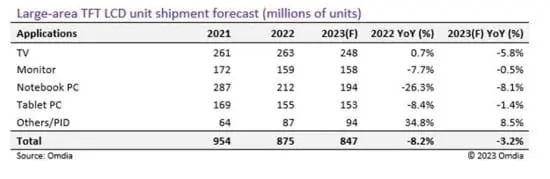

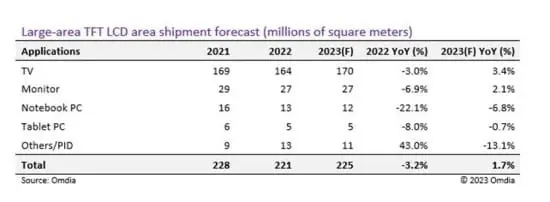

Omdia’s Large Area Display Market Tracker for the first quarter of 2023 shows a change in the forecasted growth of large-area LCD shipments from an initially predicted increase of 0.6% year-on-year (YoY) in 2023 to a negative growth of -3.2% YoY. The cause of this negative growth is attributed to slowing demands and panel makers’ management of utilization.

There are plans by some panel makers to either withdraw from the business or shut down older fabs. Despite a decrease in unit shipments, the shipment area for large-area LCDs is still expected to increase, albeit at a slower pace than previously forecasted (1.7% YoY instead of the 3% YoY).

IT Displays: The display makers had aimed to increase IT display shipments while decreasing LCD TVs in 2023. However, recovery in demand for IT LCDs is uncertain as display makers are facing significant deficits in this business. Despite inventory issues being seemingly resolved, PC brands and Original Equipment Manufacturers (OEMs) are keeping their inventory levels lower than before. This has been noted by Peter Su, the Principal Analyst of Omdia.

Notebook PC LCDs: The initial forecast was for a positive growth of 1.9% YoY in notebook PC LCD shipments in 2023, but the updated forecast predicts a negative growth of -8.1% YoY. The demand for notebook PC displays is slower than other large-area display applications.

Tablet PC LCDs: The decrement in tablet PC LCD shipments has been eased in the latest forecast, changing from -2.7% YoY to -1.4% YoY. This change is likely due to a global recession where cheaper tablet PCs may take some market share from notebook PCs.

As for revenue, large-area TFT LCD is forecasted to reach $ 65.2 billion in 2023, which represents a decrease by 0.9% YoY, caused by slower demand and the recovery of IT LCD prices. The only area expected to see growth is the TV LCD segment, which is expected to increase by 13.6% YoY, accompanied by a price hike from mid Q1’23.

Lastly, BOE is forecasted to have the largest market share of large-area TFT LCD unit shipments at 33.5% in 2023, followed by Innolux with 13.5%, and China Star with 11.5%. This highlights the ongoing dominance of certain key players in the market.