I’m really a ‘big display’ specialist, but as part of some work I am doing to cover the whole of the SID Business Conference (a major task as it includes 41 talks, with plenty that are going past the 20/30 minute plan!), I listened in to the smartphone segment and I thought that the presentation from Tom Kang of Counterpoint Research gave a very rounded view of where that market is at the moment.

Kang started by saying that Covid-19 has been very disruptive in the smartphone market and combined with the ‘trade wars’ is having a big affect on the markets especially in the US, Brazil, Russia and India. China is an exception as it prevented the spread of the virus early on.

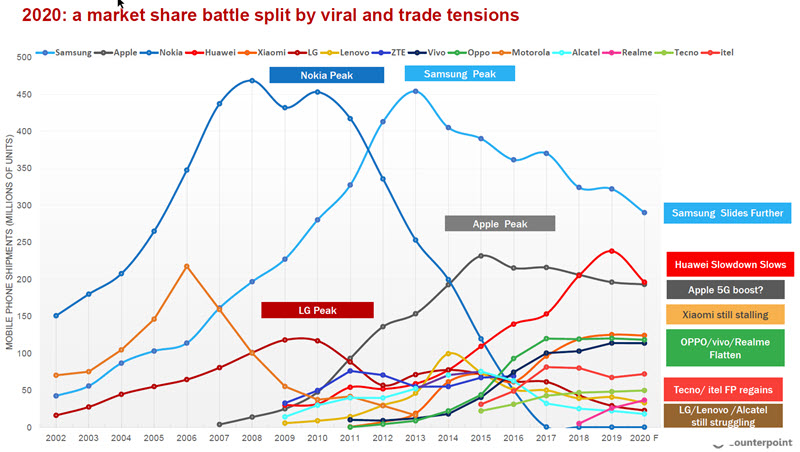

Historical perspective can be useful and , in the past, when there have been financial crises, the smartphone handset industry typically sees a set-back.

After the 2000 bubble burst, the handset industry dropped by just 3% and within a couple of years it had rebounded. The same thing happened in 2008 with the demand side hit for a couple of years. Counterpoint thinks this is a repeating pattern of around a two year rebound. Each time there was a shake-up of brands and the firm expects that again.

The firm tracks weekly and monthly and this year, the market was hit hard in February and was well down, but by June it is back to about 85% of the previous level as consumers defer anything but essential purchases. In the US, the market is back to around 80%/90%. A survey showed a lot of consumers delaying a new purchase because of economic uncertainty, with the strongest hesitation in India and the lowest in Germany. Around 30% to 40% of consumers will reduce their budget for their phones.

That change in behaviour will impact the premium market. Foldable demand will be hit, but 5G demand may be more resilient, Kang said.

China may be back to last year’s level by Q4 this year, with the US not far behind, based on Counterpoint’s view that a vaccine may start to be available by Q4.

Tech & Trade Wars

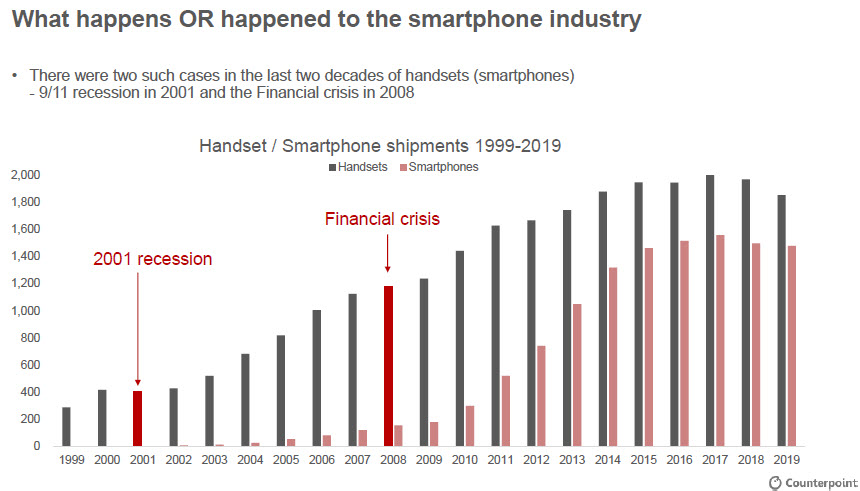

Turning to the tech/trade wars. Huawei has been a target of the Trump administration. The US is ‘blocking door after door’ for the company and the most recent is the blocking of TSMC-manufactured chipsets, which form 80% or 90% of the APs used by the firm. The banning of the use of the Google Android by Huawei is not so important within China, but the chipsets are used both inside and outside China. TSMC also makes chips for Huawei for 5G base stations and data centres and cloud computing.

There are disputes between Japan and Korea and also disputes between India and China and this is part of a move from more globalisation to more protectionist policies because of political changes around the world.

The US semiconductor equipment makers (along with European and Japanese makers) has been ‘caught in the crossfire’. The US government says that TSMC cannot use US equipment to make chips for Huawei and without US equipment, it can’t make any chips. Huawei may have 6-9 months of chipset inventory, but this will run out early in 2021. Huawei may be able to use Mediatek chipsets, but eventually, the US may block that as well.

Despite this, Huawei is strong in China (around 45% share) and took the #1 position in the market in April and May, although Samsung came back in Q2. On a sell-in basis, for Q2, Huawei was top, but on sell-through, Samsung is narrowly the top brand. Most consumers around the world are not that bothered about avoiding Chinese-made products, although 40% in India are negative about it. Samsung is the main alternative to Chinese brands, but is in different price bands so there is not so much direct competition.

The Indian market was hit hard in Q2, but Counterpoint expects a strong rebound. 25% of the Indian market is still feature phones and these buyers are expected to switch to smartphones in the near future. However, Huawei is likely to miss out on this switch. Huawei may withdraw from a number of markets around the world.

Apple is very dominant in the US with 47% share and 60% in Japan, with the UK at 50%.

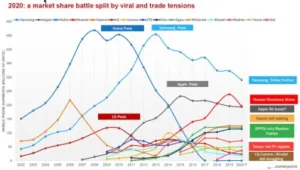

A long term view of the industry shows that there was a Nokia peak, an LG peak, a Samsung peak and an Apple peak. Samsung is sliding down from its peak sales from 450 million per year in 2013 to under 300 million (forecast) this year. Huawei and Samsung were expected to cross, but that won’t happen now. Oppo may be the next winner with its Vivo and Realme sub-brands which are growing fast. Xiaomi is stalling while LG, Lenovo and Alcatel are all struggling.

Apple’s iPhone SE 2020 has been a big hit and has a good price/performance ratio. It is probably the firm’s last 4G phone, with a full 5G lineup likely next year, Kang forecast. The SE has been helped by promotions from operators which has bridged the gap to 5G, with the phone available on contracts from $99 in the US.

Technology Competition

A couple of years ago, the battle was over memory capacity, whether of RAM or flash memory. Then there was competition around cameras and their configuration and although this will continue, 5G will be a big factor in the near future.

Turning to displays, the development of “the notch” allowed full screen designs and waterfall displays (XXX) have become successful. Other hot features are about bigger notches, more sensors under the glass and higher refresh rates. OLED has become mainstream, but LCD makers are competing strongly on price and performance, although their shares are declining. LCD is really competing with rigid OLED, not really with flexible. OLED will eventually win, but LCD is still over 50%.

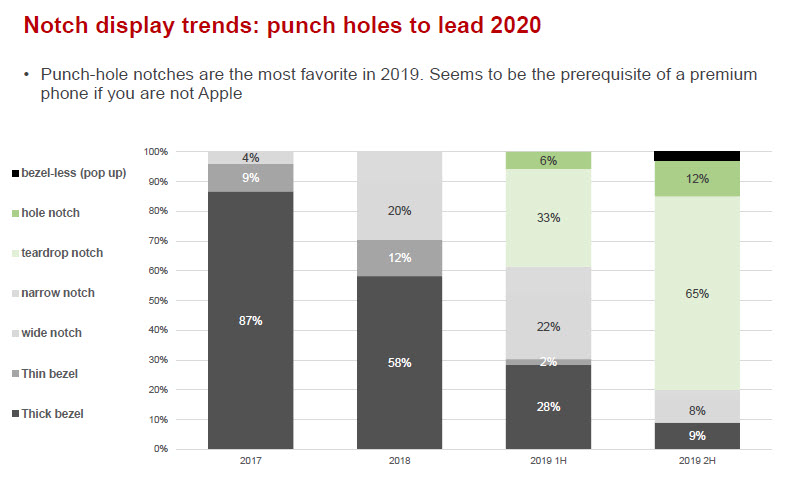

There has been a lot of development in notches over recent years, although now ‘teardrop’ notches are very popular and hole notches are mandatory in the premium segment (except for Apple). That’s because the most favoured content is video especially because of the epidemic which has reduced cinema visits and social interaction. That has also helped drive the demand for larger displays.

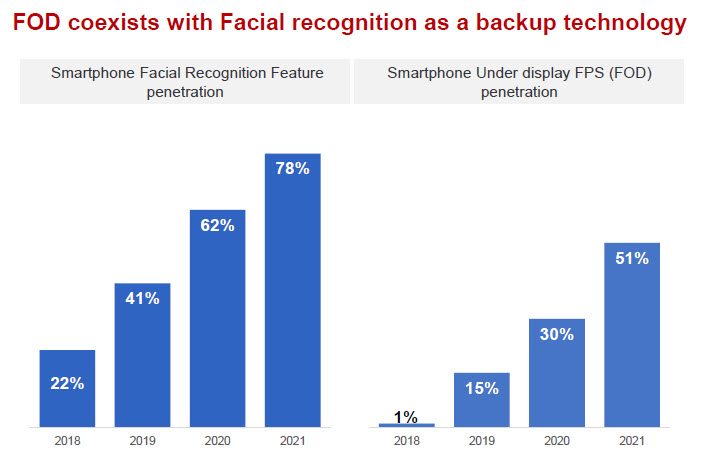

Moving the fingerprint sensors under the glass really helps and is popular. If the sensor is on the back, the phone is not so easy to use. That doesn’t eliminate the need for facial recognition, and that feature will be in over 78% of phones next year, up from 62% this year, and that will be helped by under glass fingerprint recognition which is 30% this year and 51% next. Samsung and Huawei are the leaders in moving the sensor under the glass and it’s a premium feature, so the shares are similar to the premium market shares.

Foldables

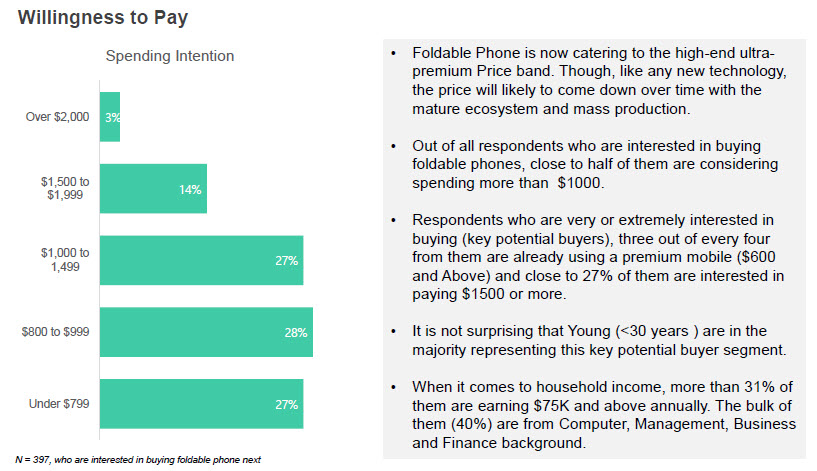

Foldables have a lot of potential, but with consumers wanting to reduce their smartphone budgets, foldables simply will not be affordable for many. However, the category will grow later next year as many brands have deferred their plans by a year or more. The high price is a barrier, but there is a lot of real interest in the idea. Users are ready to spend quite a bit, but the sweet spot for volume may be between $800 and $1000, so it may take some time to develop. Eventually, foldable phones will take 30% to 40% share of the premium market.

So foldable is the ‘next big thing’ and the firm thinks that Apple will go foldable in 2022. They are not typically the ‘first movers’, but usually adopt key trending technology.

5G Critical in China

Adoption is faster for 5G because it is being promoted by operators, whereas foldable is just ‘between the user and the brand’. It is rolling out faster than 4G and 5G will be more than 10% of the market this year, with China driving the push. A third of the phones sold in Q2 in China were 5G and China will be more than half of the global market this year. However, consumers are not happy about power consumption. The adoption of 5G has been quicker than 4G partly because the component prices have fallen faster than in 4G and that was because Qualcomm was not the sole supplier for very long. This year, Huawei, Mediatek and Samsung all have 5G solutions.

Qualcomm previously kept the ASP of smartphones with new chips (e.g. 4G) higher for longer, but the 5G phones got under the $300 level by the end of 2019, which is partly a response to the entry of Mediatek. By the end of this year, 5G phones should be under $200.

5G is a more transformative technology as its impact will go beyond smartphones. For smartphones only, 4G might be enough, but 5G will enable more social transformation and applications in many fields including robotics. Developments in 5G will continue to make the technology even more important in applications including autonomous vehicles.

This was an interesting talk and I make no apology for making it a bit longer than my usual DD articles. (BR)