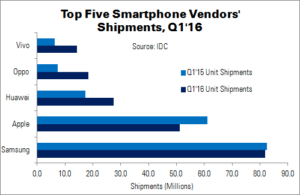

Although global smartphone shipments rose YoY in Q1’16, it was the smallest-ever recorded rise: just 0.4 million units, or less than 0.2%. IDC says that the low growth (from 334.5 million units to 334.9 million) was due to smartphone saturation in developed markets. Apple and Samsung, the world’s largest smartphone vendors, both suffered falling sales.

The biggest change in the market came from two new top five entrants: China’s Oppo and Vivo, which displaced domestic (and better-known) rivals Lenovo and Xiaomi. China’s smartphone market has peaked, with growth slowing from 62.5% in 2013 to 2.5% in 2015. At the same time, though, smartphone ASPs rose from $207 to $257.

Melissa Chau, a senior research manager at IDC, notes that the brands benefiting the most from China’s changing smartphone market are the ones most aligned with growth. Lenovo led in 2013, when ASPs were below $150, and Xiaomi in 2015 when ASPs were below $200. “Now Huawei, Oppo and Vivo, which play mainly in the sub-US$250 range, are positioned for a strong 2016,” she continued. “These new vendors would be well-advised not to rest on their laurels though, as this dynamic smartphone landscape has shown to even cult brands like Xiaomi that customer loyalty is difficult to consistently maintain.”

IDC research manager Anthony Scarsella added that the unfamiliarity of non-Chinese markets with these brands could hurt them; the ability of these vendors to gain entry into markets such as the USA and Western Europe will be “essential” if they hope to catch market leaders. Huawei is already recognised as a premium brand in China, and it is now going up against high-end devices with its own, like the Nexus 6P. “[S]elling equally impressive volumes outside of China remains a challenge for many of these brands,” Scarsella added.

| Top Five Smartphone Vendors’ Shipments, Market Share and Growth, Q1’16 (Preliminary) (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Samsung | 81.9 | 82.4 | 24.5% | 24.6% | -0.6% |

| Apple | 51.2 | 61.2 | 15.3% | 18.3% | -16.3% |

| Huawei | 27.5 | 17.4 | 8.2% | 5.2% | 58.4% |

| Oppo | 18.5 | 7.3 | 5.5% | 2.2% | 153.2% |

| Vivo | 14.3 | 6.4 | 4.3% | 1.9% | 123.8% |

| Others | 141.5 | 159.8 | 42.3% | 47.8% | -11.4% |

| Total | 334.9 | 334.5 | 100.0% | 100.0% | 0.2% |

| Source: IDC | |||||

Despite an annual decline of 0.6%, Samsung remained the smartphone market leader. Both the Galaxy S7 and S7 Edge enjoyed ‘vigorous’ sales in March. Samsung performed well in emerging markets with its more affordable J Series.

Apple’s revenues and unit sales declined for the first time in Q1 (for more, see Apple’s 13-Year Growth Grinds to a Halt), with volumes down to 51.2 million units (a 16.3% decline). IDC believes that, despite the new features, current iPhone 6/6 Plus owners do not feel that an upgrade to the 6S/6S Plus is worth it.

The iPhone SE is set to challenge similarly-priced Android phones in emerging markets: an area where Apple has struggled for a long time to make an impact. However, at $400 the phone still faces stiff competition.

Huawei took third place, thanks to its leading position in China and growing presence outside of its home market. Shipments rose from 17.4 million units to 27.5 million (up 58.4%). The company’s launch of both premium and entry-level devices served it well in both China and many developed European markets.

Oppo is the first of the entrants to the smartphone top five. The firm has been in the market since 2011, with a focus on China, although it has been shipping internationally since 2012 – specifically to Asia and MEA. Almost 20% of its shipments went outside of China last year. Oppo is focused on building channel partnerships, and emphasises self-promotion. The firm’s 18.5 million Q1’16 shipments represented 153.2% YoY growth.

Like Oppo, Vivo has been shipping smartphone since 2011; however, it has more rigidly focused on China. Vivo only began to test international markets (Southeast Asia and India) in 2014, and less than 10% of shipments were non-domestic in 2015. The company’s phones are placed as relatively premium models: its flagship X5Pro costs around $300. Vivo shipped 14.3 million units in Q1’16 (123.8% growth).