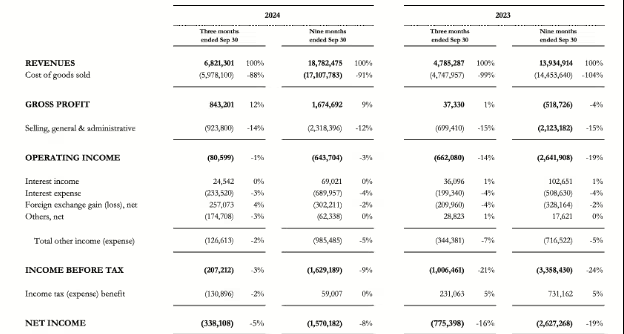

LG Display (LGD) executives were subdued presenting what was a positive Q3’24 of YoY performance; revenues of 6,821 billion won up 42.5%, Operating income -0.08 billion won versus -0.662 billion won and net income of -0.338 billion won versus -0.775 billion won. Q3’24 EBITDA profit was 1,162 billion won, compared 1,287 billion won in Q2’24 and 382 billion won in Q3’23. LGD benefited from:

- Increased shipments and profits from its Gen 8.5 LCD fab in China that has been sold to TCL CSOT and will close at the end of Q1’25. In the interim, LGD benefited from increased TV panel orders from TCL and Samsung as they prepare for the transition in ownership.

- Shipments of iPhone 16 Pro and Pro Max panels, which didn’t happen in 2023 for the iPhone 15.

- Shipments of 2-3 million OLED panels for the new Apple iPad Pro, which carried price tags in the $250 range.

These positive factors should carry forward to Q4’24, although LGD’s CFO and staff did not provide any outlook or guidance. They did caution that the impending sale price of the Gen 8.5 fab, widely reported to be $1.54 billion would be adjusted by closing and operating costs. Since Q4’23 was LGD’ first profitable quarter in 2 years and one of the last vestiges of the old strategy, combining LCD and OLED production is over, a more positive outlook was expected. Now that LGD has restructured into an OLED dominant panel maker (they still have an LCD fab for automotive and IT applications), they are faced with a number of challenges:

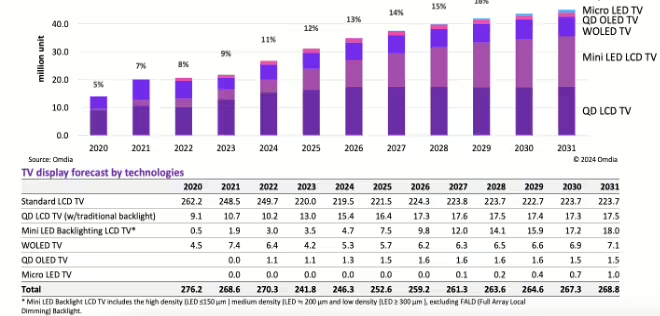

- The two Gen 8.5 OLED fabs operate at ~50% capacity and market conditions are favoring competition from MiniLED LCDs, which provide near OLED performance at half the price. Omdia recently forecasted that LGD’s capacity of 10 million panels would not be achieved in this decade. LGD has been unable to develop or at least communicate a solution to what is their existential issue.

- The Gen 8.5 OLED fabs are also used to produce high-end game monitors. The market is 1.2 million units per year and SDC’s QD-OLED’s have been judged to be more effective as a monitor and have captured three quarters of the market.

- To date, the hybrid OLED design for iPads has been a disappointment with demand only 6.5 million panels versus a planned 9 million. LGD has said it might convert some Gen 6 capacity for iPads back to smartphones.

- LGD traditional position as an Apple second source behind Samsung is being challenged by BOE, which recently demonstrated the advanced panel technology needed for high end iPhones. A fully enabled BOE, which already supplies panels for the 2 low-end models is likely to affect SDC the most, but it could in the long term result in a reduction of iPhone panel demand for the Koreans

- LGD has a substantial lead in OLED auto panel production and should benefit from the increasing use by high end automobile manufacturers, BMW, Mercedes Benz, Cadillac and others adopting OLEDs, the market is less than 1% of the total in 2024.

- Finally, the next major market for OLEDs is IT, specifically tablets and notebooks. These applications use panels that average 2x the diagonal of smartphones and the current plans are for Samsung, BOE and Tianma to use Gen 8.5. If LG, which performed the initial design of the hybrid, is to compete in the IT OLED market, they will be at best 2 years behind SDC and one year behind BOE.

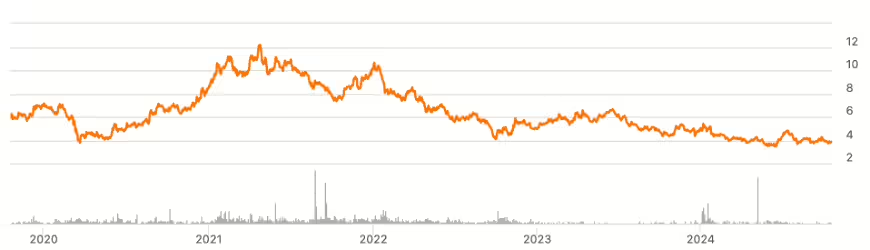

LGD, formed when Philips sold its share of LPL, followed SDC’s initiative in OLEDs but struck a different strategy. While SDC targeted small-medium OLEDs, dedicated to OLED smartphones. it quickly exited LCDs and rode the rapid penetration of smartphones to profitability. Almost concurrently, SDC tried to replicate the OLED smartphone design for Gen 6 fabs in a Gen 8.5 fab to produce TV panels, which was much too expensive. LGD took the opposite tact by investing in OLED TVs, minimizing their investment in small-medium OLEDs and slowly exited LCDs. This strategy caused LGD to play catch-up after missing the smartphone panel conversion. As a result, LG has reported 8 quarters of losses in 2 plus years. Over 5 years, the net return to shareholders was -36%.

Restricting their ability to respond to some poor choice, LGD has been averaging negative cash flows since 2020, down $786 million, between 2020 and 2023., even though it was aided by a positive $274 million FX adjustment as shown below.

Analysts following LGD were so disappointed by the Q3’24 report that just about all of them downgraded the company one or two levels out of 3 (e.g. buy, sell, hold).

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.