Large LCD panel prices have been continuously increasing for last 10 months due to an increase in demand and tight supply. This has helped the LCD industry to recover from drastic panel price reductions, revenue and profit loss in 2019. It has also contributed to the growth of Quantum Dot and MiniLED LCD TV.

Strong LCD TV panel demand is expected to continue in 2021, but component shortages, supply constraints and very high panel price increase can still create uncertainties.

Low Panel Prices: Drive Demand/Adoption Rates

LCD TV panel capacity increased substantially in 2019 due to the expansion in the number of Gen 10.5 fabs. After growth in 2018, LCD TV demand weakened in 2019 caused by slower economic growth, trade war and tariff rate increases. Capacity expansion and higher production combined with weaker demand resulted in considerable oversupply of LCD TV panels in 2019 leading to drastic panel price reductions. Some panel prices went below cash cost, forcing suppliers to cut production and delay expansion plans to reduce losses.

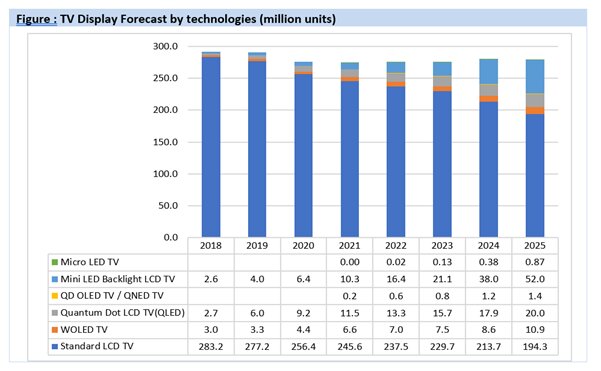

?Panel over-supply also brought down panel prices to way lower level than what was possible through cost improvement. Massive 10.5 Gen capacity that can produce 8-up 65″ and 6-up 75″ panels from a single mother glass substrate helped to reduce larger size LCD TV panel costs. Also extremely low panel price in 2019 helped TV brands to offer larger size LCD TV (>60-inch size) with better specs and technology (Quantum Dot & MiniLED) at more competitive prices, driving higher shipments and adoption rates in 2019 and 2020.

While WOLED TV had higher shipment share in 2018, Quantum Dot and MiniLED based LCD TV gained higher unit shares both in 2019 and 2020 according to Omdia published data. This trend is expected to continue in 2021 and in the next few years with more proliferation of Quantum Dot and MiniLED TVs.

Source:omdia.tech.informa.com Jan, 2021 press release

Source:omdia.tech.informa.com Jan, 2021 press release

Very Low Panel Prices: Can Reduce Production & Investment

Panel suppliers’ financial results suffered in 2019 as they lost money. Suppliers from China, Korea and Taiwan all lowered their utilization rates in the second half of 2019 to reduce over-supply. Very low prices combined with lower utilization rates made the revenue and profitability situation for panel suppliers difficult in 2019. BOE and China Star cut the utilization rates of their Gen 10.5 fabs. Sharp delayed the start of production at its 10.5 Gen fab in China. LGD and Samsung display decided to shift away from LCD more towards OLED and QDOLED respectively. Both companies cut utilization rates in their 7, 7.5 and 8.5 Gen fabs. Taiwanese suppliers also cut their 8.5 Gen fab utilization rates.

Some suppliers also shifted capacity away from TV to other applications. In summary, drastic price reduction resulted in a cut in utilization rates, delays in fab construction and ramp-ups and the closing down of older fabs, or conversion to OLED or QDOLED fabs. This helped to reduce oversupply.

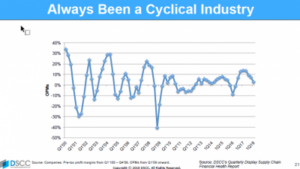

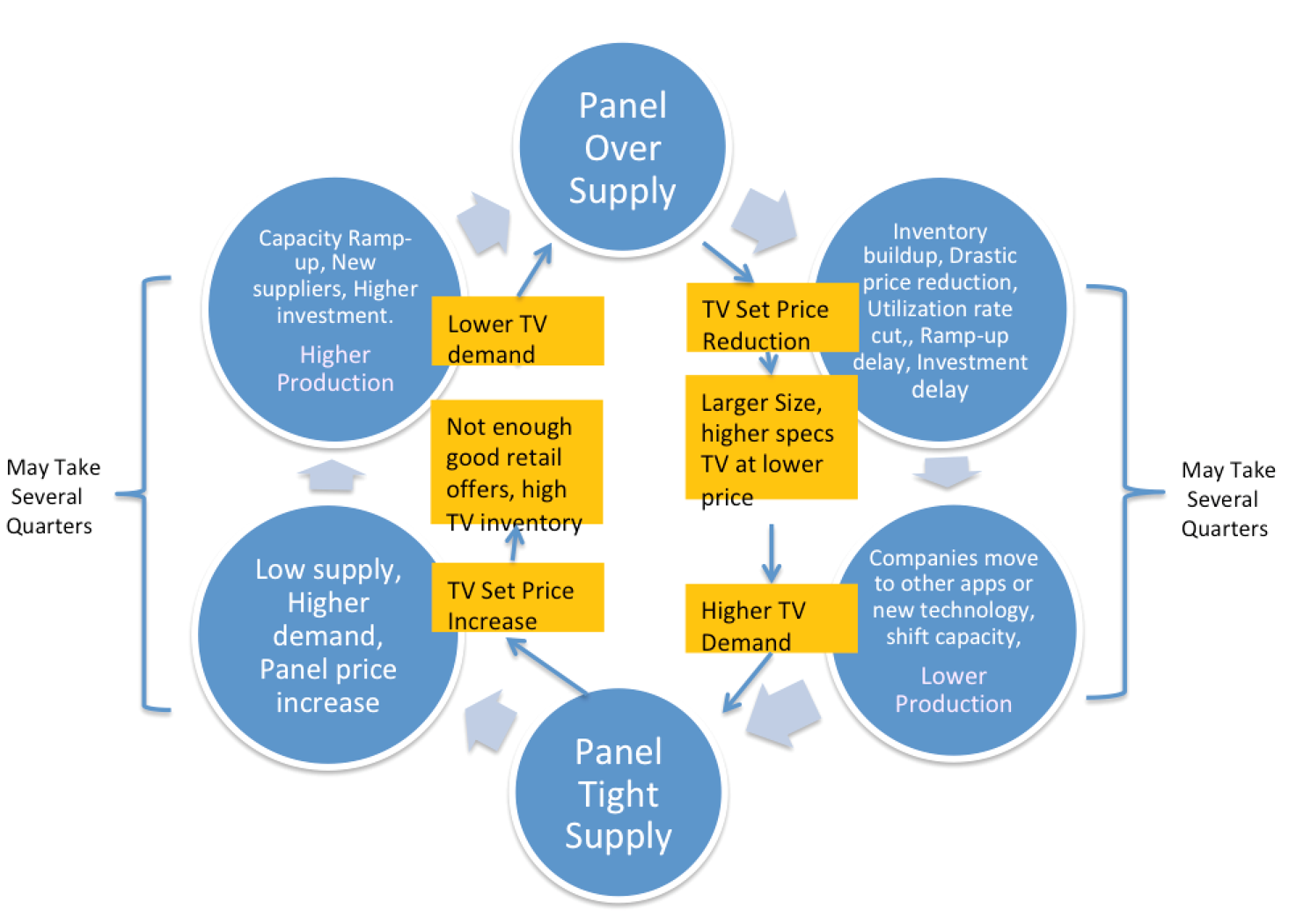

LCD Crystal Cycle – Source – Dash Insights

LCD Crystal Cycle – Source – Dash Insights

Higher Demand: Can Cause Tight Supply & Panel Price Increase

An increase in demand for larger size TVs in the second half of 2020 combined with component shortages has pushed the market to supply constraint and caused continuous panel price increases from June 2020 to March 2021. Market demand for tablets, notebooks, monitors and TVs increased in 2020 especially in the second half of the year due to the impact of “stay at home” regulations, when work from home, education from home and more focus on home entertainment pushed the demand to higher level.

With stay at home continuing in the firts half of 2021 and expected UEFA Europe football tournaments and the Olympic in Japan (July 23), TV brands are expecting stronger demand in 2021. The panel price increase resulting in higher costs for TV brands. It has also made it difficult for lower priced brands (Tier2/3) to acquire enough panels to offer lower priced TVs. Further, panel suppliers are giving priority to top brands with larger orders during supply constraint. In recent quarters, the top five TV brands including Samsung, LG, and TCL have been gaining higher market share.

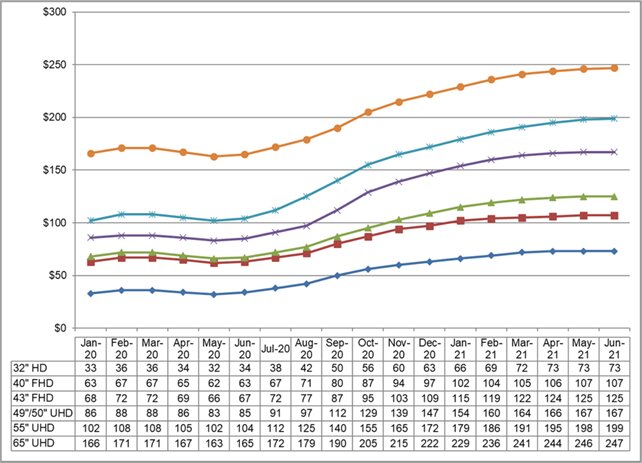

From June 2020 to January 2021, the 32″ TV panel price has increased more than 100%, whereas 55″ TV panel prices have increased more than 75% and the 65″ TV panel price has increased more than 38% on average according to DSCC data. Panel prices continued to increase through Q1 and the trend is expected to continue in Q2 2021 due to component shortages.

Panel prices – Source DSCC – Feb 15th 2021

Panel prices – Source DSCC – Feb 15th 2021

In last few months top glass suppliers Corning, NEG and AGC have all experienced production problems. A tank failure at Corning, a power outage at NEG and an accident at an AGC glass plant all resulted in glass supply constraints when demand and production has been increasing. In March this year Corning announced its plan to increase glass prices in Q2 2021. Corning has also increased supply by starting glass tank in Korea to supply China’s 10.5 Gen fabs that are ramping up. Most of the growth in capacity is coming from Gen 8.6 and Gen 10.5 fabs in China.

Besides glass there have been other component shortages including driver ICs and polarizers. Component shortages are expected to continue in the first half of 2021.

Very High Panel Prices: Can Cause Cost & Set-Price Increase

Major increases in panel prices from June 2020, have increased costs and reduced profits for TV brand manufacturers. TV brands are starting to increase TV set prices slowly in certain segments. Notebook brands are also planning to raise prices for new products to reflect increasing costs. Monitor prices are starting to increase in some segments. Despite this, buyers are still unable to fullfill orders due to supply issues.

TV panel prices increased in Q4 2020 and are also expected to increase in the first half of 2021. This can create challenges for brand manufacturers as it reduces their ability to offer more attractive prices in coming months to drive demand. Still, set-price increases up to March have been very mild and only in certain segments. Some brands are still offering price incentives to consumers in spite of the cost increases. For example, in the US market retailers cut prices of big screen LCD and OLED TV to entice basketball fans in March.

Higher Panel Prices: Can Increase Production & Investment

Higher LCD price and tight supply helped LCD suppliers to improve their financial performance in the second half of 2020. This caused a number of LCD suppliers especially in China to decide to expand production and increase their investment in 2021.

New opportunities for MiniLED based products that reduce the performance gap with OLED, enabling higher specs and higher prices are also driving higher investment in LCD production. Suppliers from China already have achieved a majority share of TFT-LCD capacity.

BOE has acquired Gen 8.5/8.6 fabs from CEC Panda. ChinaStar has acquired a Gen 8.5 fab in Suzhou from Samsung Display. Recent panel price increases have also resulted in Samsung and LGD delaying their plans to shut down LCD production. These developments can all help to improve supply in the second half of 2021. Fab utilization rates in Taiwan and China stayed high in the second half of 2020 and are expected to stay high in the first half of 2021.

Higher Set Prices – Can Impact Demand

Price increases for TV sets are still not widespread yet and increases do not reflect the full cost increase. However, if set prices continue to increase to even higher levels, there is the potential for an impact on demand.

QLED and MiniLED gained share in the premium TV market in 2019, impacting OLED shares and aided by low panel prices. With the LCD panel price increases in 2020 the cost gap between OLED TV and LCD has gone down in recent quarters.

OLED TV also gained higher market share in the premium TV market especially sets from LG and Sony in the last quarter of 2020, according to industry data. LG Display is implimenting major capacity expansion of its OLED TV panels with its Gen 8.5 fab in China.Strong sales in Q4 2020 and new product sizes such as 48-inch and 88-inch have helped LG Display’s OLED TV fabs to have higher utilization rates.

Samsung is also planning to start production of QDOLED in 2021. Higher production and cost reductions for OLED TV may help OLED to gain shares in the premium TV market if the price gap continues to reduce with LCD.

Lower tier brands are not able to offer aggressive prices due to the supply constraint and panel price increases. If these conditions continue for too long, TV demand could be impacted.

Implication: Uncertainties in 2H of 2021

Strong LCD TV demand especially for Quantum Dot and MiniLED TV is expected to continue in 2021. The economic recovery and sports events (UEFA Europe footbal and the Olympics in Japan) are expected to drive demand for TV, but component shortages, supply constraints and too big a price increase could create uncertainties. Panel suppliers have to navigate a delicate balance of capacity management and panel prices to capture the opportunity for higher TV demand. (SD)

Sweta Dash, President, Dash-Insights Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com