Bizarrely, although LG is the exclusive supplier of the most widely prized display technology in the TV world and has a range of TV brands happy to buy as many OLEDs as it can make, it has not been able to make a profit in making the panels.

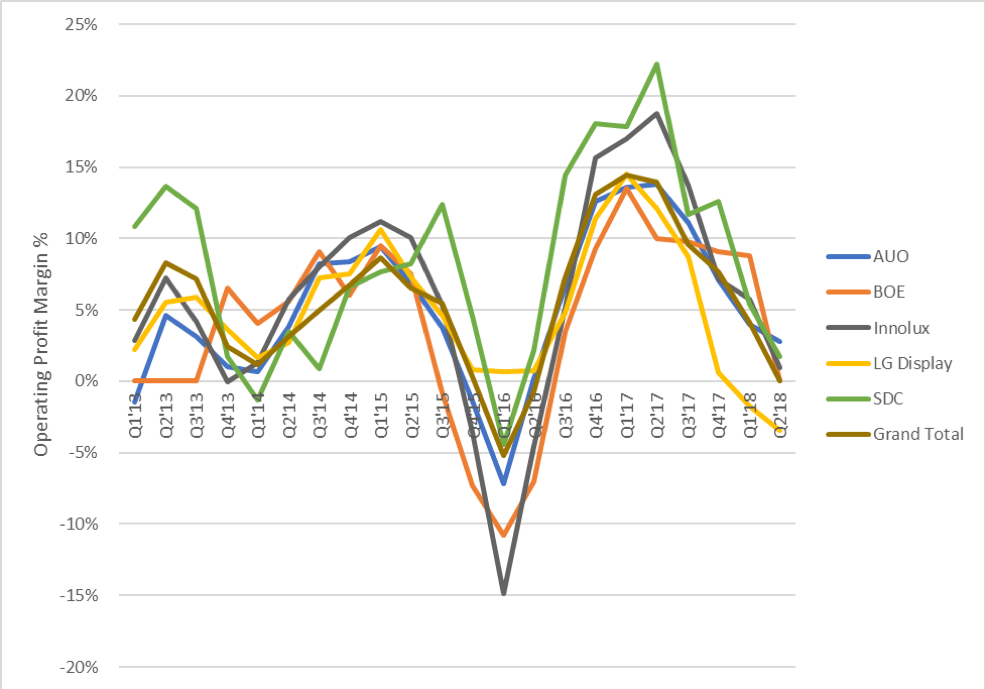

DSCC has been looking at this issue and published a blog with some analysis of the phenomenon, which has become an issue for LG Display recently as the profits from its LCD business have dived as the panel industry heads for a negative (and possibly prolonged) period in the ‘crystal cycle’. (I’ll come back to that topic next week)

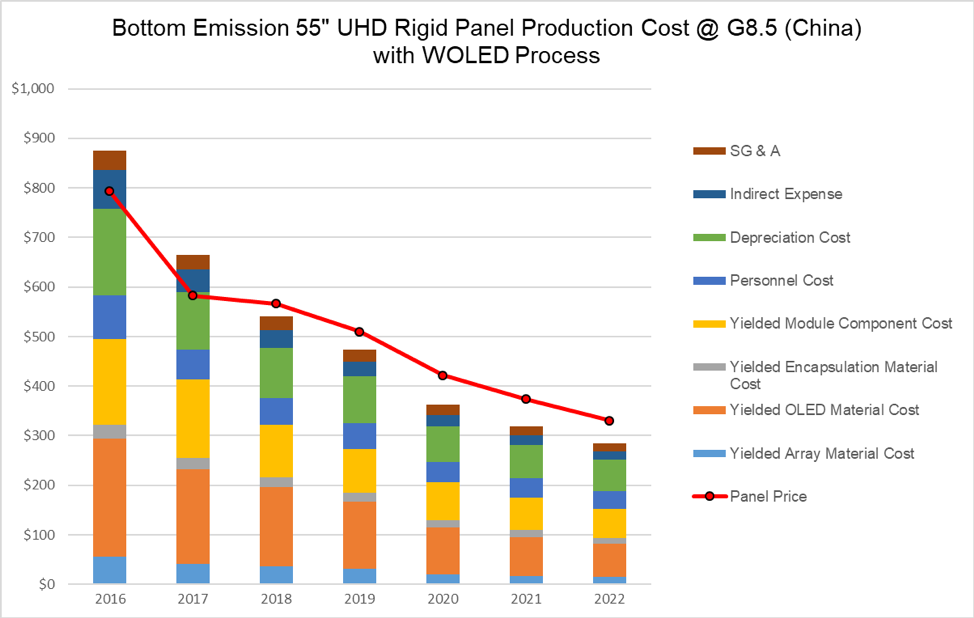

DSCC Quarterly Advanced TV Display Cost Report

DSCC Quarterly Advanced TV Display Cost Report

The main issue for LG has been cost. Although it has often described the technology it uses (white OLED with a colour filter) as ‘simple’, the reality is that there is no White OLED material – the white is created from red, green and two blue layers which combine to create white. Each of those emissive layers needs supporting layers, so the sandwich of the OLED is actually composed of 22 layers. As Ken said to me when we discussed this, these are basically ‘simple’ layers, but still a small defect in any of the layers can cause a panel to have to be rejected, so careful process control is needed. The vapour deposition process is quite wasteful of expensive OLED materials, which is why OLED makers are looking at inkjet printing, to save cost.

The white OLED system also uses a color filter, which costs money. The filter also means that most of the expensively produced light is thrown away, so LG uses an RGBW structure to boost peak white, and that increases the cost of drivers.

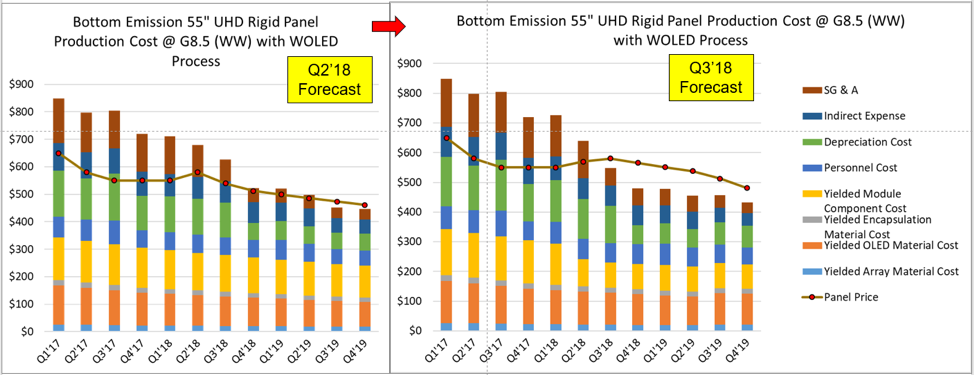

DSCC made a calculation of OLED costs and panel prices in Q2 and that suggested that LG would just scrape breakeven. However, a revised forecast shows that LG Display should actually move into profit based on the following changes:

- Raised prices for the panels, as we have reported in Large Display Monitor

- The end of a depreciation charge as LG Display’s E4-2 fab will be fully depreciated in Q4 2018

- LGD has stopped providing Market Development Funds to set makers in the second half of 2018

- Some components such as driver ICs, TCons, polarisers and other components have dropped in price

55” UHD Cost and Price, Q2’18 Forecast Compared with Q3’18 Forecast. Source DSCC Quarterly Advanced TV Display Cost Report

55” UHD Cost and Price, Q2’18 Forecast Compared with Q3’18 Forecast. Source DSCC Quarterly Advanced TV Display Cost Report

The same kind of trends have improved the profitability of 65″ panels.

A big project for LGD is the development of a new G8.5 fab in Guangzhou that should allow LGD to reduce costs. Part of the improved cost advantage may be offset by a need to reduce panel prices to supply Chinese TV brands. China has been less keen on OLEDs than other areas (especially Europe, which according to data from the GFU shown at IFA, accounts for 40% of the current world market) and DSCC believes that LGD may have to drop its prices by 10%. However, that should still allow profitability.

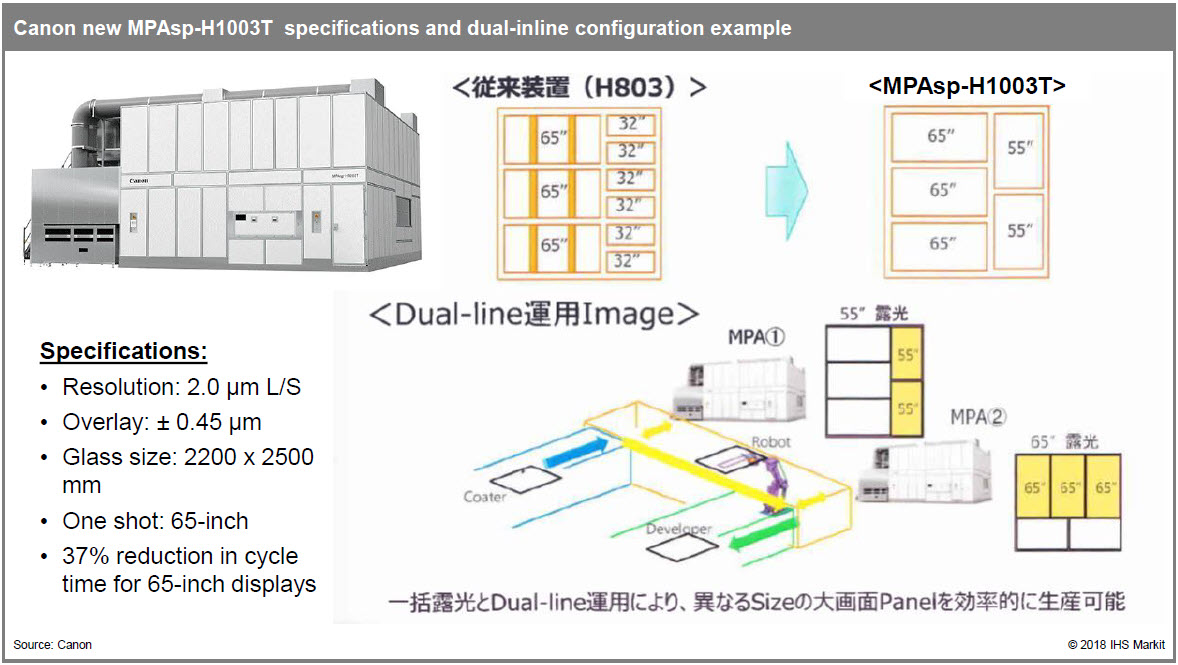

The improved efficiency in China is also enabled by a new Canon FPD lithography tool, the MPAsp-H1003T (what a name!), that is being used in China, according to Charles Annis from IHS in a recent webinar. This new tool allows LGD to make MMG (multi-mother glass) configurations, mixing 65″ and 55″ panels on the same substrate to allow very efficient use of glass. The new tool allow ‘one shot’ exposure of 65″ panels.

The new Canon tool allows single-shot 65″ exposure. Image:IHS Markit

The new Canon tool allows single-shot 65″ exposure. Image:IHS Markit

DSCC has looked ahead at the costs of making 55″ OLEDs in China and that shows that 55″ panels could get below $300 in 2022. However, costs in China for LCDs will be close to half that, so OLED will remain a premium product. Nevertheless, the move to make more OLEDs in China should make OLED a profitable panel for the future.