The unprecedented increase in prices for LCD TV panels will soon come to an end as the demand surge which resulted from the COVID-19 pandemic eases and industry supply has caught up. We expect prices to peak in June 2021 for some sizes and in July for others, and to decline for the rest of 2021. Even with the declines, prices at year-end will remain higher than they were in December 2020 and dramatically higher than their all-time lows.

In our last update in early May, we saw no end in sight to price increases, but a series of events in the last month have suggested slowing demand:

- Strong TV demand has been slowing, especially in the US, with TV sales at retail down double-digit percentages in every week since mid-April;

- Samsung VD is said to have had a downward revision of its 2021 sales plan for TVs by more than 10%;

- Chinese LCD makers have begun to ask TV brands to buy more panels;

- The slowdown of various consumption in India etc., due to rapid spread of coronavirus infection (32-43″ TV inventory is said to be increasing);

- The rate of increase in LCD TV panel prices began to ease in May. Average price increases in April for the seven TV screen sizes we track were 7% M/M, but this slowed to 3.7% M/M in May.

On top of slowing demand, we have also seen signs of increasing supply which combines to shift the dynamic from shortage to oversupply:

- Glassmakers have recovered from disruptions that occurred over the winter, and are striving to increase the supply of glass substrates;

- LCD makers have responded to higher prices by planning more than 16 new investments. While many of these are incremental capacity additions to existing fabs, BOE’s plans for a new Gen 10.5 fab will add substantial LCD capacity to the industry starting in 2023;

- Samsung and LG Display, which both indicated in 2020 that they would discontinue LCD TV production in Korea, have extended production of LCD TV panels at least until the end of 2021. For Samsung, this represents at least a one-year delay in SDC closing its G8.5 fab, and for LGD the production of LCD TV is likely to extend far beyond the end of this year.

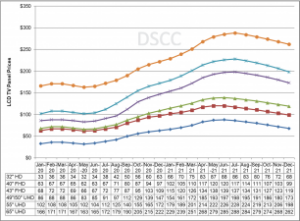

The first chart shows our latest TV panel price update, with prices increasing across the board from a low in May 2020 to a high point in June or July of this year and then a decline to December 2021. We saw multiple inflection points for the year-long up cycle, but we now see the slowdown which started in May 2021, as the end of the cycle. Prices in June 2021 have reached levels last seen in July 2017.

Prices increased in Q1 2021 for all sizes of TV panels, with double-digit percentage increases in sizes from 32” to 65” ranging from 12% to 18%. Prices for 75” increased by 8% as capacity has continued to increase on Gen 10.5 lines, where 75” is an efficient 6-cut. Price increases accelerated in March/April, and then decelerated in May/June, such that for the full quarter, the Q2 increases will be slightly larger than those seen in Q1 2021. Price increases will range from 11% for 75” to 22% for 32”, and we now expect prices to peak in June or July, varying by screen size.

LCD TV Panel Prices January 2020 –December 2021

We expect smaller TV screen sizes (32” up to 43”) to peak in June while larger sizes (49” and larger) will peak in July. Smaller screens have seen the largest increases in the up part of the cycle, with sizes made efficiently on Gen 10.5 (65” and 75”) having the smallest increases. As a result, in Q3 we expect that prices for the three small sizes will decrease Q/Q while prices for the four larger sizes will increase Q/Q.

The current upturn in the Crystal Cycle has seen the biggest trough-to-peak price increases for LCD TV panels, far exceeding previous Crystal Cycle rallies. Comparing our forecast for peak panel prices (in June or July 2021) with the prices in May 2020, we see trough-to-peak increases from 33% for 75” to 175% for 32”, with an average of 107%. In comparison, the average trough-to-peak increase of the 2016 to 2017 cycle was 48%, and prior cycles saw smaller increases.

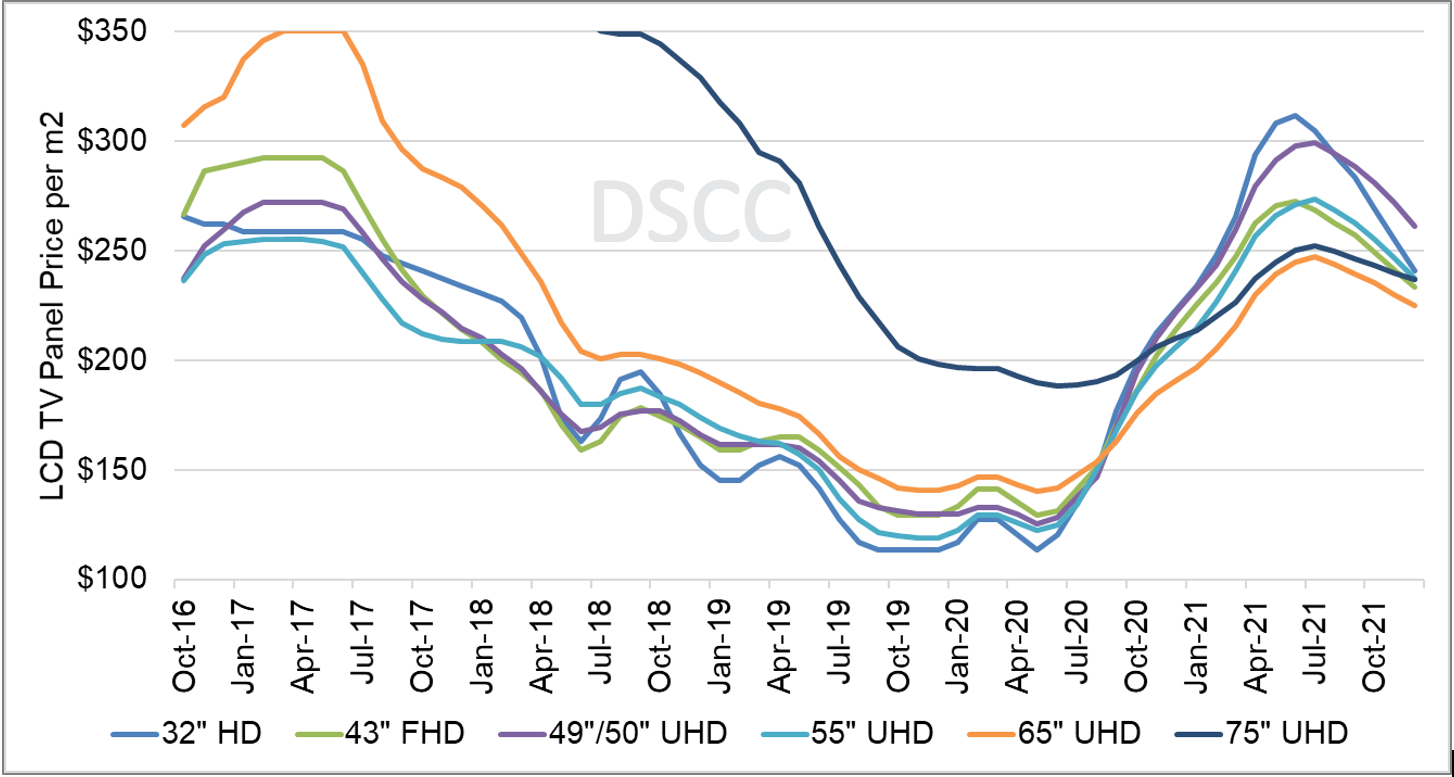

As we look at pricing on an area basis, we have noted that smaller screen TVs are the most commoditized: prices for 32” panels fall the fastest during a period of oversupply, but prices for these panels also rise the fastest during a period of shortage. We see that pattern repeating again as we head into oversupply. Before the current upswing, the largest panels sold with an area premium, but the year-long rally flipped that upside down, as shown in the next chart.

Monthly Area Prices per Square Meter for TV Panels, October 2016 – December 2021

Whereas in May 2020, 75” panels sold at an area premium of $77 per square meter higher than the 32” panel price, as of June 2021 they are selling at a $62 discount on an area basis. This means that those Gen 10.5 fabs could earn higher revenues from making 32” panels than from 75” panels. The pattern for 65” is even more severe, and 65” now is selling at a $67 per square meter discount (alternately, a 21% area discount) compared to 32”.

In the second half of 2021, though, we expect 32” TV panel prices to fall fastest, with a 23% decline between June and December 2021, while 75” TV panel prices decline only 6% from their mid-year peak. By the end of the year, we expect area prices for the smallest and largest panels to be close to the same, and no doubt 32” panels will again be the lowest price on an area basis in 2022.

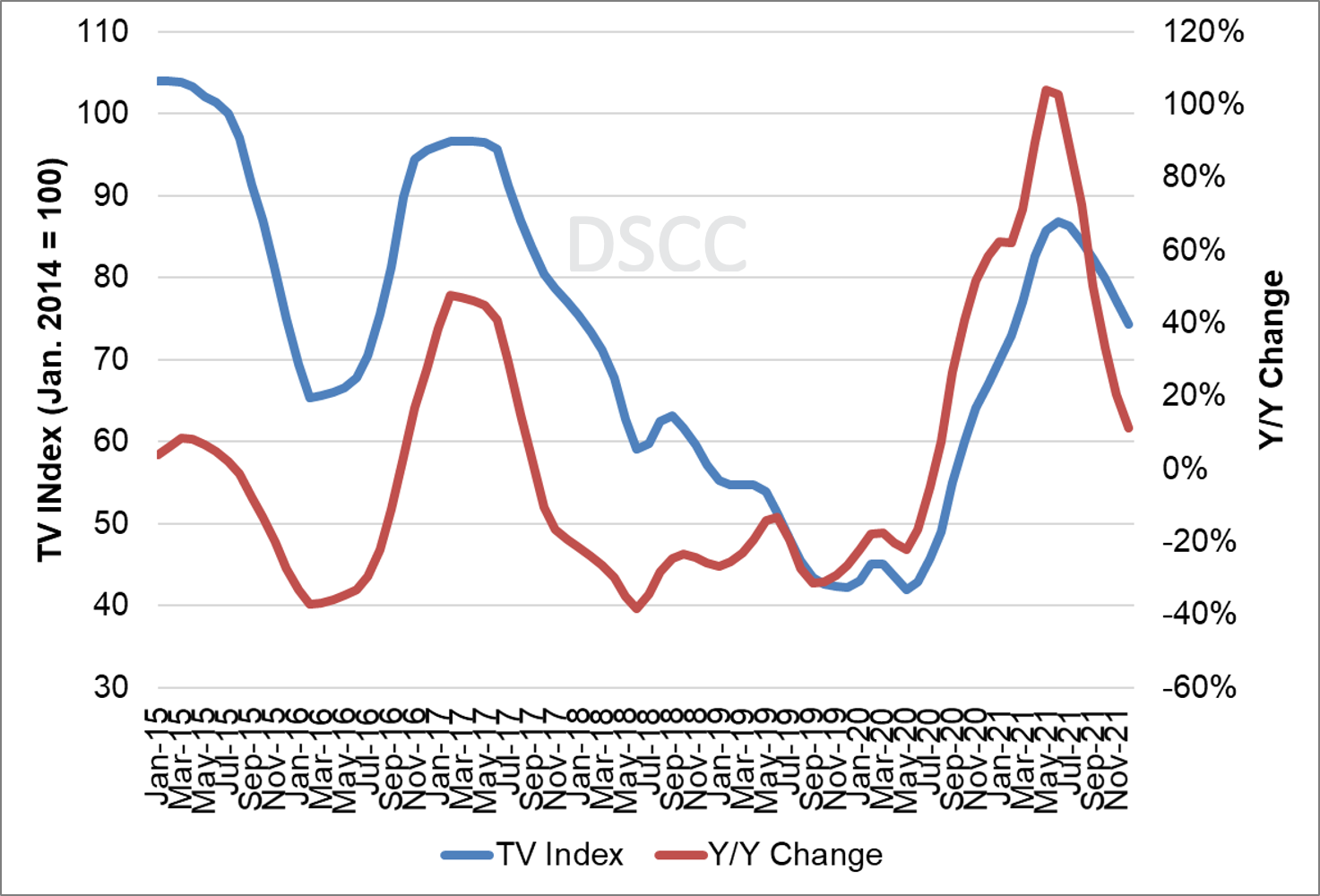

The last chart here shows our TV price index, set to 100 for prices in January 2014, and the Y/Y change of LCD TV panel prices. Our index has increased from its all-time low of 42.0 in May 2020 to 87 in June 2021, but this represents the peak and we expect the index to decline to 74 at year-end. The Y/Y increase surpassed 100% in May and June 2021 and will remain positive but at declining levels through the second half of 2021.

TV Panel Price Index and Y/Y Change, January 2015 – December 2021

In addition to being an exceptionally large upcycle, the current upswing matches some of the longest stretches of increasing prices ever seen, more than a full year from trough to peak. The length of the upswing can be attributed to several factors: glass and driver IC shortages, the pandemic-driven demand or the potential for Korean fab downsizing.

Based on their most recent financial reports, TV makers continued to make strong profits in Q1 2021 despite increasing panel prices. With demand remaining strong, TV makers have weathered the increase in panel prices and remained very profitable, but as demand falls off, especially in the richest markets of North America and Western Europe, TV makers will pull back.

For three years, from 2017 to 2020, LCD panel makers suffered through a continuous pattern of price declines interrupted only with brief respites. With the COVID-19 demand surge assisted by shortages in glass and DDICs, we have seen a historic year of increases in panel prices. We have seen Korean, Taiwanese and Chinese panel makers reporting robust margins in Q1 2021 and we expect the good news for panel makers to get even better in Q2, but that likely represents the peak in profitability for panel makers in this Crystal Cycle. (BOB)

Robert J (Bob) O’Brien is Co-Founder, Principal and CFO of DSCC

This article was first published on the DSCC blog and is re-published with kind permission.