 19.4% | 19.9% | -7.1% |

| Dell | 1,869 | 2,010 | 11.6% | 11.9% | -7.0% |

| Asus | 1,865 | 1,630 | 11.6% | 9.7% | 14.4% |

| Acer | 1,428 | 1,479 | 8.9% | 8.8% | -3.5% |

| Others | 3,711 | 4,481 | 23.1% | 26.5% | -17.2% |

| Total | 16,087 | 16,887 | 100.0% | 100.0% | -4.7% |

| Source: IDC | |||||

Vendor Highlights

The top five vendors in EMEA saw their share continue to grow, with the top three now accounting for 56.5% of the market, compared to 55.1% last year.

HP Inc. led, with a market share of more than 25% across EMEA. Its performance was boosted by particularly strong commercial notebook results. Lenovo came second with a 19.4% share, although growth slowed compared to Q2’15. Consumer notebooks and commercial desktops were down from last year, but Lenovo gained share from competitors.

Dell recorded a slower quarter, facing strong competition – especially in MEA. However, it did well from the commercial notebook growth in Western Europe.

Asus came in fourth place, with notebooks contributing to its growth – especially on the consumer side. Acer remained in fifth place; its share was flat compared to last year.

Outside of the top five, Apple remained in sixth place; Fujitsu and Toshiba came seventh and eighth, respectively, both registering double-digit contractions; MSI and Wortmann closed out the top 10.