The PC market in the MEA region is suffering from currency fluctuations and unstable global oil prices, says IDC. Shipments fell 9.6% YoY in Q1, to 4.3 million units. Desktops were down 10%, to 1.6 million units, while portable PCs fell 9.4% to 2.7 million units.

Key markets such as Nigeria, Turkey, Egypt and Algeria were all affected by fluctuating currency values, said IDC’s Fouad Charakla. In addition, low oil prices have negatively affected “almost all” of the region; the extent varies by country. The market in Turkey fell faster than last year to high inventory. The political and social upheaval in the ‘Rest of Middle East’ sub-region compounded the MEA decline.

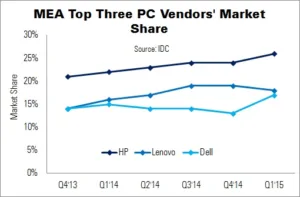

The top three vendor positions remained unchanged, with all three achieving growth. HP led the market, rising 6.5% YoY, while Lenovo rose 5.3%. Dell, in third place, saw a 3.5% rise in shipments. Toshiba came in fourth, but shipments fell 34.3%. Asus completed the top five, with a YoY fall of 7.2%. Local desktop OEMs suffered the most, facing competition from international brands and – more importantly – the refurbished PC market.

The MEA PC market is expected to decline 4.8% YoY in 2015, with a total of 17.3 million units shipped. High inventory levels in the region’s channels will be a significant market inhibitor, extending from Turkey to other parts of the region – including the UAE and ‘Rest of Middle East’. Currency devaluations will also continue to have an affect.

Between 2015 and 2019, IDC forecasts that the PC market in the region will remain mostly flat. There will, however, be a gradual shift in weight of demand from consumers to the commercial segment. This will be caused by consumers switching to tablets and smartphones.