This week, while creating this issue of the newsletter, I was also involved with the finalising of our quarterly data for desktop monitors, public displays and interactive meeting room displays. The markets are very different and are changing very differently. As you can see on the front page story in “Large Display Monitor”, the market for desktop monitors is really in difficulty. The result was the worst for many years as the PC market struggles and as economic factors really work against growth.

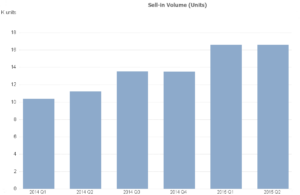

The Public Display market was also somewhat impacted by macro economics, but over the first half of 2015, sales were up, making the first half of 2015 the twelfth half year of growth since 2009. Since then, the market has grown from around 100K units in a half year to 340,000. We have been tracking the market since 2004 and for the first six years, it was very flat and clients were always asking when the big growth would start. Eventually, it really got going in 2011 and Western Europe has done really well, although the East and MEA have been basically flat for two years.

It’s likely that, before long, the growth in the West will start to slow down – it may already be starting – but there is a lot of scope to migrate the idea of digital signage to the South and East in Europe and IHS is clear that the market for display will continue to see growth (although with only limited value growth) on a global basis.

The third market that we are looking at, for the first time, is the Interactive Meeting Room Display market. This is the market for touch-enabled displays for use in business conference rooms and also, and importantly, education. Len has been writing about the adoption of large displays in education in the newsletter for some time. Educators, who in many countries are used to using interactive whiteboards, have liked the idea of a big display that can also show video and act as a whiteboard.

At the moment, for business meetings, the touch technology has not really been good enough. Business users really want a tablet/smartphone-like experience, but the touch technologies have not been mature and fast enough. That is changing, with great procap touch becoming available (although at a high price) from Microsoft, Sharp and others, and better alternatives to infrared from companies such as Baanto and FlatFrog.

Further technology and cost improvements will happen and, pretty soon, the use of a projector in a meeting room is only likely to be in really large conference rooms, and then alongside an interactive display. At the moment, the interactive display market is just 5% of the size of the overall PD market, but it’s growing much faster. Although we think that the Microsoft Surface Hub product is too expensive for dramatic adoption levels, we do think it will set a standard and drive corporate interest in the segment.

Bob