The Electronics business unit of Merck operates in three main areas – Semiconductor Solutions, Display Solutions, and Surface Solutions. The Semiconductor Solutions business provides materials and equipment to semiconductor manufacturers. It saw an organic sales decline in Q3’23 due to the cyclical slowdown in the semiconductor industry which has lasted longer than expected.

The Display Solutions business provides liquid crystals, photoresists and OLED materials for display applications. It recorded increased sales in Q3’23 as liquid crystal customer utilization improved significantly versus a weak Q3’22. However, pricing and product mix remained unfavorable resulting in an organic sales decline in the first 9 months of 2023 versus the prior year.

The Surface Solutions business provides coatings for applications like automotive and cosmetics. It saw moderate organic growth in Q3’23 driven by stronger cosmetics demand which offset weaker automotive coatings demand. However, sales still showed a moderate organic decline in the first 9 months of 2023 versus the prior year.

| Electronics Business Unit (€ million) | Q3’23 | Q3’22 | Change |

| Net sales | 916 | 1,036 | -11.58% |

| Cost of sales | -592 | -591 | 0.17% |

| Gross profit | 324 | 445 | -27.19% |

| Marketing and selling expenses | -144 | -173 | -16.76% |

| Administration expenses | -40 | -33 | 21.21% |

| Research and development costs | -75 | -78 | -3.85% |

| Other operating income and expenses | -13 | -16 | -18.75% |

| Operating result (EBIT) | 52 | 145 | -64.14% |

Overall, the Electronics business unit saw an 11.6% sales decline in Q3’23, with organic growth of -4.0%. Lower volumes and unfavorable pricing/product mix negatively impacted gross profit and margins. However, operating expenses decreased due to cost discipline and efficiencies. Electronics net sales are expected to trend around the mid-point of €3.5 – 3.8 billion ($3.8-$4.1 billion) for full year 2023, with an organic decline of -6% to -1%.

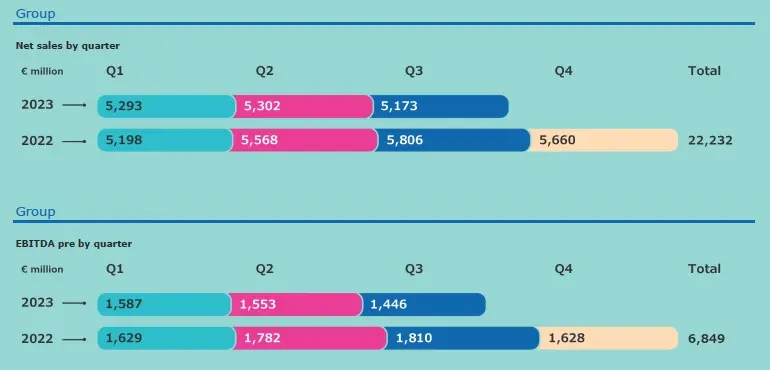

Merck Group Results

Merck’s overall business showed resilience in Q3’23 despite challenging macroeconomic conditions. Group sales declined organically by 4% YoY to €5.2 billion ($5.65 billion), driven by declines in Life Science and Electronics which were partially offset by organic growth of 7% in Healthcare.

In Life Science, sales declined 13% organically due to fading demand for COVID-19 related products and de-stocking by key customers in Process Solutions. Electronics sales declined 4% organically, impacted by the prolonged cyclical downturn in semiconductors which was only partially offset by growth in Display Solutions. In contrast, Healthcare delivered strong broad-based organic growth of 7%, driven by double-digit growth of newer products like Bavencio and Mavenclad along with solid growth in Fertility and the Cardiovascular/Metabolism portfolio.

Merck Q3’23 Financials (€ million) | Q3’23 | Q3’22 | Change | Jan.-Sept. 2023 | Jan.-Sept. 2022 |

|---|---|---|---|---|---|

| Net sales | 5,173 | 5,806 | -10.9% | 15,768 | 16,572 |

| Operating result (EBIT) | 983 | 1,234 | -20.3% | 2,988 | 3,585 |

| Margin (% of net sales) | 19.0% | 21.3% | 18.9% | 21.6% | |

| EBITDA | 1,418 | 1,704 | -16.8% | 4,361 | 5,016 |

| Margin (% of net sales) | 27.4% | 29.3% | 27.7% | 30.3% | |

| EBITDA pre | 1,446 | 1,810 | -20.2% | 4,586 | 5,221 |

| Margin (% of net sales) | 27.9% | 31.2% | 29.1% | 31.5% |