Consumer spending on technology is forecast to reach $1.32 trillion in 2019, an increase of 3.5% over 2018. According to the inaugural Worldwide Semiannual Connected Consumer Spending Guide from International Data Corporation (IDC), consumer purchases of traditional and emerging technologies will remain strong over the 2018-2022 forecast period, reaching $1.43 trillion in 2022 with a five-year compound annual growth rate (CAGR) of 3.0%.

“The new Connected Consumer Spending Guide leverages IDC’s long history of capturing consumer device shipments, combined with valuable insights from regular consumer surveys and channel discussions, to tell a comprehensive story about consumer spending,” said Tom Mainelli, IDC’s group vice president for Devices and Consumer Research. “The Connected Consumer Spending Guide team has built out an initial set of consumer-focused use cases designed to deliver insights about spending across a wide range of device types, from smartphones to tablets, PCs to drones, and smart speakers to wearables. Over time, the team will continue to develop an ever-widening array of use cases, adding additional data about software and services, and eventually demographic-focused insights.”

Traditional technologies – personal computing devices, mobile phones, and mobile telecom services – will account for more than 96% of all consumer spending in 2019. Mobile telecom services will represent more than half of this amount throughout the forecast, followed by mobile phones. Spending growth for traditional technologies will be relatively slow with a CAGR of 2.4% over the forecast period.

In contrast, emerging technologies, including AR/VR headsets, drones, robotic systems, smart home devices, and wearables, will deliver strong growth with a five-year CAGR of 20.6%. By 2022, IDC expects more than 5% of all consumer spending will be for these emerging technologies. Smart home devices and smart wearables will account for more than 80% of the overall spending on emerging technologies in 2019. Smart home devices will also be the fastest growing technology category with a five-year CAGR of 38.0%.

“Connected technologies are transforming consumers’ activities and habits, becoming more and more integrated into their daily lives. This is fueling the consumer’s unquenchable thirst for content and immersive experiences delivered anytime, anywhere, via multiple formats and across a myriad of channels. As a result, we see the balance of power shifting in consumer-facing industries. Whereas once upon time, the enterprise called the shots, more and more consumer demands and expectations are propelling innovation,” said Jessica Goepfert, program vice president, Customer Insights & Analysis at IDC. “What’s the next wave of consumer transformation? Even more widely adopted and mature activities such as listening to music and shopping are being disrupted by new technologies such as smart speakers. And disruption presents opportunity.”

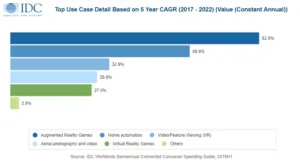

Communication will be the largest category of use cases for consumer technology, representing nearly half of all spending in 2019 and throughout the forecast. Most of this will go toward traditional voice and messaging services, joined by social networking and video chat as notable use cases within this category. Entertainment will be the second largest category, accounting for nearly a quarter of all spending as consumers listen to music, edit and share photos and videos, download and play online games, and watch TV, videos, and movies. The use cases that will see the fastest spending growth over the forecast period are augmented reality games (82.9% CAGR) and home automation (59.8% CAGR).

“There’s an expectation among today’s consumers for a seamless consumer experience. The connected consumer is no longer a passive one; the connected business buyer is in control and it’s essential for technology providers to understand this if they want to continue to grow and gain market share in this digital age. As technology becomes more affordable and accessible, the connected consumer is expected to spend more as they leverage these platforms for entertainment, education, social networking, commerce, and other purposes. IDC’s Worldwide Semiannual Connected Consumer Spending Guide presents a comprehensive view of the consumer ecosystem and serves as a framework for how IDC organizes its consumer research and forecasts,” said Stacey Soohoo, research manager with IDC’s Customer Insights & Analysis group.

The Worldwide Semiannual Connected Consumer Spending Guide quantifies consumer spending for eighteen technologies in nine categories across nine geographic regions. The guide also provides spending details for 24 consumer use cases. Unlike any other research in the industry, the Connected Consumer Spending Guide was designed to help business and IT decision makers to better understand the scope and direction of consumer investments in technology over the next five years.

About IDC Spending Guides

IDC’s Spending Guides provide a granular view of key technology markets from a regional, vertical industry, use case, buyer, and technology perspective. The spending guides are delivered via pivot table format or custom query tool, allowing the user to easily extract meaningful information about each market by viewing data trends and relationships.

For more information about IDC’s Spending Guides, please contact Monika Kumar at [email protected].

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of IDG, the world’s leading technology media, data, and marketing services company. www.idc.com.