As the COVID-19 pandemic caused flagship smartphones to turn in lower-than-expected sales performances in 1H20, the market share of AMOLED phones fell short of forecasts made in early 2020, according to TrendForce’s latest investigations.

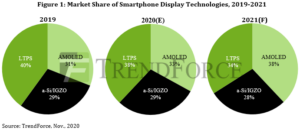

The market share of AMOLED phones for 2020 is expected to reach 33%, a 2% increase YoY, thanks to the release of Apple’s new iPhone 12 models in 2H20. LTPS LCD smartphones are likewise undergoing sluggish demand this year; their market share is projected to reach 38%, a 2% decrease YoY. On the other hand, the majority of smartphone market demand has reemerged for the entry-level and mid-range segments, thereby lending support to the demand for a-Si LCD smartphones, some of which are now in short supply. The market share of smartphones with a-Si displays is estimated to reach 29% this year, remaining relatively unchanged from 2019.

However, as the pandemic is slowly brought under control in 2H20, the demand for smartphones has made a gradual return to stable levels as well, with downstream smartphone brands beginning to step up their panel procurement activities. Huawei, for instance, stocked up on smartphone panels in 3Q20 ahead of the U.S. sanction’s September 15 deadline, thus providing some upward momentum for entry-level and mid-range smartphone panel demand. In 4Q20, other smartphone brands have similarly been stocking up in preparation for the upcoming smartphone demand in 2021, while the shortage of TDDI persists. Therefore, the demand for entry-level and mid-range smartphone panels is projected to last until 1H21. In light of this, TrendForce projects the market share of a-Si smartphone displays to undergo only a slight decline in 2021, reaching 28%.

With regards to high-end smartphone panels, on the other hand, the market has become hypercompetitive as Korean AMOLED panel suppliers aggressively pursue client orders, and Chinese panel makers construct additional AMOLED panel fabs. As such, smartphone manufacturers are expected to increase their adoption of AMOLED panels, and the resultant upward momentum will likely propel the market share of AMOLED smartphone displays to 38% in 2021. In other words, the share of LTPS displays in the smartphone market will be constrained by both rising demand for high-end AMOLED phones and momentum from entry-level and mid-range a-Si phones. These constraints will be detrimental to the overall LTPS capacity utilization rate and profitability, in turn forcing panel makers to accelerate their strategies to expend LTPS panel capacities.

TrendForce believes that panel makers’ major LTPS capacity allocation plans will include not only their current smartphone applications, but also notebook panels or tablet panels, both of which are trending towards mid-sized dimensions. The market for LTPS notebook panels has gradually expanded due to Taiwanese panel makers’ developmental efforts in the past few years. In this market, Chinese panel makers are expected to become competitors in the supply chain going forward. Furthermore, LTPS panels will see further application in the automotive panel market, which is more niche compared to the notebook and tablet markets. Japanese and Korean panel makers currently maintain a competitive advantage in automotive panel manufacturing, followed closely by Taiwanese and Chinese companies. Alternatively, technological development in Mini LED and Micro LED has become an important topic in panel industry in the past two years, with panel makers successively investing resources into backplanes for these emerging display technologies. LTPS technology appears promising as a potential backplane for Mini LED and Micro LED displays, while also serving as an avenue for expending panel makers’ excess capacities.