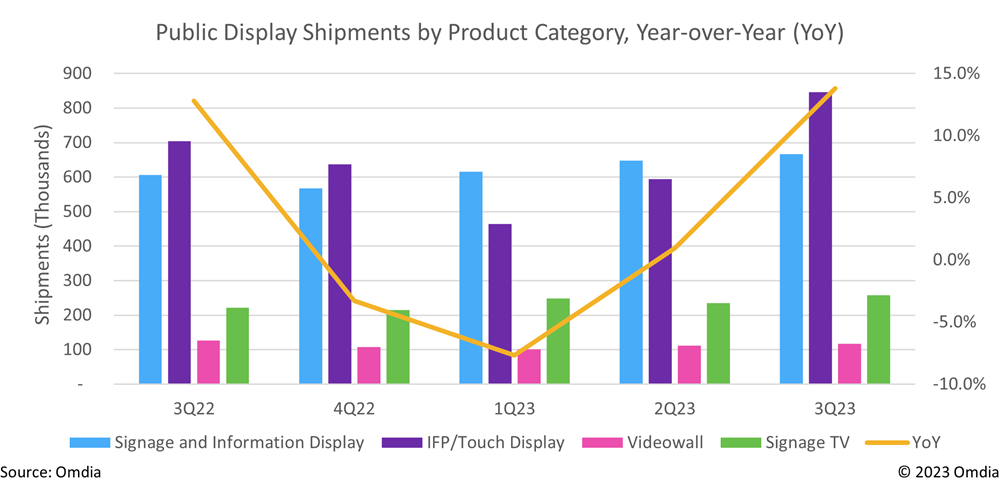

The public display market saw a 13.8% YoY growth in the third quarter of 2023, according to a new report from Omdia. This growth was driven by increased shipments of interactive flat panels (IFPs) and touch displays, especially in China where shipments more than doubled from the previous quarter.

The boost in China came from schools purchasing replacements and upgrades of interactive displays, particularly 75-inch and 86-inch models which accounted for over 80% of China’s IFP shipments. Strong performance in other countries like Turkey and Egypt also contributed to the overall YoY growth seen in Eastern Europe and the Middle East & Africa.

Global signage and information display shipments continued to grow steadily at 2.8% from the previous quarter. However, many projects faced delays or postponements due to economic uncertainty and inflation concerns. Western Europe remains the top region for signage and information displays, though North America saw an 8.3% quarterly increase helped by recovering corporate investment.

New 105-inch 5K 21:9 ultra-wide displays debuted from brands like Jupiter and Avocor, targeted for hybrid meetings and Microsoft Teams. Mainstream LCD vendors showcased similar products, though demand has yet to be determined. Still, these niche displays sold nearly 500 units globally last quarter, over 65% in Western Europe and the Middle East. The corporate sector is expected to drive further growth in 2024.

Chinese brands SeeWo and Hitevision saw significant shipment growth from domestic demand as China’s economy recovers from 2022’s downturns. Dahua, Goodview, Hisense and Maxhub remain among the country’s top public display vendors. With a 34.8% global market share, China was the largest public display region in the third quarter, followed by North America and Western Europe.