The global thin and terminal client market had a strong Q1 and Q2 in 2014, followed by a ‘mild’ contraction in Q3 and double-digit fall in Q4, says IDC.

Shipments were down 12.5% in Q4 and 0.2% for the year; a weak comparison against Windows XP migration projects during 2013. These migrations spurred more virtual desktop infrastructure adoptions, as well as the continued decline of terminal client deployments.

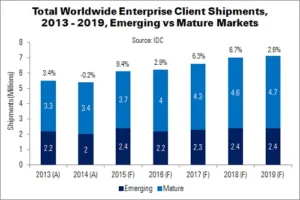

There were some positive signs to the market, however. Thin clients remained resilient, with shipments rising 4.6% throughout the year. The volume decline was limited to terminal clients. Mature markets, where several trials have finally evolved into full deployments, were also found to have performed well, growing 4.3%.

In the future, IDC expects the APACxJ region to reclaim its title as the world’s largest thin/terminal client shipment region in 2015. Several projects that were delayed in 2014 should resume this year. Mature markets will follow, taking global shipments to almost 6 million units.

Thin clients were responsible for 96% of enterprise client shipments. However, thin clients without an OS (zero clients) fell in Q4, ending 2014 with a 23.5% of the thin client market.

Dell was the leading enterprise client vendor, thanks to some ‘key’ shipments in the financial sector. Meanwhile NComputing, hindered by financial troubles, faced conservative adoption from its channels. The vendor fell to fifth place in shipments.

| Worldwide Enterprise Client Device Unit Shipments, Market Share and YoY Growth, Q4’14 | |||||

|---|---|---|---|---|---|

| Vendor | Q4’14 Units | Q4’13 Units | Q4’14 Market Share | Q4’13 Market Share | YoY Change |

| Dell | 385,566 | 344,261 | 27.2% | 21.2% | 12.0% |

| HP | 360,480 | 434,696 | 25.4% | 26.8% | -17.1% |

| Centerm | 153,425 | 148,577 | 10.8% | 9.2% | 3.3% |

| Igel | 73,907 | 66,788 | 5.2% | 4.1% | 10.7% |

| Ncomputing | 72,245 | 239,701 | 5.1% | 14.8% | -69.9% |

| Total | 1,418,402 | 1,620,595 | -12.5% | ||

| Source: IDC | |||||