Large TFT LCD panel makers are expected to reduce production of comparatively smaller-sized 32″, 40″ and 43″ TV panels, helping to stabilise panel prices in the third quarter of 2018. In the longer term, however, the oversupply issue still remains, eventually causing older TFT LCD fabs to be restructured, according to IHS Markit.

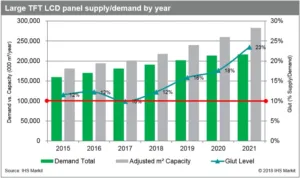

Currently planned new factories will increase large display panel production capacity by 31% or 77.7 million m² from 2018 to 2021. However, based on the current demand forecast, there will be about 49 million m² of capacity in the pipeline more than the market requires in 2021. The supply/demand glut level is expected to continue to increase from 12% in 2018 to 23% in 2021, remaining well above 10% or what is modelled to be a balanced market.

Between 2019 and 2021, there will be a great amount of LCD TV panel capacity built, mainly from 10.5 and 11G factories in China, according to IHS.

The company’s David Hsieh commented:

“

Some panel makers may be forced to reduce utilisation rates, while some planned capacity may never be built.

Furthermore, in the next few years, legacy factory restructuring will likely accelerate. For the TFT LCD industry to return to a balanced supply/demand level, multiple 5G, 6G and even 8G factories will likely need to be shut down”.

For example, shutting down half of all 5G and 6G a-Si capacity in Taiwan would remove about 18 million m² of production capacity, according to IHS. Larger glass substrate capacity such as 8G will also likely need to be closed to bring the market back toward balance.

Possible restructuring of legacy factories may include fab shutdown, facility consolidation or conversion to other technologies such as AMOLED panels, ePaper backplanes and sensors. Fab restructuring can be attributed to multiple reasons such as no longer being competitive, old equipment, shifts in panel makers’ business focus, excessive overheads from under-utilised facilities and pressure on profitability. Hsieh concluded:

“Oversupply is not the end of the crystal cycle. The industry has a long history of dynamically adjusting itself to balance supply and demand. The process may create many challenges for supply chain companies. However, the delayed expansion of new factories, restructuring of legacy fabs and potential for faster demand growth spurred by lower panel prices will help the LCD industry to eventually return to equilibrium”.