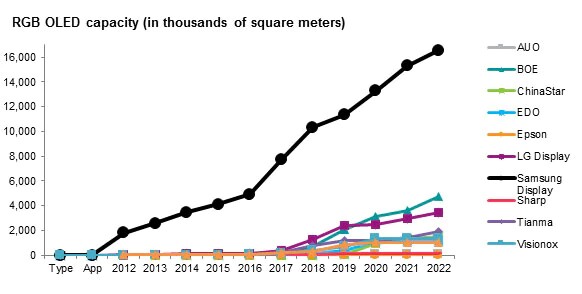

A new blog from IHS Markit shows that global AMOLED capacity will rise from 11.9 million m² in 2017 to 50.1 million m² in 2022, equivalent to 322% growth. The numbers include capacity for RGB OLED for smartphones, mobile devices, virtual reality, and automotive, as well as capacity for WOLED, used primarily for TVs. Of the two segments, RGB OLED has the larger share of market, with capacity growing from 8.9 million m² in 2017 to 31.9 million m² in 2022. Samsung Display reigns supreme with 87% of global RGB OLED capacity, followed by LG Display, and Tianma and Visionox from China, whose share of the market is projected to soar rapidly in the next couple of years.

All the new RGB OLED fabs under construction in China aim to produce flexible substrates at full screen size and a super-wide aspect ratio, as well as a curved-edge smartphone display form-factor for the next couple of years. In the long term, fabs will undertake production of bendable and foldable screens for mobile devices. By 2022, Chinese makers will possess RGB OLED capacity of some 10.7 million m², equivalent to 34% share of the global total. Chinese capacity will mostly target the smartphone display market, reserving some volume for VR and AR applications, as well as for the automotive space.

Despite the aggressive expansion of Chinese RGB OLED makers, concerns remain, especially because flexible OLED technology requires a long learning curve that impacts production variables such as yield rate, stability, and reliability. They may also face a fierce onslaught from Samsung Display. Indeed, Samsung remains the dominant force in RGB OLED for smartphone displays. Its capacity will increase from 7.7 million m² in 2017 to 16.6 million m² in 2022.

The much smaller capacity of the Chinese, compared to that of Samsung Display, may also shape competition in the future. The company will use its colossal capacity to meet the needs of its two critical customers, Samsung and Apple. Chinese makers, meanwhile, will be targeting the relatively smaller projects of smartphone makers in China, such as Huawei, Xiaomi, Vivo, Oppo, Meizu, Lenovo, and ZTE.

Analyst Comment

In its blog article, IHS detailed a lot of the plans of individual makers, so go there if that is useful to you. (BR)