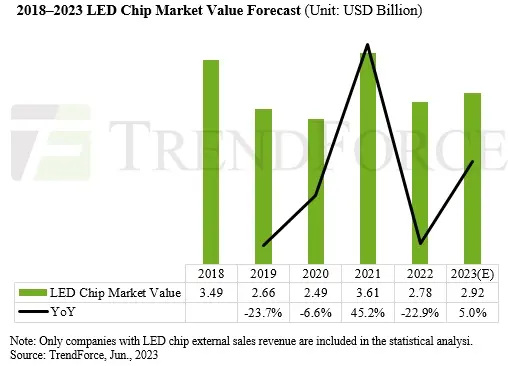

According to recent findings from TrendForce, the global LED market experienced a significant slump in 2022, with demand dropping across sectors, most notably in LED lighting and video wall markets. This decline was prompted by an oversupply of LED chips leading to a persistent price drop throughout the year. The combination of decreased demand and lowered prices led to a steep 23% annual decrease in the global LED chip market value, reducing it to $2.78 billion. A potential revival of the industry in 2023, predominantly fueled by a resurgence in the LED lighting sector, could boost LED production to an estimated $2.92 billion in 2023.

Commercial LED lighting is anticipated to spearhead this recovery, given the recent changes in the LED supply chain. After a low point in 2018, marked by an exodus of several small and medium-sized enterprises, there has been a shift in strategy by LED chip manufacturers. Many companies have transitioned into more profitable sectors, such as display technology, resulting in a reduced supply of lighting LED chips and lower inventory levels. As a result, many LED firms have elected to raise their prices, particularly for LED chips used for lighting applications. The most significant price increase was observed in low-power light chips with an area of 300 mil2 or less, seeing a rise of about 3–5%. In some cases, prices for chips of unique sizes jumped by up to 10%.