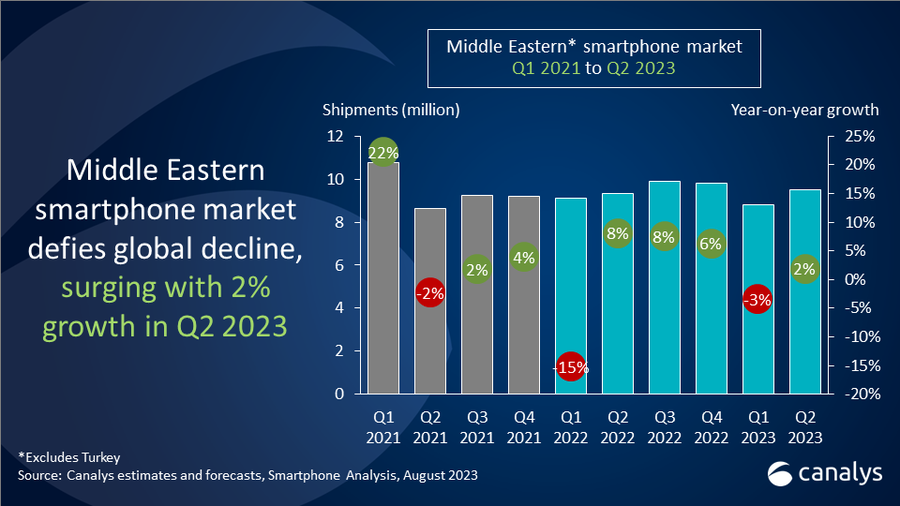

Canalys’ Q2’23 report on the Middle East smartphone market says that vendors delivered 9.5 million smartphones in the region (excluding Turkey), marking a 2% YoY growth, while the global market witnessed a 10% decline. The Middle East’s economic upturn, driven by rising global oil prices, record-low unemployment, non-oil sector expansion, and notable foreign direct investment (FDI) inflows, facilitated this growth.

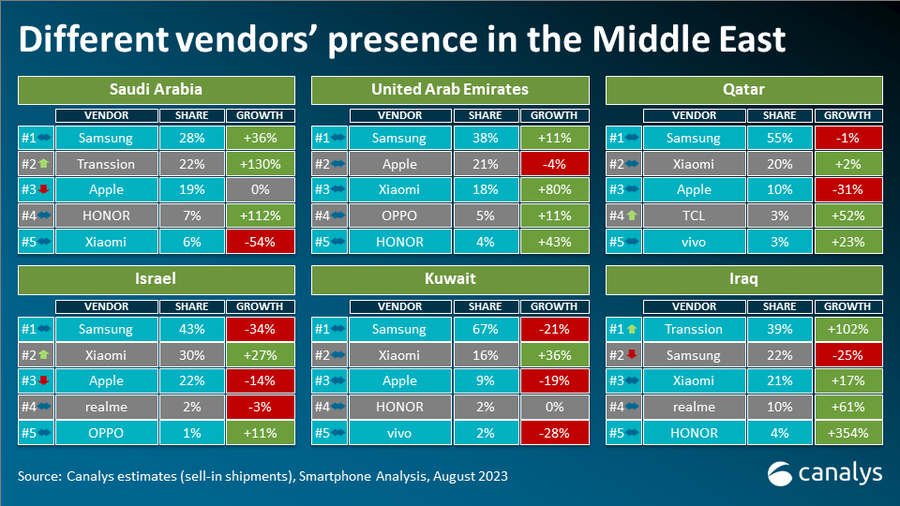

Saudi Arabia experienced robust smartphone shipment growth of 19% YoY in Q2 2023, attributed to strong macroeconomics, non-oil sector expansion, and vendors restocking distribution channels for the Eid and Ramadan sales season. The United Arab Emirates (UAE) exhibited a 6% growth, driven by an increase in tourist arrivals during festive periods.

Iraq’s smartphone shipments achieved a significant 24% growth, overcoming economic challenges and currency fluctuations. Conversely, Israel saw a 19% decline due to rising inflation and cautious consumer spending, with families extending the use of their current devices amidst higher living costs. Kuwait and Qatar, smaller markets with fewer than half a million shipments each, faced YoY declines of 15% and 23% respectively due to weak consumer demand.

Regarding brand performance, both Apple and Samsung observed declines in premium segment smartphone shipments due to cautious consumer spending and a surge in interest for budget alternatives. Samsung maintained its lead with a 9% drop, leveraging the popularity of its budget-friendly A series models. Apple dominated the premium market but focused on iPhone 12 and 13 models to cater to budget-conscious consumers.

The report highlighted the rise of entry-level shipments in Q2’23, with Transsion ascending to the second position. Infinix and Tecno, emphasizing affordable pricing, boosted shipments in Iraq and Saudi Arabia. Xiaomi held its market share through product diversity and a strong online and offline presence. Honor and Motorola also achieved substantial growth, driven by targeted marketing, impactful product launches, and strategic retail partnerships.

Looking ahead, the Middle East smartphone market is anticipated to maintain 2022’s shipment levels in 2023, supported by strong post-pandemic economic performance. Easing geopolitical tensions and increased FDI inflows are expected to drive growth. The region’s recovery will be fueled by non-oil sectors, particularly within the Gulf Cooperation Council (GCC) countries. The travel and tourism sector’s resurgence will further boost non-oil activities. Brands will target middle-income consumers seeking to upgrade from lower-tier devices, emphasizing offline retail engagement to enhance visibility.

| Vendor | Q2’23 Shipments (million) | Q2’23 Market Share | Q2’22 Shipments (million) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Samsung | 3.4 | 36% | 3.7 | 40% | -9% |

| Transsion | 1.7 | 18% | 1.3 | 14% | 29% |

| Xiaomi | 1.3 | 14% | 1.3 | 14% | 0% |

| Apple | 1.2 | 12% | 1.2 | 13% | -5% |

| realme | 0.4 | 4% | 0.2 | 2% | 98% |

| Others | 1.5 | 15% | 1.6 | 16% | -2% |

| Total | 9.5 | 100% | 9.3 | 100% | 2% |