There has a been a lot of news lately about the rapidly changing media market. This will have an indirect impact on the future of displays, so I thought I would summarize some of the recent news and add some thoughts on what this means for the display industry.

I think it is fair to say that the success of Netflix has ushered in a new wave of consolidation, investment and changing of business models in the media industry that has not been seen for decades.

What impressed me was a report in a recent Variety article stating that Reed Hastings, the CEO of Netflix, laid out his vision of the future of TV back around 2000 that clearly foresaw that we would move to a streaming TV model. The DVD strategy was simply a step toward the goal. He noted that postal rates were increasing while bandwidth got twice as fast at half the price every 18 months. At some point it would become more cost efficient to stream a movie rather than to mail it. That happened in 2007.

Netflix watched how content was consumed and discovered consumers loved to watch a number of TV episodes in row, i.e. bingeing. Netflix began experimenting with developing its own original content, which became a huge growth driver in 2013 with the launch of “House of Cards.” Today, Netflix has 130M customers worldwide and in 2018, it is anticipated to spend $13B to deliver 80 new feature films (original and acquired) along with 700 new TV episodes. It is now a full-fledged studio that has reinvented the cable bundle for the on-demand era.

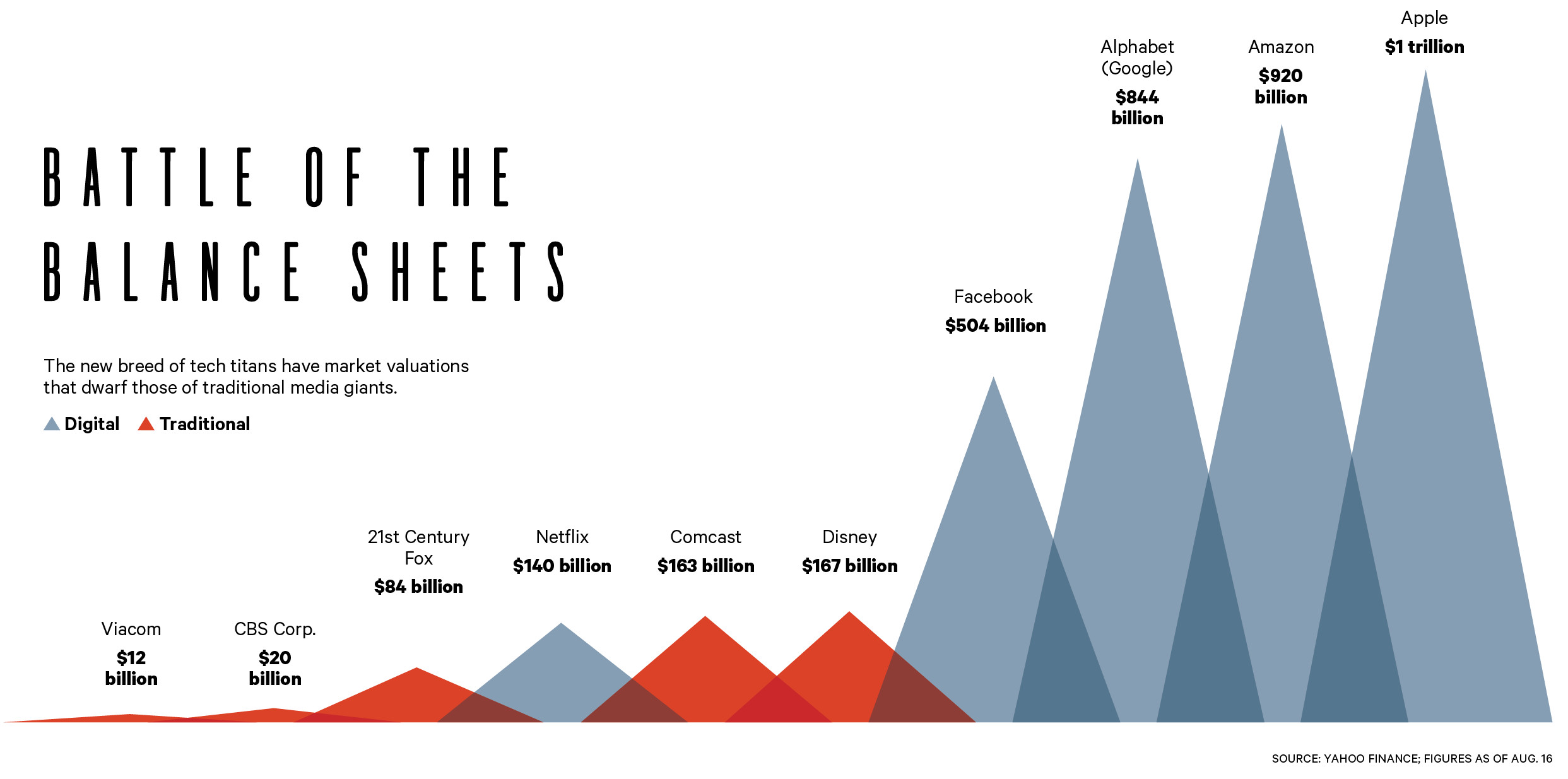

The rise of Netflix has set off a frenzy in the media world. In the traditional media conglomerate space, it appears to be a big motivating factor in AT&T’s purchase of Time Warner, Disney’s acquiring some of the 21st Century Fox assets, and Comcast’s pursuit of the Sky assets. They need to bulk up to compete not only with Netflix, but with even bigger competitors like Facebook, Amazon, Apple and Google.

The graphic below shows the balance sheets of the key players. You can see why Viacom and CBS want to merge and you can also see how the war chests at Facebook, Amazon, Google and Apple must scare the bejezous out of these traditional media companies.

Changes are happening quickly. For example, Disney will pull its content from Netflix and soon launch its own direct to consumer service. Apple has hired studio executives and is greenlighting projects for original content. Amazon is already a force to be reckoned with and multiple other content creation and delivery schemes are in the works as well. The herd is each moving to create its own direct-to-consumer service.

This will be great for consumers as there is a clear emphasis on quality in these efforts, but it must be hell for these companies from a business point of view. Think about it. Companies like Disney must change from a B-to-B business model, give up revenue from Netflix and other distribution channels while simultaneously investing heavily in a new on-demand B-to-C business model. Plus, they are taking on a lot of debt to acquire the Fox assets. This is going to be a tricky strategy to pull off. Meanwhile, Netflix is still in growth mode with lots of cash and far less performance pressure.

How this will all play out is anyone’s guess. As a consumer, I will have the ability to create my own content bundle via a number of independent services. In addition, new or existing aggregators will begin to bundle these independent services into various packages to reinvent the cable bundling business. There will be more content and more choices than consumers can consume which will create confusion and then drive a wave of consolidation, I suspect. This is the scenario I think many of these companies foresee and they want to be in a position to be a survivor.

All these new content options and competition for viewer’s eyeballs will drive innovation throughout the ecosystem. Let’s start with bandwidth. I have not researched this, but I would not be surprised if Hunt’s prediction of a doubling of bandwidth and halving of costs every 18 months has continued and will continue for a while. What seems challenging to deliver today will not be so challenging in the near future. Fiber networks continue to get closer and closer to homes while 5G will create new high bandwidth capabilities as well. New codecs will make delivery even more efficient.

In my last Display Daily column, Cable Industry Gearing up for the High Bandwidth Needs of Light Field Displays, I described how the cable industry sees no end in sight for the need for bandwidth and the applications that will drive this. Their video provides a very interesting view of the near future with all kinds of transparent, wall-scale, 3D and handheld devices all connected to a smart web driven by artificial intelligence. This is vision is not so farfetched and is likely to become reality within 10 years.

I don’t think there is much doubt that the key trend in display technology is going to be realism. That is, many applications will strive to create a visual and auditory experience that will be very close to what we would perceive as real. That will include consumer applications like TV, gaming, VR and AR plus myriads on professional and commercial applications ranging from cinema to education; from medical to theme parks.

Natural 3D displays, such as light field displays, higher resolution (8K and beyond), wider dynamic range (to 10K nits), a bigger color gamut (BT 2020 and beyond) will all be pushed forward. It’s going to happen. These technologies will not plateau.

As Ken suggested a few weeks back, the summer affords an opportunity to “think big things.” With changes happening at a mind-spinning pace in the media business nowadays, that got me thinking about the implications for displays, which is briefly laid out above. What do you think? – Chris Chinnock