In 2024, OLED display shipments, revenue, and area rose as the entire display industry recovered from a difficult 2023. The year also featured significant OLED achievements:

- The first tandem hybrid OLEDs were used in tablets, specifically the iPad Pro models. Previously, LG Display (LGD) had employed this technology in automotive applications.

- Major capital expenditure (capex) commitments were made for Gen 8.7 IT fabs by Samsung Display (SDC), BOE, and Visionox.

- The OLED supply base improved productivity as Chinese OLED panel makers achieved competitive yields after years of development.

- Apple moved almost completely to OLEDs, including the mid-range iPhone SE4 starting in 2025, iPads in 2024, MacBooks in 2025/2026, and a foldable device likely in 2027.

- OLED monitors emerged suddenly as the preferred display for high-end gamers, who appreciated the fast response time, high contrast ratio, and thin form factor, despite the higher price points.

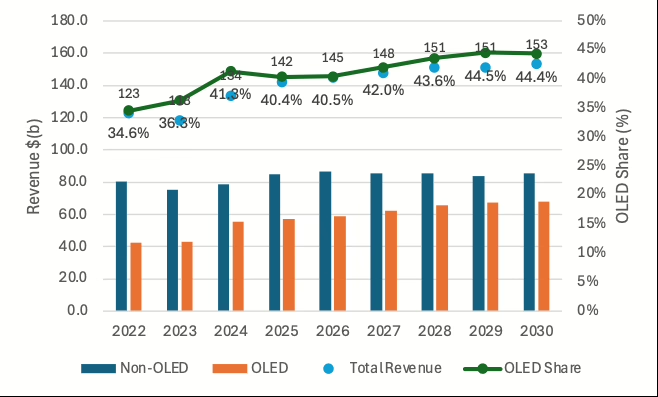

The display industry’s revenue grew from $134 billion in 2023 to $142 billion in 2024. Meanwhile, OLED’s share rose from 36.8% in 2023 to 40.4% in 2024 and is expected to reach 44.5% by the end of the decade. As shown in the figure below, total revenue growth paralleled the increase in OLED share.

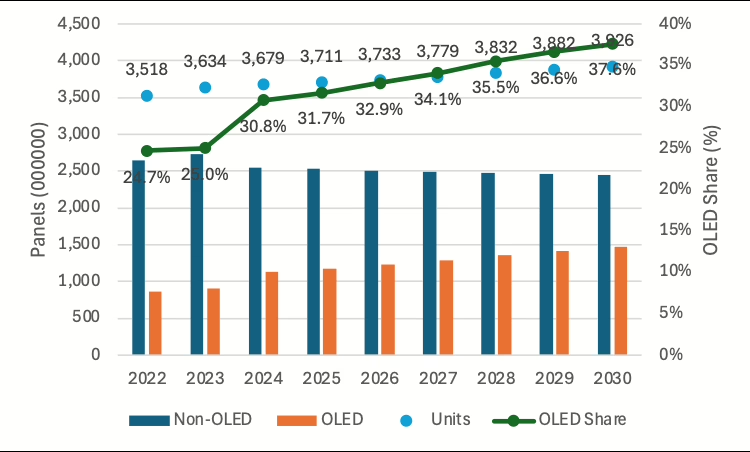

Panel shipments grew minimally in 2024 to 3.679 million units and are expected to continue slow growth through 2030. However, OLED panel shipments, which were up 4% year-over-year (YoY) in 2023, increased by 25% YoY in 2024, reaching 1 billion units for the first time.

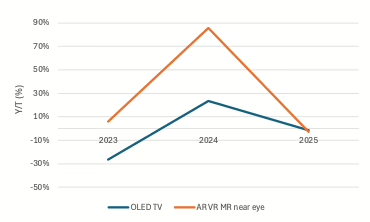

Not everything progressed as planned. Although OLED TV shipments were higher than in 2023, they still did not reach 2022 levels. The high-end TV market shifted toward 77”+ TVs, where Gen 8.5 OLED fabs struggled to compete against large Gen 10.5 LCD fabs in China.

- MiniLED TV set shipments outpaced OLED TVs in the profitable advanced TV category.

- The low OLED TV panel shipments caused LGD to continue operating at a loss, and Samsung’s QD-OLED fab also operated in the red.

- Universal Display Corporation (UDC) disappointed the market by not releasing a phosphorescent (Ph) blue emitter. Although there were reports of “good progress,” the material was not ready. Panel makers indicated the issue was lifetime, less than half that of the current fluorescent (FL) blue, with no improvement over the past year.

Two other events in 2024 had almost no short-term impact but hold potential long-term implications:

- Apple abandoned its dream of independence from panel makers by ceasing efforts to build a supply chain based on MicroLEDs. The test case—a 2” smartwatch display—proved too expensive and power-hungry. This decision cost Apple and its partners, including LuxVue, ams Osram, and LGD, billions of dollars and hurt the momentum and capital flowing into the MicroLED industry.

- UDC announced research on plasmonics, which promises to double or even triple OLED external quantum efficiency (EQE). This technology, which shifts the photon source from within the OLED stack to outside it, could enable OLED displays with longer lifetimes, higher luminance, and significantly reduced power consumption. Given its R&D status, UDC is targeting the end of the decade for commercial readiness.

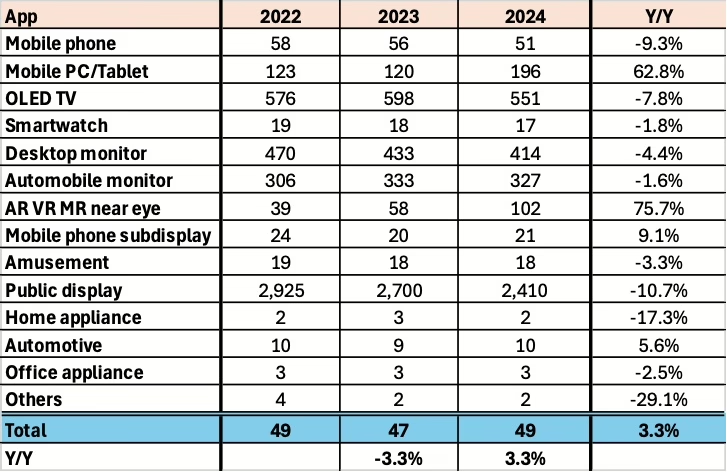

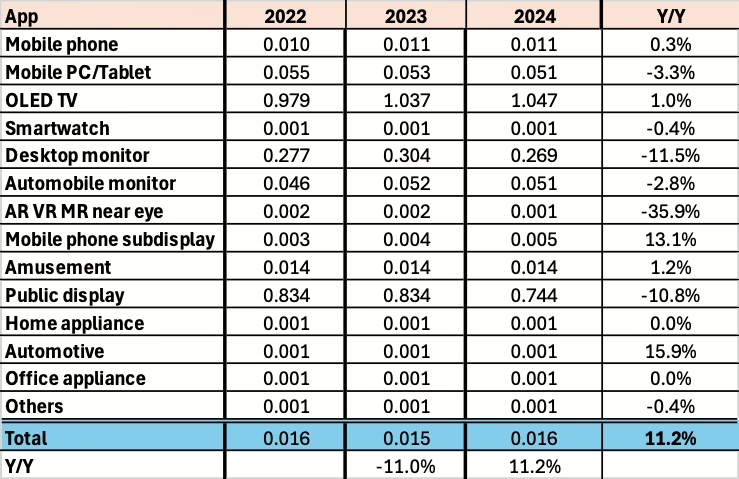

2022–2024: By the Numbers

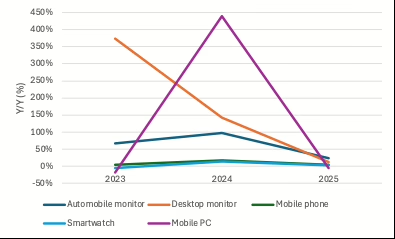

Applications with 2024 YoY performance above and below the average are shown in the following figures.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.