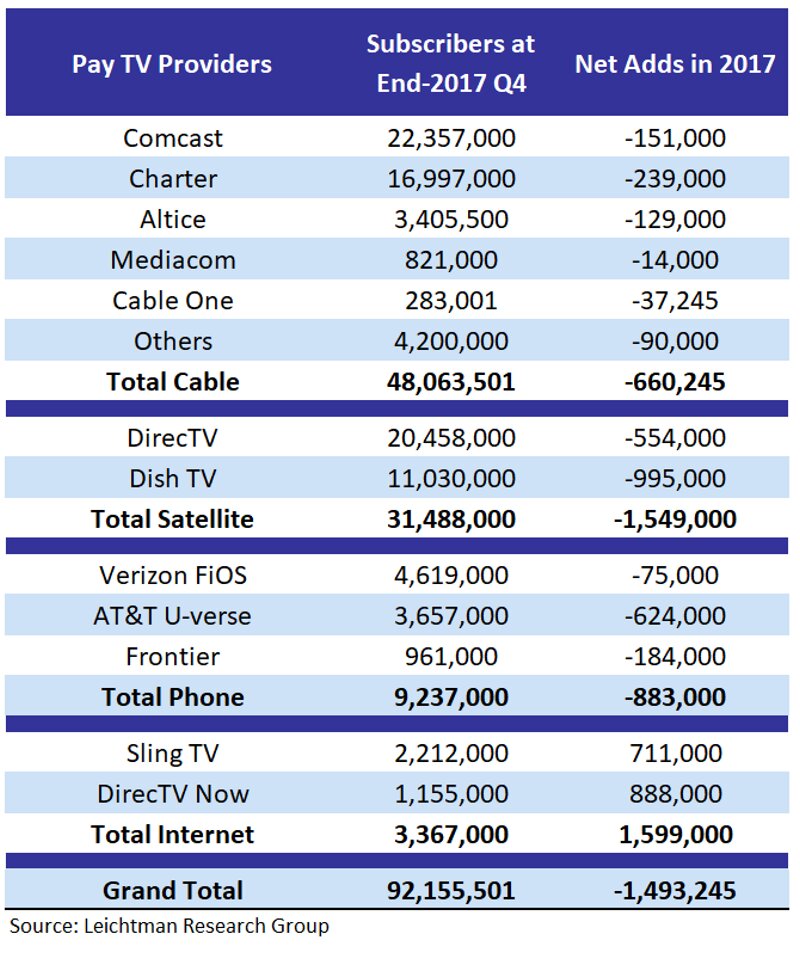

Leichtman Research Group has found that the largest pay TV providers in the US—representing about 95% of the market — lost about 1.5 million net video subscribers in 2017, compared to about 760,000 in 2016. The top pay TV providers account for 92.2 million subscribers, with cable companies having about 48.1 million video subscribers, satellite TV services 31.5 million subscribers, telephone companies 9.2 million subscribers and internet-delivered pay TV services nearly 3.4 million. The report’s key findings include:

- The top six cable companies lost about 660,000 video subscribers in 2017, compared to a loss of about 275,000 subscribers in 2016.

- In 2017, the top cable providers cumulatively lost 1.4% of video subscribers, compared to a loss of 0.6% in 2016.

- Satellite TV services lost about 1,550,000 subscribers in 2017, compared to a loss of about 40,000 subscribers in 2016.

- DirecTV lost 554,000 subscribers in 2017, compared to a gain of 1,228,000 subscribers in 2016.

- In 2017, DBS services cumulatively lost 4.7% of video subscribers, compared to a loss of 0.1% in 2016.

- The top telephone providers lost about 885,000 video subscribers in 2017, compared to a loss of about 1,590,000 subscribers in 2016.

- AT&T U-verse lost 624,000 subscribers in 2017, compared to a loss of 1,359,000 subscribers in 2016.

- In 2017, the top telcos cumulatively lost 8.7% of video subscribers, compared to a loss of 13.6% in 2016.

- The top publicly reporting, internet-delivered services added about 1,600,000 subscribers in 2017, compared to 1,145,000 net adds in 2016.

- Subscribers to the top internet-delivered services increased by 90% in 2017.

- Traditional pay TV services (not including internet-delivered) lost about 3,095,000 subscribers in 2017, compared to a loss of about 1,905,000 in 2016.

Leichtman Research Group’s President and Principal Analyst, Bruce Leichtman, said:

“The pay TV market saw net losses increase in 2017 and the continuation of a share shift from traditional services to newer, internet-delivered services. Satellite TV services, DirecTV and Dish TV, had more combined net losses in 2017 than in any previous year, yet these losses were offset by gains from their internet-delivered flanker brands, DirecTV Now and Sling TV. Overall, the top pay TV services lost 1.6% of subscribers in 2017 compared to a loss of 0.8% in 2016”.