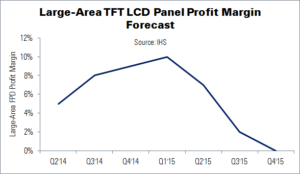

Profit margins for large-area TFT-LCD displays reached 10% in Q1’15, says IHS – their highest level since the first half of 2010. However, prices and margins are now being pressured downwards by high factory utilisation rates being maintained at leading panel makers, and rising inventories at set makers. Margins are forecast to fall to 0% in Q4 this year.

Large-area TFT-LCD displays have been profitable since the end of 2012. However, end-market demand for TVs, monitors, notebooks and tablets has shrunk significantly this year. A mix of economic and product reasons have caused demand outlook to deteriorate. The rising US dollar value, in particular, has caused local prices for various consumer electronics products to rise in many countries; this has caused demand to shrink.

Charles Annis, senior director at IHS, notes that panel manufacturers have maintained utilisation rates above 90% at their larger glass fabs since 2014 – despite falling demand.

“Even with recent price declines, many large panel sizes currently sell at marginal profits…At least for now, panel makers have decided to keep utilisation high and minimise overhead costs, in order to chase as much profit as possible while they are still able to. The downside to this strategy is that panel inventories at set-makers have ballooned, widening the gap between TV panel shipments and TV set shipments”, Annis said.

As excess inventory is cleared, panel prices are expected to fall quickly. Large-area display profitability is expected to follow the same trajectory. New G8 factories are ramping production at the same time. IHS expects large-area capacity to grow at 6% YoY in 2015 and 8% in 2016 – the highest rates in several years.

Annis expects growing concerns about the global economy – and its effect on end-market demand – to “weigh heavily” on profit margins throughout the remainder of 2015 and well into 2016.