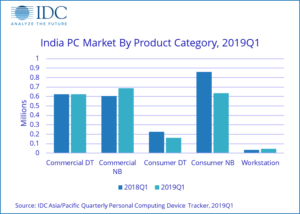

The India traditional Personal Computing (PC) market declined for the third consecutive quarter in 2019Q1 according to IDC’s Asia/Pacific Quarterly Personal Computing Device Tracker, 2019Q1. The market witnessed a year-on-year (YoY) drop of 8.3 percent with shipments reaching 2.15 million units in 2019Q1.

The market remained weak outside big commercial deals due to weak consumer demand, high inventory from previous quarters, and supply issues for Intel chips. The announcement of central elections on March 10th, 2019 resulted in the model code of conduct coming into immediate effect further resulting in a delay in execution of government projects and impacting the commercial segment.

Notebook category contributing 61.4 percent of the overall India traditional PC market shipments witnessed a 9.8 percent YoY decline. Within Notebooks, Ultraslim category, with a 25.3% share of the market, grew by 86.5%.

Segment Highlights

The India consumer PC market witnessed a 26.5 percent dip compared to 2018Q1. The dip in the consumer segment was mainly because of low discretionary spending and seasonality. The low discretionary was partially also because of macroeconomic factors such as shrinking industrial output and slowdown in consumer spending. Demand from Online channel was also muted as it has been dealing with excess inventory pile up from the previous two quarters. Inventory correction from 2018Q3 stockpile up continued in 2019Q1 and is expected to be normal by Q2 end. However, the Gaming PC segment saw good traction through both online and retail as vendors decreased GPU prices resulting in a spike in demand.

“Spending towards Ultraslim notebooks is increasing as owing to factors such as improved mobility due to the thinness of the product and enhanced aesthetics,” says Bharath Shenoy, Market Analyst, PCs, IDC India.

The overall commercial PC market saw a total shipment of 1.35 million units in 2019Q1, a growth of 7.3 percent YoY. The growth in the commercial segment was primarily driven by ELCOT shipments of around 159000 units which got partially executed in 2019Q1.

“Business sentiment has been on the lower side as enterprises look to wait and watch before taking any major decision due to ongoing elections in 2019Q2; the model code of conduct came into the picture in 2019Q1, thereby delaying the Government and Education projects. Demand from BFSI and IT/ITES sector remained good in 2019Q1 but the main segment driver was ELCOT,” adds Shenoy.

Top 3 Company Highlights:

HP Inc:

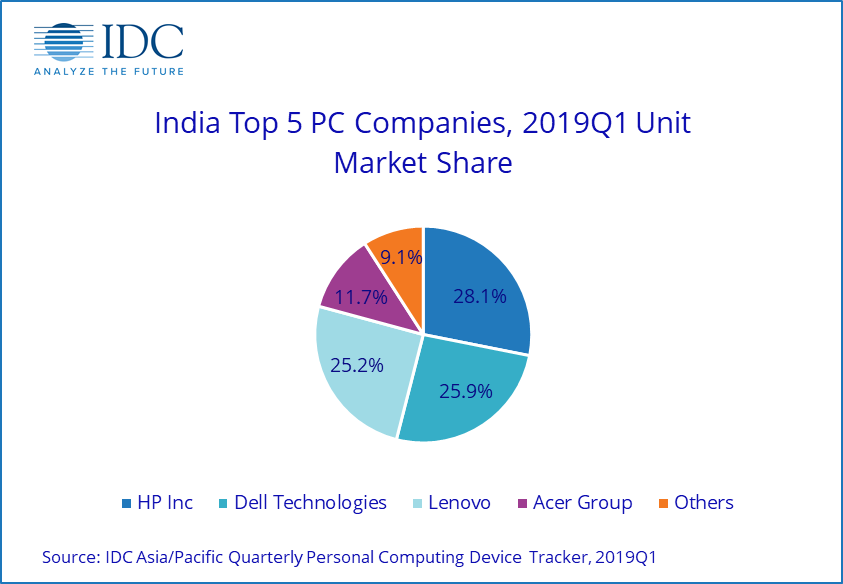

While HP Inc. maintained its leadership with an overall market share of 28.1 percent in 2019Q1, it saw a year-on-year decline of 9.7 percent mainly due to consumer segment which declined by 21.3 percent over 2018Q1. However, HP’s Ultraslim notebooks witnessed steady consumer traction from its exclusive stores and large format retailers. In the commercial segment, however, HP did not see any major dip in shipment despite elections leading to delayed projects.

Dell Inc:

Dell Inc. retained the second position with a 25.9 percent market share in the overall India traditional PC market in 2019Q1; with a year-on-year growth of 2.2 percent and a quarter-on-quarter growth of 26.7 percent. Dell Inc.’s commercial business witnessed a 25.9 percent year-on-year growth owing to prioritization of India market by Dell to provide the necessary supply of Intel chips resulting in the execution of some projects which were delayed in 2018Q4 due to same issues and also helping them improve their performance in Government, BFSI and IT/ITeS sector.

Lenovo:

Lenovo remained at third position, with a market share of 25.2 percent in 2019Q1 in overall India traditional PC market, observing a 6.2 percent year-on-year growth and a growth of 29.2 percent sequentially. The vendor also witnessed a dip in consumer segment like all other vendors, while on the commercial segment, it witnessed a massive quarterly growth of 70.8 percent driven by partial execution of ELCOT deal, since Lenovo is the sole executor of this project.

India PC Market Forecast:

IDC anticipates the overall India traditional India PC market to witness a growth in 2019Q2 over last quarter driven by further shipment of ELCOT. The commercial market is expected to pick up post new government formation in end of May. “The consumer market is expected to pick up largely driven by back to school campaign by vendors and online sales creating a pull to attract consumers through various schemes and financial incentives such as EMIs/Cashbacks,” says Nishant Bansal, Senior Research Manager, IPDS & PCD, IDC India.

“Commercial spending due to refresh and fresh demand by large and medium enterprises is expected to continue led by Education, BFSI, and IT/ITeS sector. The public sector is expected to pick up post elections, once the new Government comes into power,” adds Bansal.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight help IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.

All product and company names may be trademarks or registered trademarks of their respective holders.