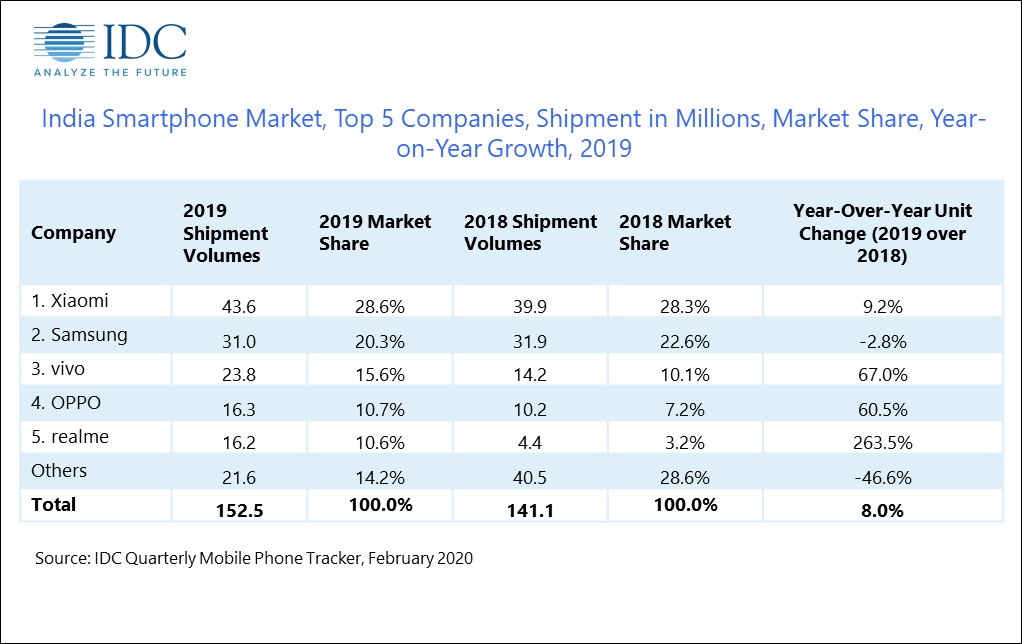

According to the International Data Corp o ration ’s (IDC) Quarte r ly Mobile Phone Tracker, India’s smartphone market shipped 152.5 million units in 2019, with a modest 8.0% year-over-year (YoY) growth. India also became the second largest smartphone market in 2019 after China but was still ahead of the USA. The overall mobile phone market, with annual shipments of 282.9 million units, declined by (-12.3%) YoY in 2019 due to fewer 4G feature phones.

2019 also witnessed longer inventory cycles in the offline channel as online exclusive models held back offline sales, resulting in a meagre 1.6% annual growth in 2019 in the offline channel. “The online growth momentum continued through the year with a record share of 41.7% in 2019, growing by 18.4% YoY annually due to deep discounts, cashback offers, buyback/exchange schemes, and complete protection offers clubbed with attractive financing schemes like No Cost EMIs across major model line ups and brands,” says Upa s ana Joshi, Associate Research Manager, Client Devices, IDC India.

Smartphone ASPs stood at US$163 in 2019, registering 2.8% YoY growth with the sub-US$200 segment still accounting for 79% of the market. The mid-range segment of US$200-500 accounted for the strongest YoY growth of 55.2%, accounting for 19.3% of the overall smartphone market. In the mid-premium (US$300-500) segment, vivo continued to lead the market with 28.0% share in 2019, on the back of the high selling vivo V15 Pro, followed by OnePlus at 20.2% share owing to the OnePlus 7 model. In the premium (US$500+) segment, Apple surpassed Samsung for the leadership position with a market share of 47.4% in 2019, driven by aggressive price drops on previous generation models, bank offers on debit/credit cards, strong e-Tailer sales momentum, and a lower iPhone 11 launch price compared to the iPhone XR.

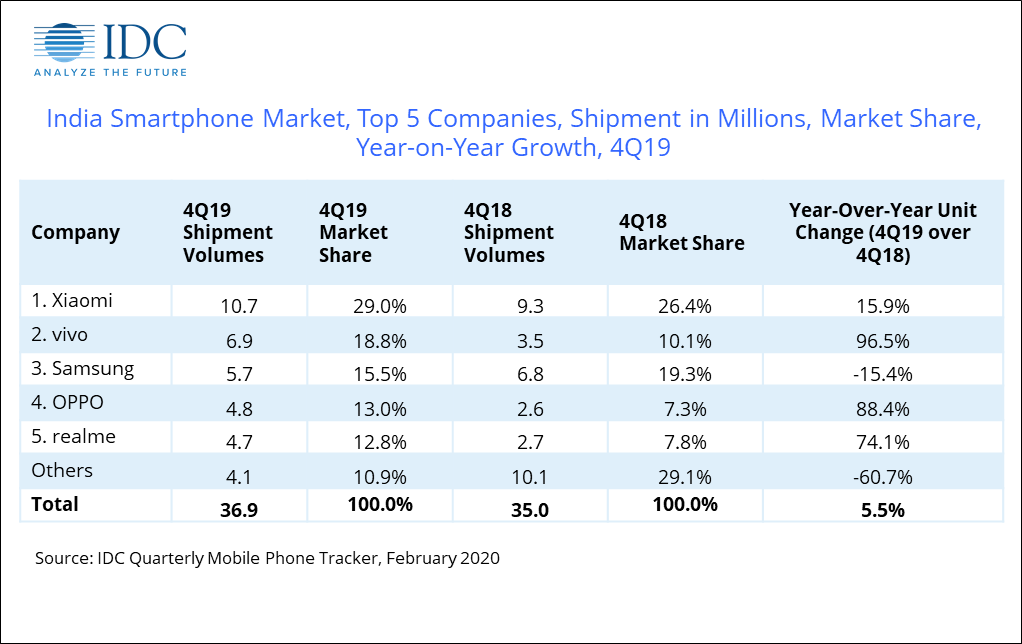

A total of 36.9 million smartphone units were shipped in 4Q19 registering 5.5% YoY growth but a 20.8% quarter-on-quarter (QoQ) decline. Usually the third quarter sees heavy channel loading in preparation for the Diwali festive period, and the last quarter of the year sees a cyclical dip as channels focus on clearing leftover inventory. Owing to multiple rounds of sales by e-Tailers beyond the festive quarter continuing into December, the online channel registered 11.2% YoY growth in 4Q19 with a share of 43.3%. However offline shipments remained flat with 1.4% YoY growth in 4Q19.

The ASP for 4Q19 stood at an all-time high of US$172, as shipments in US$200-300 grew by 71.9% YoY on the back of fast selling Galaxy M30s and vivo S1, while strong shipments of the newly launched iPhone 11 series drove the US$700 and above segment. In the mid-premium (US$300-500) segment in 4Q19, OPPO surpassed OnePlus for the leadership position with a share of 26.8% and 24.4% respectively with the fast-moving Reno 2 series. In the premium (US$500+) segment, Apple reached a record 75.6% market share.

The feature phone segment continued to decline YoY by (21.1%) with shipments of 30.1 million units in 4Q19. However, the Diwali offer (Rs 699) launched by Reliance Jio in the festive month of October helped clear off existing channel inventories of 4G-enabled Jio Phones. Xiaomi became the largest mobile phone brand in 4Q19 (ahead of Samsung and Reliance Industries) with a market share of 16.0% and YoY growth of 15.9%.

Top 5 Smartphone Vendor Highlights

Xiaomi registered annual shipments of 43.6 million units in 2019, the highest ever smartphone shipments made by any brand in a year, with a growth of 9.2% YoY. The Redmi Note 7 Pro and Redmi 6A were the highest shipped devices nationally in 2019. Xiaomi continued to dominate in 4Q19 with 15.9% YoY growth on the back of newly launched Redmi Note 8 Pro/8A/Note 8/8 series.

vivo climbed to the second slot, surpassing Samsung with massive 96.5% YoY growth in 4Q19. It also became the leader in the offline channel, ahead of Samsung on the back of multiple price drops across major models in Nov/Dec’19 to clear off inventory post-Diwali, clubbed with attractive channel schemes in 4Q19. The continued focus on its offline channel, despite the exclusive line-up in online channel and presence across price segments, led to this phenomenal rise in 2019.

Samsung slipped to third position, registering declining shipments amongst the top five brands with a (15.4%) YoY decline in 4Q19. The refreshed Galaxy As series was unable to sustain its momentum owing to a delay in launch time and a gap in phasing out the older Galaxy A clubbed with fewer channel incentives. However, its Galaxy M series and in particular Galaxy M30s performed well in the online segment, helping to revive its online share in 4Q19 at an all-time high of 16.6%. Despite the attractive cashback offers in the premium (US$500+) segment, Samsung faced heat from offerings by Apple, leading to channel inventories.

OPPO climbed to the fourth position in 4Q19, with huge YoY growth of 88.4% on the back of its affordable A series and successful Reno 2 series. The offline channel remains upbeat with the incentives and offerings and spends on marketing initiatives.

realme slipped to the fifth position in 4Q19, but with a YoY growth of 74.1%. It continued to be in the second slot in the online channel with a market share of 18.1% in 2019, up by 10 percentage points as compared to 2018. The realme C2 featured in the top 5 model list in the online channel in 2019. Further, its newly launched X2 Pro became the highest shipped device in the mid-premium US$300-500 segment in 4Q19.

IDC India Forecast

Navkendar Singh, Research Director, Client Devices & IPDS, IDC India mentions, “IDC expects the India smartphone market to see modest single digit growth in 2020 as well. As organic growth becomes challenging with increasing replacement cycles, it is imperative for the smartphone ecosystem to really put its energy and focus on enabling migration of the massive feature phone user base in India in addition to continue offering compelling propositions at the mid-premium segment to boost faster upgrades. During the year, we will see launches with newer concepts like under-display cameras, gaming-centric features, and higher refresh rate screens clubbed with efforts by the brands to open new revenue areas like OS monetization and financing services etc.”