A few days of my year end up as ‘high bandwidth’ when information flows in as fast as I can absorb it – or faster! At the SID Business Conference in Los Angeles, I should say it was ‘ultra-high bandwidth’, with over twenty speakers who each could have inspired a Display Daily article. I had more than 6,000 words of notes by lunchtime!

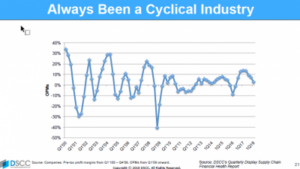

The master of high bandwidth is Ross Young of DSCC. Over the years, I have attended many of his presentations and he is an expert in communicating huge amounts of information in record time. At Display Week, he was on top form with 57 slides in a 20 minute talk! His key point, though, was simply stated. The flat panel display industry has always been very cyclical – based on the so-called ‘crystal cycle’ (I looked back in our archive and we first reported Ross Young using that phrase in 2001!)

The master of high bandwidth is Ross Young of DSCC. Over the years, I have attended many of his presentations and he is an expert in communicating huge amounts of information in record time. At Display Week, he was on top form with 57 slides in a 20 minute talk! His key point, though, was simply stated. The flat panel display industry has always been very cyclical – based on the so-called ‘crystal cycle’ (I looked back in our archive and we first reported Ross Young using that phrase in 2001!)

There is a classic cycle that is:

- panel prices rise,

- companies raise money to build fabs,

- increased supply comes in and

- the market goes into oversupply,

- prices fall and

- investment stops.

- Supply gets tight, prices rise again and investment restarts.

Over the years, we have been through that cycle many times (2001 was the third such cycle). I have been known to call the industry “The LCD farmers”. The price of beef goes up – everybody gets more cattle. Too many cattle, the price of beef goes down Everybody gets rid of the cattle..

Young showed this chart of the history of the crystal cycle

Young showed this chart of the history of the crystal cycle

On the Pricing Slope

At the moment, we’re on the point in the cycle where there is oversupply and panel prices are falling. The rate of fall may slow as we head towards the peak point of the year, when demand for panels it as its highest as the TV set industry makes sets ready for the sales from Black Friday onwards. Panel production tends to be around three months before the peak set sales. However, after the peak passes, in Q4, the oversupply will continue.

One of the key reasons for the cycle is timing, or, more accurately, a timing lag. It turns out that most stock markets have a very short attention span and little patience (who knew?), so, historically, panel makers could only raise money for new investment by selling stock when the panel price was high, so they were making money. However, it takes a couple of years to get from collecting or securing promises of money to a fab operating, so by the time the fabs were ready, we were in the ‘down side’ of the cycle. Then investment stopped, as panel makers were losing money. However, as nobody then had money to build fabs, that did mean that supply gradually tightened as demand continued to grow but supply didn’t.

Samsung Was the Exception

The exception to this pattern was Samsung. At a conference some ten or fifteen years ago, I remember Young pointing out in his talk that Samsung had enough money and scale that it wasn’t as sensitive to the short term thinking of investors, so it could invest even when the market was poor. That meant that by the time the fabs were built, the market was still in a good condition from a pricing point of view, so the company could make good profits by introducing capacity from new, lower cost, fabs just as the price was high.

After the talk, I cornered him. “Don’t tell them this”, I pleaded. “If they all continue investing even when the market is down, the market may not turn around at all”

That’s where we look to be today.

There’s a Plan Here

At this point of the cycle in the past, we would normally expect to see investment rapidly dropping away, but the plans of Chinese local government authorities, which are supporting development of the LCD industry in China, are to continue building fabs. At the event yesterday, Nakane-san of Mizhuo Securities (who makes Young look measured, with 152 heavy text slides in his presentation!) agreed that while there is probably a need for four new Gen 10 scale fabs to keep pace with demand, he expects eight or nine to be built!

There was a general concensus at the Business Conference that this is about the likely number, although one or two could get delayed. Chris Hudson from Corning, which makes most of the glass for these fabs, later in the day said that there is probably a need for one new fab a year, way below the level of fabs being built. (which also suggests a question about what Corning should do – match the fabs or match the market?)

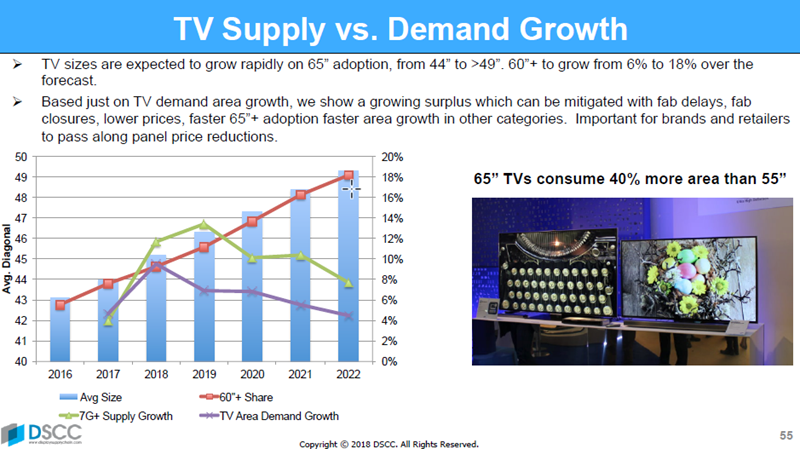

TV Supply and Demand growth forecasts from DSCC. TV is critical because it absorbs so much capacity.

TV Supply and Demand growth forecasts from DSCC. TV is critical because it absorbs so much capacity.

The Circle Will be Broken

All of this means that it might be quite a while before the circle moves back towards tightness in supply. TV set makers, of course, will be broadly happy that panel prices have fallen as the trend means that they have a chance to increase their margins On the other hand, the development that will push prices back up is some tightness in supply and that will need panel makers to make sure that TV set makers pass panel price reductions on to encourage consumers to trade up. It’s not obvious how they do that, although most of the big panel makers have some vertical integration into TV supply.

Anyway, in summary, the normal crystal cycle may be temporarily stalled, with a real chance of several very tough years for panel suppliers and ‘normal service’ will only be resumed when the Chinese stop investing in new display fabs. That may be happening as there has been a shift in priorities towards semiconductors and other technologies, rather than displays. – BR