You’d have to have been underground helping to recover pot-holers or trapped miners not to have seen the flood of news this week following a plummet in the stock price of Netflix after it announced that it’s subscriber base had dropped. It looks like an inflection point.

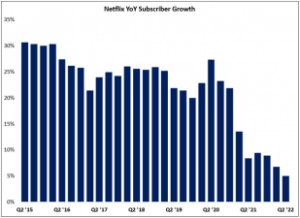

Netflix has had a long history of success and growth, from the days when it delivered DVDs direct to the home (which is where I became a customer – my daughter was a studying film and media and the endless supply of movies to her student address were great for her). netflix moved to streaming and has had great growth. I saw this chart on Paul Kedrosky’s daily chart service.

That shows a relentless level of growth that was starting to slow down when the pandemic came along and boosted things. However, the world is looking a bit different with serious inflation, uncertainty over the aggressive Russian war on Ukraine, supply chain challenges and other macroeconomic headwinds. At the same time, Netflix has loads of competitors for paid streaming services (although today it has one less as CNN+ is to close after just three weeks) and also recently raised its prices to become the most expensive mainstream streaming service. As well as the 200K drop in subscribers in Q1, Netflix forecast that it would lose two million more in Q2.

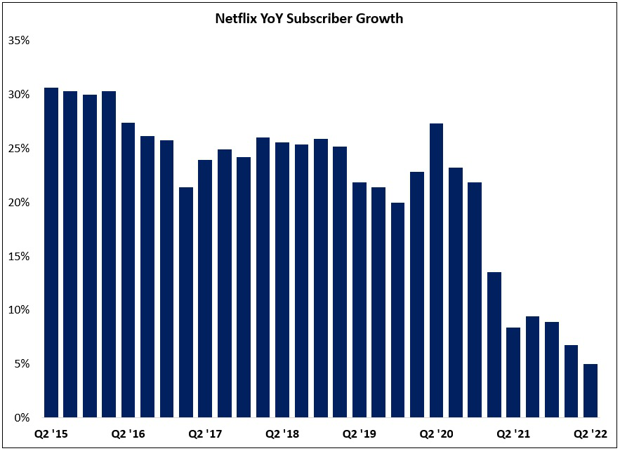

The stock markets really reacted violently to the news and hammered the Netflix stock price down by 35.1% on Wednesday. One hedge fund manager, Bill Ackman, sold his whole stake, acquired for $1.1 billion just in January, with a $400 million loss. That was quite a turn-around, but you won’t see much empathy from me for the loss on such a quick volte-face.

These charts are from Netflix and show the 5 day and 5 year trends for the Netflix stock price. The price had been on the decline since the second half of last year. Source:Yahoo Finance

These charts are from Netflix and show the 5 day and 5 year trends for the Netflix stock price. The price had been on the decline since the second half of last year. Source:Yahoo Finance

Anyway, this looks like the end of the first phase of the growth of the streaming market. Markets that are going to be big typically start growing with acceleration of the growth. At some point, the acceleration stops and it becomes the moment to, in the time honoured phrase ‘get big, get niche or get out’. I suspect that this ‘Netflix moment’ might have been a while ago had we not all been stuck at home during the pandemic.

Get Big, Get Niche or Get Out

Netflix is big, so it should be able to negotiate the future. Management have talked about ‘crossing the Rubicon’ and offering a lower cost Netflix service with advertising. That’s hard to do when one of your big claims is that you don’t have advertising (and that’s one of the reasons I’m prepared to pay for it). My gut feel is that this is the way to go for the service in order to keep pushing its scale on the ‘get big’ track. If it doesn’t, it runs the risk, with consumers under huge pressure from food, fuel and housing inflation, of becoming, in the longer term, the niche supplier of content without ads.

Confirming the shift in consumer behaviour, Kantar, a research company said that UK consumers had cancelled around 1.5 million subscriptions for VOD in the first quarter of the year. Consumers and households are increasingly reluctant to add TV services, and become more picky about choosing multiple services. Some analysts have pointed out that the Netflix practice of enabling binge watching by releasing content in batches may encourage viewers to sign up for a while, but leave when they have seen what they want. (I admit to doing that with a free three month AppleTV subscription I got at Christmas). Maybe, at some point, Netflix may have to move to more of a drip-feed strategy.

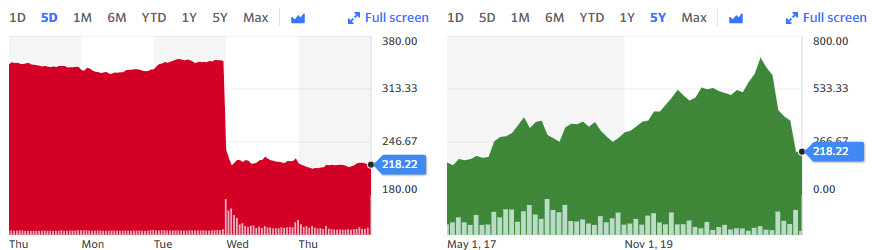

Netflix’s churn rate looks as though it’s on the increase.

Netflix’s churn rate looks as though it’s on the increase.

Moving to become a niche or specialist supplier is not necessarily a bad outcome. You can build a successful and profitable strategy based on a niche position. I helped a company make the decision to become a specialist some 30 years ago and it remains a growing and profitable company. One of the factors in that decision was that the culture of the firm was clearly better suited to that kind of business. I don’t know Netflix except as a customer and journalist, but its actions, to me, have been to try to be the biggest and dominate. It’s hard to change that kind of culture.

Netflix probably also needs to be a bit more selective about its content. A few months ago at a TV industry event, an executive said to me that “Netflix will throw money at anyone with an idea”. If Netflix wants to be the biggest streaming supplier, it is going to have to ensure that it has content that is of the highest quality and appealing to the greatest number because it will have to compete with those that know how to do that. I don’t doubt that Disney also wants to be the biggest… and Apple… and Amazon etc. (BR)

As this article really follows on from Andy Marken’s article yesterday, the two will only be counted as one if you do not have a paid subscription to Display Daily and rely on two free articles per month.