In a blog post, David Hsieh of IHS has said that there is a serious prospect that Foxconn will break the traditional pattern of making displays in Asia, by building a fab in the US. He said that Foxconn is considering two possible plans:

- A G6 TFT LCD fab in Michigan, which will be using oxide TFT LCD technologies for high-resolution-, low-frequency panels, aimed at display applications for mobile PCs, smartphones, and automotive.

- A Gen 10.5 TFT LCD fab somewhere in the Great Lakes region, in the states of Wisconsin, Ohio, Illinois, or Michigan, among others. Here the technology to be used will be a-Si—or amorphous silicon—TFT LCD for 4K/8K high-resolution and super-large-screen LCD TVs.

The logic is that Sharp is a leader in Oxide and the G6 would be the optimum for panels below 10″. The IHS area demand forecast for oxide TFT LCD is expected to grow from 1.2 million square meters in 2015 to 17.7 million square meters in 2024.

The logic for the G10.5 is that there is expected to be a lot of demand for super-large sized TVs at 65″ and above – with IHS forecasting demand in the US for 65″ and above sets to rise from 4.2 million in 2015 to 9.5 million in 2021.

Foxconn’s supply chain has been used to improve the competitiveness of the Sharp brand and TV sales are expected to rise from 4.7 million in 2016 to 12 to 14 million this year. The company has been aggressively growing its business in China (and we can see moves to try to regain control of the brand in the US in this issue, with the legal battle with Hisense)

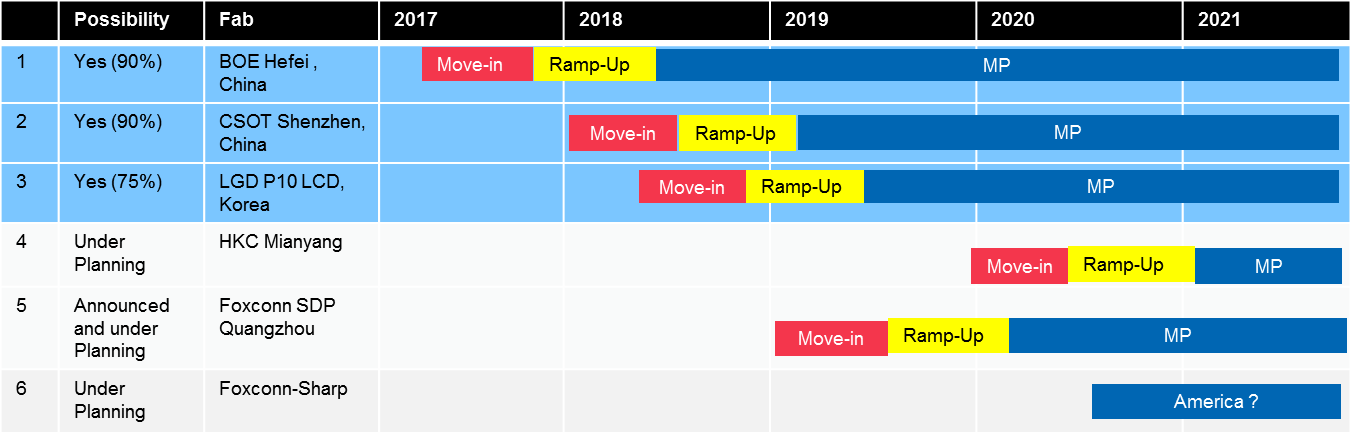

The G10.5 would be the sixth plan that IHS is aware of in that class.

How logical is it, though, for Sharp to build a G10.5 fab in the US? Positive advantages for doing it include the duty situation (it would save any duty into the US for panels (currently 4.5%) and would be positive for logistics costs. It would also give advantages in flexibility of supply to customers in the TV business. It would be positive or neutral for labour costs as they are not that much higher than for China, IHS believes.

Obvious negatives are the amount of capital that would need to be raised, the lack of a supply chain locally for materials and components and the distance from key equipment suppliers. Glass would need to be supplied, but Hsieh said that Corning could make glass in the US (although its ROI would be less certain – further, Corning has suggested to us in the past that it dislikes having a glass factory with only one customer as it makes the relationship potentially difficult.

Sharp also doesn’t have current control of its TV brand, although when the current contract with Hisense ends, there will be the chance to boost sales.

Hsieh points out that a G10.5 fab is a huge construction that could run up against environmental concerns as the US has stricter limits than China.

Overall, Hsieh believes that building a fab would be a good move for Foxconn although it would need a number of organisations to come together for the project.

Analyst Comment

I can see the logic of a fab, especially one that could supply the automotive industry, but I do have doubts that it will ever happen. There are just too many ducks that need to be put in a row, to me. However, I wouldn’t bet against it. (BR)