The transition from LCD to LED public displays is inevitable as the LED video displays market size is predicted to grow from $5.3bn in 2022 to $11bn in 2026, with a 12.1% CAGR growth through 2026, according to data from Omdia. Despite this shift, LCD video walls continue to be popular in applications such as retail, control rooms, and transportation due to their affordability. Asia & Oceania is expected to lead the high brightness LCD public display growth with a 14.3% CAGR through 2026, driven by the retail vertical and increasing consumer spending, particularly in India. While LED public displays gain momentum, key markets still exhibit demand for LCD public displays, particularly video walls and IFP/touch displays.

Transition from LCD to LED Public Displays:

- LED video displays market size growth (2022-2026): $5.3bn to $11bn

- Shipments worldwide: 2.7 million sqm

- CAGR growth through 2026: 12.1%

- Market leaders: China, North America, and Asia & Oceania

LCD Video Walls Popularity:

- Popular applications: Retail, control room, conference room, transportation, and education signage

- Continued dominance in certain markets due to affordability

High Brightness LCD Public Displays Growth (2022-2026):

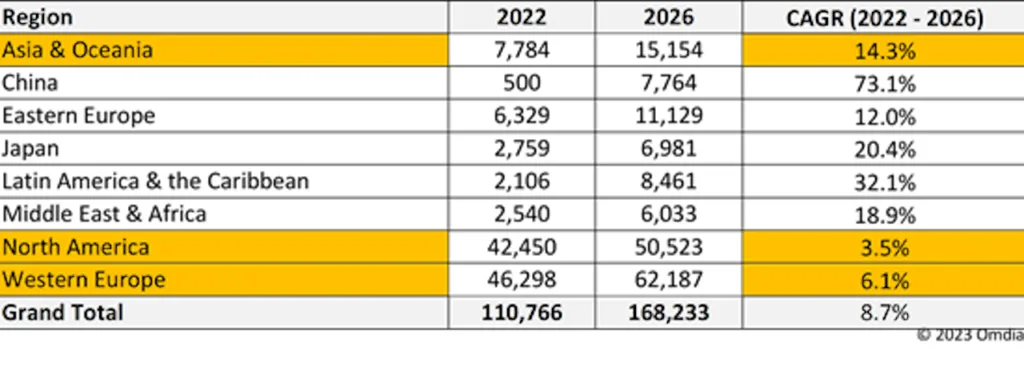

- Asia & Oceania:

- CAGR: 14.3%

- Shipment growth: 7,784 units in 2022 to over 15,000 units in 2026

- Market share: 7% in 2022 to 9% in 2026

- Western Europe:

- CAGR: 6.1%

- Market share: Shrinking from 41.8% in 2022 to 37% in 2026

- North America:

- CAGR: 3.5%

- Market share: Shrinking from 38.3% in 2022 to 30% in 2026

LCD vs. LED Public Displays:

- Average selling price (ASP) of LCD video walls (2022-2026): $2,800

- ASP of LED video walls (2022-2026): $3,600

Asia & Oceania and China’s Public Display Growth in 2023:

- Led by India (6% growth in 2023)

- Factors: Increasing consumer spending, young population, and government investments in various sectors

Key Market Drivers:

- Retail vertical in Asia & Oceania holding 35% market share in 2023

- Reopening of China’s borders

- Increased savings and consumer spending in China