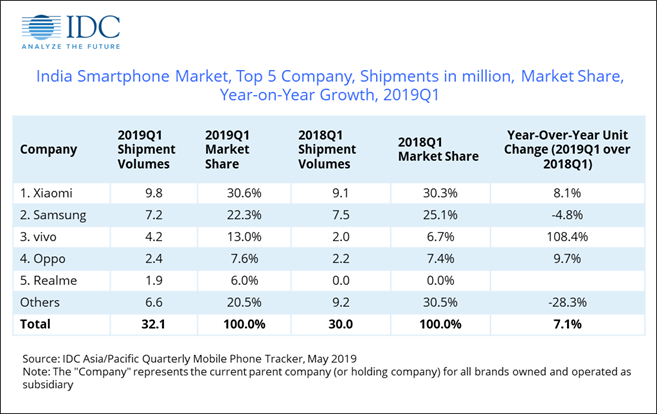

According to the International Data Corporation’s (IDC) Asia/Pacific Quarterly Mobile Phone Tracker, India’s smartphone market got off to a good start with a total shipment of 32.1 million units in 1Q19 (2019Q1), maintaining a healthy 7.1% year-on-year (YoY) growth.

High channel inventory from the previous quarter resulted in a sequential decline of 8.4%.

“Despite the government’s new e-commerce rules, online channels managed to sustain their pace, registering 19.6% YoY growth in 1Q19. Fueled by attractive offers and new launches by vendors like Xiaomi, Samsung, Realme, and Huawei, online sales reached 40.2% of the market in 1Q19,” says Upasana Joshi , Associate Research Manager, Client Devices, IDC India.

Large shipments in the festival quarters of 3Q18 and 4Q18 led to high channel inventory, leading to flat YoY growth in offline channels in 1Q19. But new products still arrived in Samsung’s A series and online-heavy vendors like Xiaomi and Realme expanded to offline counters.

Average selling prices grew by 3.3% YoY to US$161. This can be attributed to the growth in the US$300-US$500 segment, accounting for 6% of the overall smartphone market in 1Q19. This segment also outgrew all other price bands on the back of newly launched vivo V15 Pro.

Joshi further adds, “Samsung surpassed Apple for the leadership position in the premium (US$500+) segment with an overall share of 36.0% in 1Q19 due to its newly launched Galaxy S10 flagship series that was supported by huge marketing campaigns. OnePlus followed, as its OnePlus 6T was the top-selling model in India’s US$500+ smartphone segment in 1Q19.

The feature phone market, which still accounts for half of the total mobile phone shipments, registered 32.3 million-unit shipments in 1Q19, with a sharp decline of 42.4% YoY. There was a sharp drop in 4G-enabled feature phones, declining by more than 50% YoY due to channel inventory from previous quarters. There was also a sequential dip in 2G/2.5G feature phones.

Top 5 Smartphone Vendor Highlights

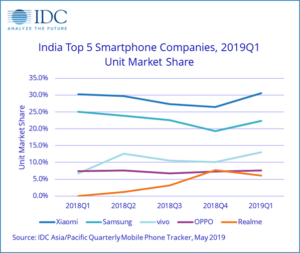

Xiaomi maintained its leadership position, growing YoY by 8.1% in 1Q19. There were multiple new launches by Xiaomi, namely the Redmi Note 7 series along with Redmi Go. Xiaomi also continued to dominate the online channel with 48.6% share in 1Q19.

Samsung continued in the second position with a YoY decline of 4.8% in 1Q19. The vendor revamped its product strategy by launching its online-exclusive M-series (which raised its online share to 13.5% on the back of the Galaxy M20) and its offline-exclusive A-series to counter the Chinese vendors. Offline channels are upbeat about the vendor’s schemes and support as it phases out its old J-series.

vivo continued in third position as its shipments doubled YoY in 1Q19, driven primarily by its new flagship V15 Pro and affordable Y91. The vendor continues to invest heavily in its marketing initiatives as the IPL season started in 2Q19 with attractive channel margins and schemes.

OPPO recaptured its 4th position with YoY growth of 9.7% in 1Q19, backed by new models such as the K1 (the first ever online-exclusive model for India) and the F11/Pro series, as well as its ongoing affordable A-series.

Realme continued to feature in the top 5 vendors list, despite dropping to the fifth position in 1Q19. Its newly launched realme 3 series produced the highest shipments for the vendor. Originally launched as an online-focused brand, Realme realized the importance of an omnichannel presence with its quick expansion to offline channels; now almost one out of three Realme phones are sold offline.

IDC India Forecast

Navkendar Singh , Research Director, Client Devices & IPDS, IDC India mentions, “In 2019, we should expect further aggressive offline expansion by the online-heavy vendors in an attempt to get a wider footprint in smaller cities and towns. Having said that, the influence of the online channels and their focus on the smartphone business will continue. This will gain momentum in the all-important second half of the year since the affordability driving factors like EMIs/cashback offers continue to be top-of-mind attributes for consumers.”

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhoneand iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.