I’m back in the office now after nearly two weeks full time at IFA and IBC. We caught up with most of the news today and are working away on the IFA and IBC reports which we will issue as soon as they are done.

One of our writers sent back the “HP buys Samsung’s Printer Business” to me, saying “I thought we didn’t cover printers?”. They were right, but this is quite a big deal for Samsung, although probably less significant for HP, so I had thought it worth a mention.

Samsung executives in Europe told me, several years ago, that they were very happy with the progress of the printer business and the company was determined to get to first or second place in the market – which is where Samsung wants to be if it is to stay in a business segment. The sale of the division suggests to me that corporate management could no longer see how to get to one of those top positions.

HP is almost twice the size of its nearest rival at 8.5 million units compared to Canon’s 4.7 million volume (source IDC Q2 2016). Samsung had dropped to just below a million units, with negative growth of 8.9%, a fall that was faster than the drop in the market. A falling share of a falling market makes it hard to develop.

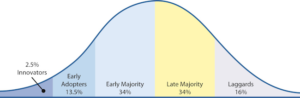

When I first started to research the TV set market, I came from a background in the PC business. When I looked at the brands then involved, Sony, Panasonic, Samsung, LG, Philips and the rest, the first thing that I realised was that the companies were not seen as major IT vendors. It seemed to me that there was clearly a challenge for consumer companies to enter the IT market and vice versa. It seemed to me, after some thought and discussion, that one of the reasons is that purchasing is a bit different. While consumers of TVs are the vast majority of people and include the ‘early and late majority’ and ‘laggards’ of the classic technology adoption cycle. That means you have to talk to them as though they are extremely conservative and buy largely on price and security of purchase.

On the other hand, IT buyers tend, broadly, to buy like “innovators” and “early adopters” from that model. If you can convince them of the benefits, they will try something new. Often, those in the later segments will ask those in the earlier segments before buying a PC or IT equipment. I think many people have a friend or family member that they might talk to before buying a new PC, but less often about a TV.

That idea meant that when HP, Dell and other PC makers told me that they were going to enter the TV market, as it switched to LCD, I suggested that they were, basically, doomed to failure. It would have been good for my business if they had succeeded, but it turned out that I was right and none of them succeeded in TV. Since then, there has been even less overlap. So the question posed by the HP/Samsung deal is whether, despite its huge efforts to re-position itself as a B2B business, Samsung can really pivot and succeed in this area? I wouldn’t bet against it, but having to move out of this segment won’t add to Samsung’s B2B credibility.

Bob