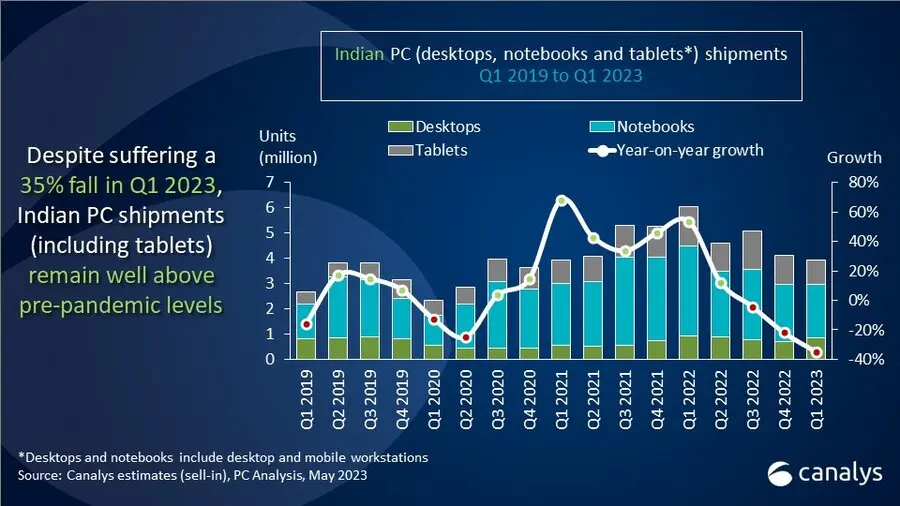

The Indian PC market has witnessed a significant downturn in Q1’23, according to Canalys. Shipments of desktops, notebooks, and tablets suffered a sharp year-on-year decline of 35%, equivalent to 3.9 million units. However, despite the dramatic slump, the Q1’23 figures remained 47% higher than pre-pandemic levels seen in Q1’19.

The decline in shipments varied across different types of devices. Notebooks bore the brunt of the downturn, with shipments dropping by a hefty 41% to 2.1 million units. Desktop shipments experienced a less severe, yet notable decline of 7% to 859,000 units. Similarly, tablet shipments plummeted by 37%, amounting to 987,000 units.

Notwithstanding this decline, optimism prevails for a rebound in the Indian PC market, buoyed by rising consumer confidence, improving economic conditions, and expected closure of delayed education and public sector tenders. Canalys anticipates an 11% growth in 2024 and a further 13% growth in 2025.

Various vendors are also actively targeting the burgeoning Indian consumer base, underscoring the importance of this market. Major players such as HP and Apple are establishing more physical retail outlets, while other vendors are pivoting towards manufacturing within India to ensure supply and tap into commercial opportunities.

| Vendor | Q1’23 Shipments (‘000) | Q1’23 Market Share (%) | Q1’22 Shipments (‘000) | Q1 ’22 Market Share (%) | Annual Growth (%) |

|---|---|---|---|---|---|

| HP | 1,012 | 25.6 | 1,449 | 23.9 | -30.2 |

| Lenovo | 600 | 15.2 | 1,122 | 18.5 | -46.5 |

| Dell | 479 | 12.1 | 813 | 13.4 | -41.1 |

| Acer | 446 | 11.3 | 626 | 10.3 | -28.7 |

| Samsung | 312 | 7.9 | 433 | 7.1 | -27.9 |

| Others | 1,098 | 27.8 | 1,611 | 26.6 | -31.9 |

| Total | 3,947 | 100.0 | 6,054 | 100.0 | -34.8 |