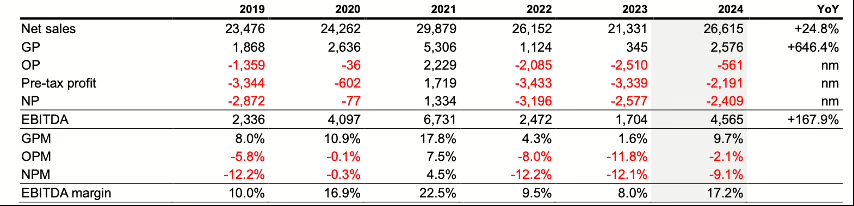

For the six year period 2019-2024, LGD’s (LG Display) revenue was 151,715 billion KRW, with a net operating margin of -4.4% and a pre-tax profit margin of -7.4%. LGD’ s OLED capacity is ill suited to today’s demand. It has 2 OLED TV Gen 8.5 OLED Fabs with a total capacity of 962.5K m2/month that operates at 50-60% utilization, where demand is static and 294.3K m2/month for small/medium displays that operates at 90% utilization, where the growth is increasing at around 10% per year.

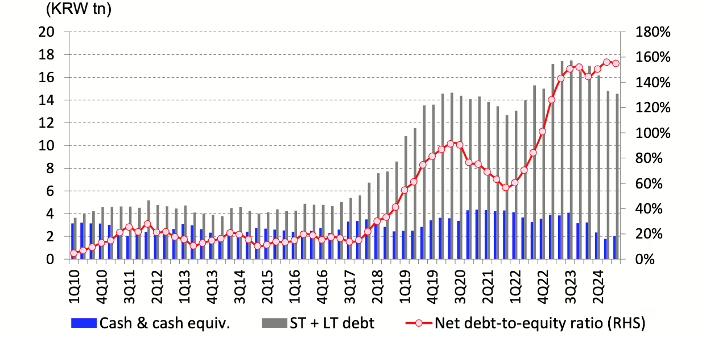

With a cumulative 6-year net profit of 9,792 billion KWR ($6.77 billion), LGD’s balance sheet has a 160% net debt-to-equity ratio, up from 100% in 2019. As a result the company has difficulty funding new capacity, which is why there is no plan to build a Gen 8.7 OLED IT fab to match its competitors.

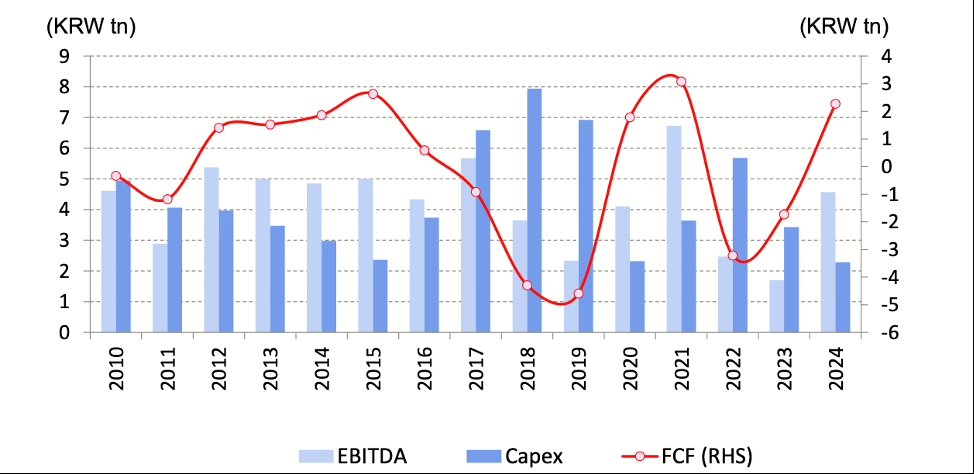

The company has made strides over the last two years in generating free cash flow by reducing staff, managing the process and increasing small/medium panel production. LGD will get a cash boost of 2 trillion KRW, when it closes on the sale of the Guangzhou Gen 8.5 LCD fab at the end of Q1’25. These funds will likely be used to pay down some of the existing debt.

The company is the top supplier of LCD panels for MacBooks and iPad. In LCD/OLED totals for automobile applications, the company exceeds SDC, which supplies OLED only, with momentum and earnings showing improvement. However, the core issue with OLEDs is their lower cost competitiveness compared to LCDs, with challenges including delayed OLED adoption for automotive applications and weaker-than-expected demand for the iPad Pro (OLED). LGD has indicated that OLED demand for iPhone applications is unlikely to grow significantly in 2025 due to constraints on production capacity and number of iPhone model launches, but it expects OLED demand for iPad applications to increase (perhaps LGD is confident that Apple will launch new OLED-equipped iPad models). However, total OLED demand (LGD and SDC combined) will be flat YoY at around 6.0 million units with no growth for automotive applications, making it difficult to be optimistic about OLED demand at LGD in 2025.

Further investment in technology and production capacity is needed to maintain a competitive position with SDC, BOE and Visionox. Although LGD has a dominant position for LCD panels going into iPads and MacBooks, BOE has some market share, and the issue with LCDs is that they command low selling prices and weak profit margins despite high development costs.

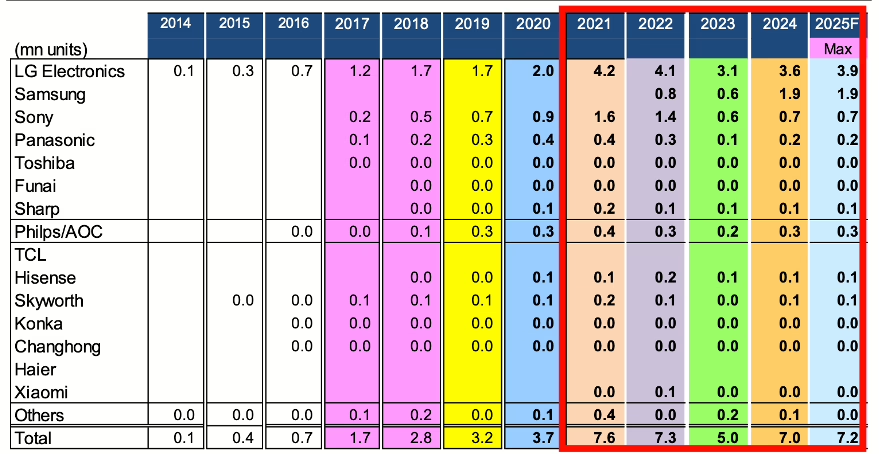

Meanwhile, the WOLED large area panel production post losses despite an improvement at the operating line thanks to increased demand from LG Electronics and Samsung Visual Display. Demand for 2025 onward will still depend on these two customers. Annual TV panel production stands at around 6 million units, and needs a fixed cost structure capable of turning a profit at the OP line by using capacity to produce and sell monitor panels.

There are no plans for additional investment in G6 and G8.7 OLED panels and cash flow from an earnings recovery seems unlikely although the sale of the Guangzhou plant to TCL CSOT could be a partial source of funds needed.

At the end of Q4’24, the company had 2.0 trillion KRW in cash and deposits, excluding cash and deposits held by the Guangzhou subsidiary, interest-bearing debt of 14.5 trillion KRW, net debt of 12.5 trillion KRW, and a debt-to-equity ratio of 155%.

The company is projecting that depreciation and amortization will decrease by 0.8t–0.9 trillion KRW YoY to 4.3 trillion KRW in 2025 (due to IT OLED G6 and back-end processinin Vietnam). LGD plans capex of around 2.0 trillion KRW (versus 2.2 trillion KRW last year), and with free cash flow expected to be positive, its financial position should improve. The company needs to repay 3.5 trillion KRW of debt each year going forward, and therefore still has a considerable way to go to restore its financial health.

LGD implemented a voluntary early retirement plan again in Q4’24, following on from Q3’24, when there was a 150.0 billion KRW program primarily for plant

workers/operators (mostly forheadquarters). This measure is expected to produce cost savings of 200 billion KRW or more on an annual basis. Management expects to secure 2.03 trillion KRW from the sale of its Guangzhou LCD plant (GP1/2; LCD plant only [OLED plant excluded]) to TCL CSOT. Management has not specified how the proceeds will be utilized, but there is a high probability that the lion’s share of the funds will be used to improve the company’s financial condition by paying down interest-bearing debt.

Large OLED Panels

LGD’s financial performance remains weighed down by the roughly $10 billion investment in 2 Gen 8.5 OLED fabs that have been operating at 50% to 60% utilization over the past 3 years and is expected to continue the UT rate thru 2025.

- In 2022, TV OLED panel shipments fell 17% YoY to 6.4 million units in 2022 compared to a production capacity of 10.5 million. Estimated sales came to 4.3 trillion KRW and there was an operating loss of around 950.0 billion KRW.

- In 2023, shipment volume was 4.4 million units (down 31% YoY), due to weak demand. Estimated sales in 2023 came to 2.9 trillion KRW and the operating loss widened to about 1.0 trillion KRW.

- In 2024, LGD reported 5.9 million units (for an average plant capacity utilization rate of 60%). Sales were just under 4.0 trillion KRW.

Samsung Visual Display (SVD) demand is expected to reach 0.7 million units for 2024. While it is certainly good news that SVD adopted all panel sizes (48”, 55”, 65”, and 77” panels) in 2024, going forward, SVD’s demand could potentially change depending on final demand as well as its own strategy. LG Electronics demand is expected to gradually rise, while demand ranges from flat to a slight decrease fo Sony and for European companies. Shipments for monitors are forecast to rise from 600,000 in 2024 to around 800,000. The operating loss is narrowing due to higher sales and cost-cutting efforts, as the loss for FY24 is estimated to be about 30% of the FY23 amount (about 300-350 billion KRW). In 2025, LGD expects to further reduce costs thru the full amortization of the 2 Gen 8.5 fabs.

*Includes 1.3m QD-OLED panels in 2024 and 2025

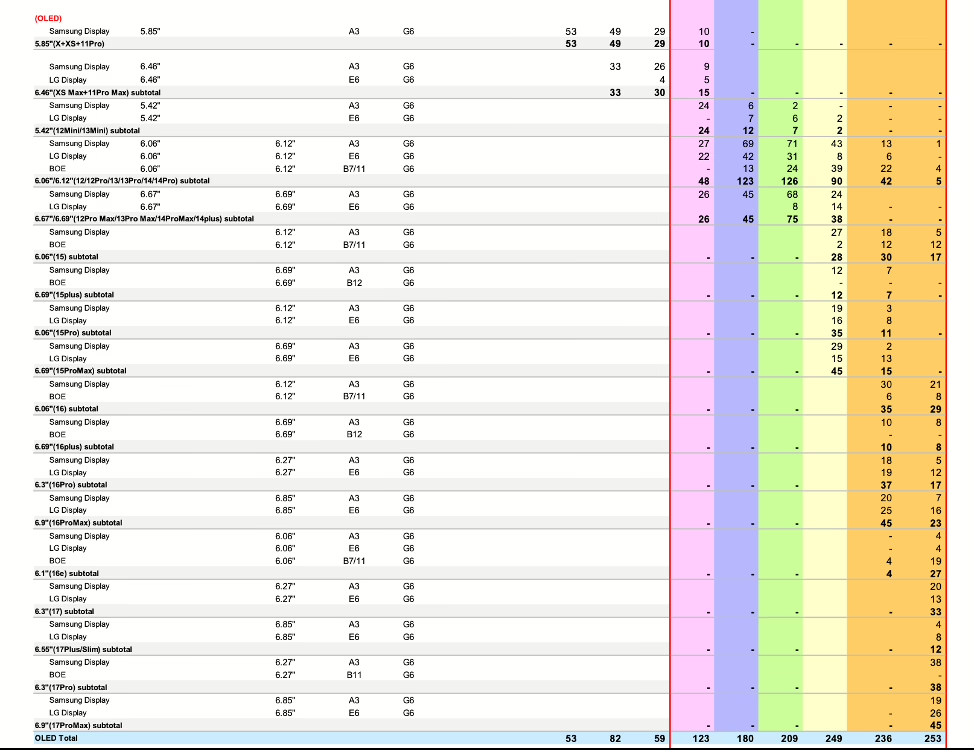

Small/Mid-Size OLED Panels: The Shift to LTPO/Pro Models Propels LGD Past SDC for iPhone 16 Pro/Max

The Gen 6 E6-1, 6-2, and 6-3 lines (each with 45,000 panels per month) are effectively dedicated to Apple (iPhone). See the next figure for past shipping quantity estimates. Due to the technological gap with SDC, LGD has long lagged behind in terms of the number of models for which orders are received, order volume, and price

However, for the iPhone 15 in 2023, LGD won orders for both the high-end 15 Pro Max and Pro (two LTPO models). Although the certification of mass production was delayed, production recovered rapidly in Q4’23, with shipment volume of 15 million units for the Pro and 16 million units for the Pro Max, for a total of 55 million units for the full year, topping 50 million units for the first time. Profitability has also improved significantly as the higher-priced LTPO models have become the main models. In 2024, the company received orders for the iPhone 16 Pro Max and Pro, and for the first time it received approval from Apple at around the same time as SDC.

LGD topped SDC in market share, at 25 milion panels for the Pro Max (55% share) and 21 millkon for the Pro (53%). All iPhone 17 models in 2025 are expected to use LTPO, and LGD will supply OLED panels for the Pro Max (it seems there will be no Pro), the Plus (which will have an updated concept of “Slim+Light”; perhaps now called the 17 Air), and the mainstream iPhone 17 models. LGD is expected to supply a share of the “17” models that would normally be provided by BOE, because BOE has yet to qualify their LTPO process. In addition, LGD will supply panels for the LTPS-based 16e, although the volume is small, and production capacity will be a medium to long-term issue. The company is expected to shift around 5,000 units of iPad production to the iPhone.

OLED for IT

LGD used its G6 plant (E6-4 at P10) for the iPad from Q1’24. Of the two OLED iPad models launched in 2024 (11.1″ and 12.9″), the company was expected to mainly supply 12.9″ panels. Modular production capacity is estimated to be 900,000 units per month, with a total annual volume of around 4–4.5 million units, but it only ended up supplying around 3.5 million units due to sluggish sales. E6-4 uses a line configuration to produce OLED panels based on a tandem structure (two stacked light-emitting layers) with G6 substrate size and G6 half deposition, the same for E6-1/2/3. SDC supplied 11.1” panels via its existing A3/A4 plant, down from the initial estimate of 3.5–4.0 million in 2024, to 2.5 million.

SDC is investing in the world’s first G8.7 RGB OLED for aMacBooks, using oxide substrates and G8.7 Canon Tokki for half deposition equipment, and is preparing for mass production supply at the end of 2025 or early 2026, providing 14.3″ and 16.3″ panels. LGD is still evaluating a G8.7 RGB OLED panels (oxide substrate + ion implantation and G8.7 half deposition) at the P10 plant that targets the MacBook. The plan was to first invest in a prototype line and then in a mass production line (7,500 units per month to 15,000 units per month for 2025–2026), but LGD currently has no leeway with cash flow, and plans have been slapped with a temporary pause.

BOE and Visionox are both in the process of constructing Gen 8.7 OLED fabs, each with about 15,000 substrate per month capacity with BOE expecting MP in 2026/27 and Visionox targeting 15,000 per month by 2028.

Sluggish sales of the iPad Pro, the first-ever iPad product to feature an OLED display, could potentially put a significant damper on the company’s investment decision.

Demand for iPad Pro panels in 2025 will likely be roughly on par with 2024 levels, making the E6-4 production capacity of 15,000 units per month under-utilized, which is why the excess production capacity will be converted to iPhone-related production.

SDC opted for Canon Tokki’s G8.7 Half as per Apple’s request, while China’s BOE, which followed SDC in deciding to invest in G8.7 is likely to use South Korea-based Sunic’s system, which BOE has jointly developed with LGD. Visionox could use the Sunic or the Tokki tool for the first phase and then switch to Max OLED from Applied.

Outlook for Q1’25 and Beyond

For Q1’25, LGD expects a mid-single digit QoQ decline or worse for total shipments (in terms of panel area; lower shipments for TV applications due to seasonal factors) and roughly 15% QoQ decline in blended ASP (due to a drop in the weighting of OLED panels for mobile devices). Management stated that earnings have been stabilizing since 2H’24 when, excluding one-off costs, it expects earnings to rebound in 2025 as OLED smartphones grow by around 20%

- H1’25. The company believes it is ready technology-wise for

- foldable smartphones, and that everything else depends on the market and customer demand.

- Despite the shortfall for OLED iPad panels, Y/Y growth is expected in 2025.

2024 capex was 2.2 trillion KRW versus 5.2 trillion KRW in 2022 and 3.6 trillion KRW in 2023. The company expects capex to flat YoY in 2025, between 2.0 trillion KRW and 2.5 trillion KRW2. LGD is taking a wait-and-see approach on the Gen 8.7 OLED IT decision. During LGD’s Q4’24 results briefing, management stated that it expects depreciation expenses to come down in 2H 2025, which should boost profit.

LGD’s existential issue is that the unused 50% of large area OLED capacity remains unaddressed publicly and is the over arching reason behind the 400% drop in market cap since 2021. During a speech at the regular LGD shareholders’ meeting CEO Jeong said; “For the large sector, we will shift to a profitable structure through increased product sales and cost innovation.”

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.