Fraunhofer’s Hubert Lakner and LETI’s Marie-Noelle Semeria held a press conference to announce the collaboration between the two institutions. Semeria said that microelectronics is key for the european industry. The industry used to be “just CMOS and Moore’s Law”, but now there are other developments (if not, there’s trouble ahead – Man. Ed). In Europe, especially, there are new and different technologies that can deliver low cost and security in semiconductors.

raunhofer’s Hubert Lakner and LETI’s Marie-Noelle Semeria held a press conference. Image:Meko

raunhofer’s Hubert Lakner and LETI’s Marie-Noelle Semeria held a press conference. Image:Meko

Grenoble is a unique hub for imaging, she said. France regards semiconductors as strategic as it helps with sovereignty in economics and also in security and defence. It is essential to keep the knowledge of advanced technologies and to be able to develop future technologies, Leti believes, but so does the French government. The same requests about technology often come from small and medium companies because they can’t afford clean rooms, which can be very expensive to establish, but are increasingly important in high technology businesses. Leti and Fraunhofer can both help with this access.

There are two main challenges in Europe and maintaining the capability to manufacture in Europe is critical, Semeria believes. For example, the demand for microcontrollers is increasing very rapidly. That means you have to ramp up capacity to stay in the game. The second challenge is to integrate the technologies according to the needs of the OEM, with supporting software and developing platforms.

The reason for the reinforcement of the cooperation with Fraunhofer is based on this need for speed and depth. Everything is moving faster and in both organisations there is a need to support at a European level. Leti has to invest to stay up to date and support the expectations of industry. That is better done by collaborating with Fraunhofer in order to support SMEs.

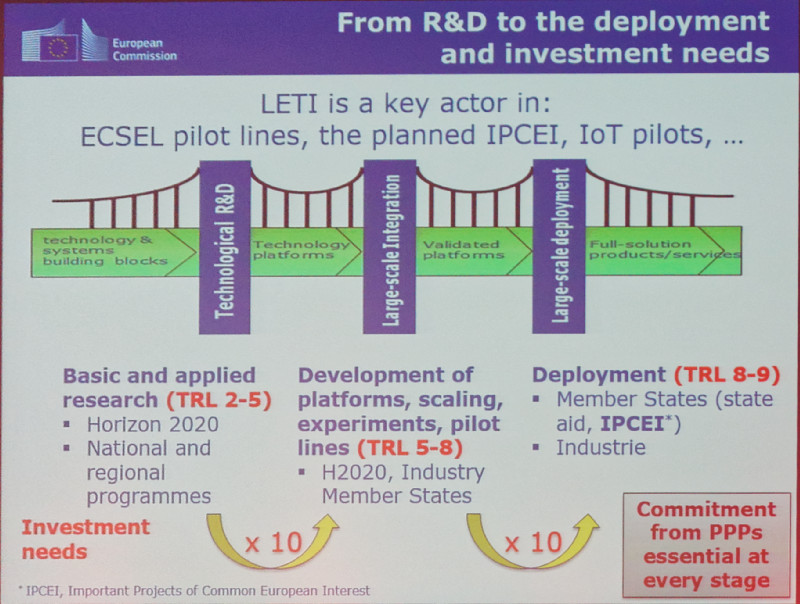

Lakner said that the two organisations worked together to create guidance for the EU and central authorities and this is now coming to fruitiion. There should be no ‘our nation first’ in trying to ensure development – it is critical to share roadmaps and facilities to develop Projects of Common European Interest (IPCEIs). The German government is investing €1 billion to help to develop fabs. Global Foundries (€1.7 billion in fab), Bosch (€1 billion) , Infineon (€300 million) and others will invest around €5 to €6 billion in semiconductor equipment in the near future. There is a big investment of €350 million in new equipment which is being aligned with the Leti roadmaps.

Players should not be soloists – more like an orchestra, Lakner said. France are Germany looking to be leaders, without the UK, and show that European cooperation can be successful. Otherwise, Europe will just be “an annexe of Asia”.

An example Lakner gave was an SME that had a good idea and in the past could just make it, but now products need AI and connectivity, but that is hard for SMEs as the costs to develop these are too high. That’s where platforms can help by sharing the costs. That means that research institutes rather than stopping their production at simply demonstrators, may need to go even to small scale production to allow product development. In that way, the institutes can support SMEs until they get to volume production, when they can find commercial development facilities.

In two weeks there will be a meeting at high state levels in Paris with Fraunhofer, Leti and the Commission as well as a number of governments.

The first joint platform is for FD-SOI technology (Fully Depleted – Silicon on Insulator which, as we understand it, is a new approach to making chips that is a planar (rather than 3D) transistor technology that is said to allow small feature size, but reduces leakage current to enable very low power operation – Man. Ed.)

The second platform is Sensors and these need to be made using FDSOI, where Europe has a real advantage. Europe, via STM and Bosch has strong positions in MEMs and other sensors.

Power electronics is the third pillar – more and more power are needed for autonomous vehicles and also for automation. SiCarbide development and production capacity is available (mainly in Italy, but some in Germany) and groups are preparing next generation based on Gallium Nitride. The plan is to build on the industry strengths.

In the US and China there are a lot of incentives to attract the highest technology industries, but Europe is first in power electronics, first in sensors, first in FDSOI, but not in FinFET or CMOS. There is a need to focus resources where there are strengths.

STM and Global Foundries are already overloaded with demand for some technologies. However, European companies mustn’t just be component suppliers – they have to move up the value chain. The car industry will have to be the best electronic car industry in the future and maybe the industry may not be selling cars but selling mobility before long?

STM will invest €300 million in the Crolles factory, near Grenoble, and will make big investments in equipment.

Lakner said that eleven of the Fraunhofer institutes are involved in microelectronics but they are using a single communication interface to Leti. Fraunhofer and Leti have shared roadmaps for ten years or so and collaborated to identify good projects at the European level. Some Leti scientists are on site in Dresden. There is no clear budget for the collaboration, yet, it may have to develop over time and both sides need to drive public money investment, Lakner believes.

The two organisations wIll use the IPCEI classification (a scheme to allow state aid for important projects – see European Commission Works With Leti, but Belgium is not in the IPCEI group. France Germany, Austria, Italy and maybe the UK, because the UK joined before the Brexit vote, but that’s not clear. Both institutes are waiting for finalisation and then will need approval of the EU and the first version will be in July. Then, there will be another milestone before the end of the year. However, Germany has already started making the investments, before the recognition as a IPCEI project, risking that its investments might not qualify.

The organisations will “optimise complementarity” – for example on FDSOI, Leti will work on front end processing and Fraunhofer will work on the back end.

The collaboration “starts today” and the first announcements of the programme will be in two weeks.

The press conference then went to questions and the first was on TSMC. That company is going for CMOS to the end of Moore’s Law – probably at around 3 micron. However, Europe is not in that race. Other technologies are not so expensive as FinFET. The industry is working on an IDM model, not a pure foundry model – so device makers still have their own knowledge

Important companies in Europe are Infineon, XFab, Global, STM, SOITEC Bosch (sensors) and it’s really about ecosystems – the developments have to be close to industry.

Germany has seen investment from the government of €1 billion for fabs and €350 million for research organisations – with four to five times that much money being added by industry. The only other IPCEI project is in High Performance Computing, but nano- micro- are both very popular topics.

There was a good question from a journalist at the conference who asked if IPCEI is “just a way that the EU can forgive itself for breaking WTO rules”. (It seems to me that there is more than a grain of truth in that suggestion! – Man. Ed)

Lakner said that IMEC is not involved because Belgium is not involved in the IPCEI. IMEC has a different business model – it has no committment to support the industry in the same way as Fraunhofer or Leti, but works with individual companies.

In response to a question, Lakner said that the Fraunhofer has around 4000 researchers in microelectronics.

Responding to another question, Semeria said that if you are not careful, there can be leakage of IP in these projects and Leti has had to both protect its IP and exploit its inventions.

Both said that there had been a big change at European level in the last year and Semeria said that in the last year there had been lots of talk about European sovereignty in some areas of technology.