GPU shipments rose 9% from the last quarter in Q3’15, says Jon Peddie Research, although sales fell 19% compared to last year. Desktop shipments were down 13%, and notebooks down 22%. Despite the annual decline, JPR writes that the quarterly uptick represents a global increase in consumer confidence.

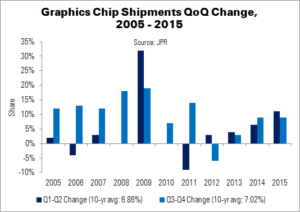

Q3 is, on average, up from Q2. While this largely was not the case in the middle of the economic recession (2009 – 2011), the PC industry now seems to have recovered its ‘seasonal rhythm’. The 10-year average is 7% QoQ growth, making this year’s 9% above-average.

GPUs are often used as a guiding indicator for the PC market, and many PC vendors are guiding cautiously for Q4. The gaming PC segment, which uses high-end GPUs, was a bright spot for the quarter. Nvidia’s sales of its new high-end Maxwell GPUs were strong, lifting the ASPs of the discrete GPU market.

AMD’s APU shipments rose 15% QoQ in desktops and fell 1% in notebooks. Discrete desktop shipments rose 33.3% QoQ, while notebooks increased 17.6%. Overall, AMD’s PC graphics shipments were up 15.9% from Q2.

Shipments of desktop and notebook processor embedded graphics rose 6.9% and 4.2% QoQ, respectively, at Intel. Overall graphics shipments rose 5.1%.

Nvidia enjoyed discrete desktop and notebook shipment increases of 26.4% and 14.1%, respectively; this led the company’s overall graphics shipments to climb 21.4% QoQ.

Total discrete GPU shipments in Q3 rose 21.9% QoQ, but fell 15.7% YoY. A variety of factors, including timing and memory pricing, can affect these shipments. JPR calculates the CAGR of discrete graphics to be -4% between 2014 and 2017.

| Total Graphics Chip Market Shares | ||||

|---|---|---|---|---|

| Vendor | Q3’15 Share | Q3’14 Share | QoQ Change | YoY Change |

| AMD | 11.5% | 10.7% | 0.7% | -2.7% |

| Intel | 72.8% | 75.2% | -2.4% | 1.0% |

| Nvidia | 15.7% | 14.1% | 1.7% | 1.6% |

| Others | 0.0% | 0.0% | 0.0% | 0.0% |

| Source: JPR | ||||

Analyst Comment

Although AMD performed well in the quarter – largely thanks to its introduction of the R9 Fury GPUs in the summer – Nvidia is moving to roll out features that encourage users to stay in the Geforce ecosystem.

Much as other technology companies do – Apple being notorious for the practice – Nvidia is working to make switching to a different GPU brand harder, or at least less appealing. Come December, the company has announced that it will secure its Game Ready drivers (these optimise a PC with the latest drivers for top-tier games) behind the Geforce Experience (GFE) software.

Nvidia has also said that it plans to turn GFE into a gaming hub, for news, hardware giveaways and early access codes for upcoming titles. It will still also be the place where gamers go to enable features such as Shadowplay and Gamestream.

Another – and compelling – way to keep people using Nvidia GPUs include the release of games built using the company’s Gameworks middleware. These games are optimised for use with Nvidia GPUs, typically looking better than if the gamer were playing with a rival card. For example, PhysX technology is part of Gameworks.

AMD has not been sitting idle, of course. Its R9 Fury cards were the first in the world to use High Bandwidth Memory, which will not be used by Nvidia until next year. It has also updated its Radeon Software Crimson control panel, offering users tools such as overclocking profiles for individual games (AMD Optimises for AR & VR). Competition between these two big GPU makers is really heating up. (TA)