David Hancock, Director, Film and Cinema at IHS Markit provided some statistics on the state of the cinema industry at CinemaCon during the International Day presentations. His data was also sourced in some market data provided by the Motion Picture Association of America (MPAA), which Bob discussed in detail in MPAA: 3D Cinema has hit and 8-year Low. This article will add some additional global perspective not included in the MPAA summary.

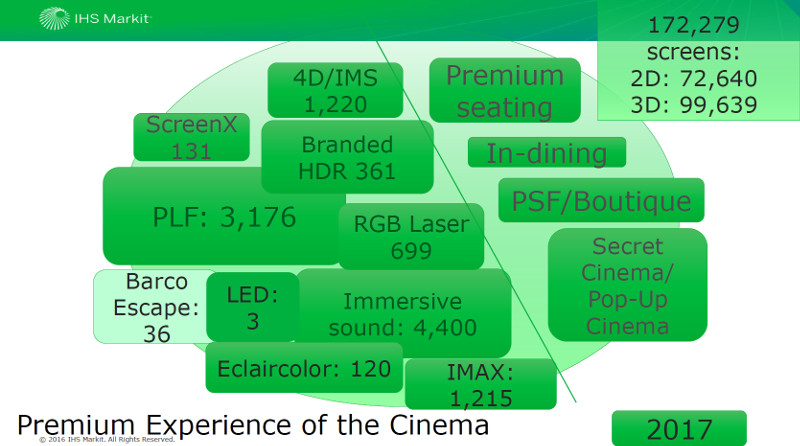

The chart below provides a nice summary of the growth of the market over the last five years in terms of total screens, admissions and 3D screens. Hancock noted that North America and Europe are now quite mature markets with moderate growth in 3D screens but low screen growth overall and falling admissions (in fact, they are at a 25-year low). The situation is quite different in other parts of the world where 3D and 2D screens are growing nicely as well as admissions. Asia is a particular bright spot. 3D remains the dominant screen format with about 100K 3D screens and 72K 2D screens globally with 3D films accounting for 17% of the global box office.

Looking to the future, the Chinese box office percentage will continue to increase rapidly reaching over 25% by 2021, about on par with North America, but bigger than Western Europe.

Turning to technology, Hancock said that cinemas need to innovate to remain relevant and they are turning to technology to help with that. The newest areas of focus are image and sound quality, analytics, 4D effects and motion seating, VR/AR and next generation cinema technology like LED screens, HDR and HFR.

In terms of the types of cinema screens, Hancock showed the following slide showing the makeup of the Premium Large Format (PLF) segment as of the end of 2017. ScreenX and Barco Escape are three-sided cinema experiences, but the Barco Escape theaters have now closed down. Lack of content seemed to have been a key issue but ScreenX seems to be doing OK and is securing new release content. RGB laser screens remain small at 699 while IMAX is now over 1200 screens. Éclair HDR screens have reached 120, while other branded HDR screens (IMax and Dolby Vision) account for 361 screens. Immersive sound screens are at 4400 with Atmos dominating this number. HIS breaks the 4D/IMS segment into two components: Motion and Extreme 4D. The latter adds elements like water, air, sent and other theme park ride elements to the experience. The 1220 screen are split even between these two segments.

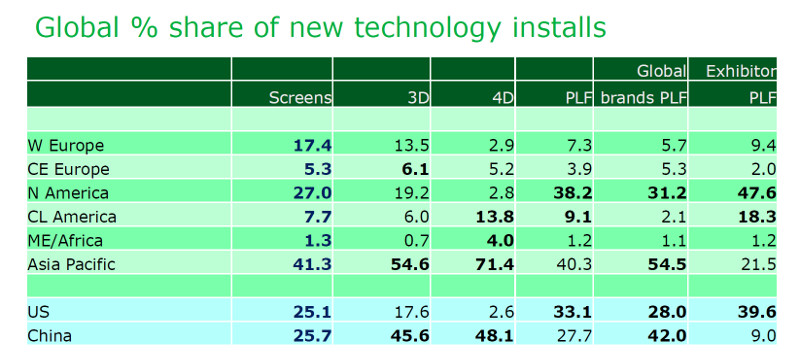

Globally, North America dominates installs of PLF theaters, with Asia Pacific dominating in 3D and 4D installs.

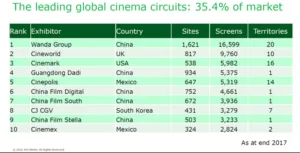

Consolidation of the exhibitor chains is a trend that is underway at the current time. The top 10 exhibitor groups account for 35% of the global box office in 2017. The top 10 only controlled 25% just a year earlier and this trend is expected to continue as the big get bigger. Consolidation as benefits as the film industry is a global business so scale can help with cross border marketing along with bigger bargaining power and analytics capability. – CC