The car display and associated car connectivity market, has long been considered by car makers as a necessary but unwanted distraction from drivers’ eyes on the road, and possibly compromising (safety) a car makers’ primary obligation.

Now, attitudes are shifting with some $750 billion (yes, billion) in new revenue on the line, from both a lucrative captive and (more importantly) mobile audience with an appetite for ubiquitous connectivity that now includes drive-time. All this is not lost on Silicon Valley mobile device makers like Apple, Google and the rest.

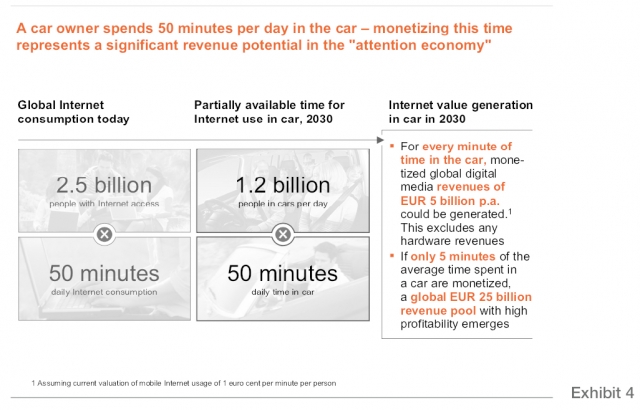

To get to that $750 billion number, McKenzie & Co. looked at what they call the “attention economy” assessing the media content that all car passengers worldwide (some 1.2 billion per day). They could view mobile media content via this “hardware pipe” delivering a ‘captive audience’. by 2030, that value is some €5 billion (per annum), for every minute spent in the car, according to McKenzie “Monitizing car data” 2016. That number excludes revenue from infotainment hardware. The group expects to see strategic partnerships for car makers with media and on-line content providers that will enhance the long evolving drive (getting there) experience.

Gesture driven concept in-dash display shown by BMW in 2016 model at CES over three years ago

Gesture driven concept in-dash display shown by BMW in 2016 model at CES over three years ago

Note this number is from data in a 2016 report from McKinzie & Co.

Note this number is from data in a 2016 report from McKinzie & Co.

Add to this displays used for GPS navigation, plus the growing need for command and control as car to car (C2C) and car to infrastructure (C2I) evolution progress along with the incessant need for infotainment (display) improvements as the prospect of self-driving vehicles moves from formation, ever closer to full realization in the coming decades.

Perhaps the most natural intersection of mobile technology and cars come in GPS navigation, and Alphabet’s Google, with its Google Maps and Waze mobile applications, seem to have an edge. Apple was late with its mobile OS map application launching (and replacing Google Maps) in its iOS in 2012. The company experienced some user resistance, and even usage setbacks at first, losing the trust of drivers. Even a single (or worse yet multiple) misguided direction can brand an application as inferior, and a ‘time waster’. But the potential pay-off in ad revenue et al. for these “gateway apps” is enormous, as the McKinsey study, indicates. So Apple stuck it out. The app is on all iOS, Mac OS and Apple watch devices to date.

Some car makers including Volkswagen (VW) met with Google (in 2016), as recently reported in the April 6, 2019 WSJ “Battle for the Dashboard” article on the vehicle display. As the story goes, the carmaker became nervous when the internet giant wanted access to a driver’s fuel level, presumably to trigger data notices to the driver on best places to fill-up. The article said VW viewed Google “…more as a competitor” and the idea of Silicon Valley firms wanting in car access as a form of “encroachment.” So VW is striking out on its own with its cloud based vw.os. That company along with Diamler (Mercedes) and BMW created a consortium to buy Nokia’s mapping business ‘HERE’, from Nokia for $3.1 billion in 2015.

Giant Google with its $82 billion in mobile advertising revenue last year alone seems to be leading the field with some 19% of all in-car operating systems, (according to IHS) and that number is expected to grow to 33% by 2024. The Android Open Automotive Aliance uses a middleware approach (Android Auto.) For its part, Apple has taken a telematics approach to connectivity with its iOS devices, launching its CarPlay (released in March 2014) offered as a “middleware” to car makers (and after-market car audio makers.) with a focus on interactivity to its iOS devices. Apple claims over 500 car models support CarPlay, and they are listed on its web site.

So it is here; the car dashboard display now sits at the confluence of technology, new media, social and connected networks, all converging and competing for the 51 minutes per day average spent inside the car, (for more details check out the AAA emerging technology 2019 web site). But the Holy Grail between the pedestrian smartphone mobile experience and driving is a seamless transition, with Apple and Google’s dominance in the mobile device space unchallenged. Moving forward, the once simple horseless carriage makers that one century ago changed the face of the earth, (and the very air we breathe) now must contend with new technology choices that could make or break their future as they transition toward new connectivity options that could represent the newest automotive industry cash cow. – Stephen Sechrist