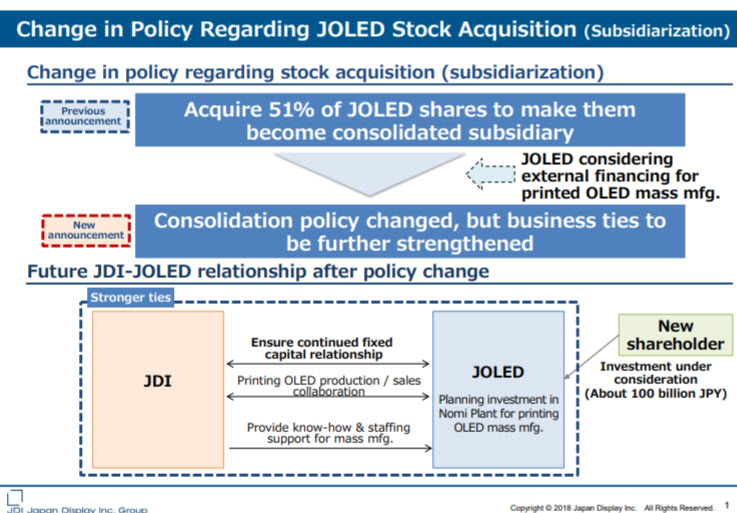

Japan Display Inc has said that it plans to increase its shareholding in JOLED from 15% to 51% and make the company a consolidated subsidiary. JDI said that the companies have worked closely to develop TFT backplanes together and JDI has been using its global sales network to boost sales for JOLED, which has already led to increased business.

JDI also said that it would sell its plant in Nomi City, Ishikawa prefecture, to the Innovation Network Corp of Japan (INCJ), who would then contribute it to JOLED.

JOLED is expected to gain additional shareholders to go alongside Sony, Panasonic and INCJ.

Separately, JDI said that it would raise ¥55 billion ($512 million) with ¥30 ($280 million) coming from overseas financial investors and ¥5 billion ($46 million) coming from Nichia Corp and other finance coming from INCJ. Around ¥9 billion ($84 million) will be used for capital expenditure to boost the capacity for ‘full active’ smartphone displays, with the rest being used for working capital for the same purpose.

JDI said that it will continue to consider alliances to boost its development of OLEDs, but the change in outlook means that it is not as pressing and there may be good demand for LCDs in other areas than smartphones (for example, automotive).

Analyst Comment

This would seem to secure JDI’s position for now. However, unless it develops OLED technology, where it should be able to get ahead of Chinese companies, it may struggle to stay competitive in the long term. Unfortunately, to become competitive in OLED, it will need a big investment and the events of the last couple of years will have made some potential partners nervous, I think. Still, JDI has good engineers and is bound to show some interesting new technology at SID. (BR)