According to a new IHS Market blog written by senior director of display technology David Hsieh, makers of AMOLED panels are setting their sights on the automotive space to serve up better display performance and greater flexibility in design, after staking out important positions in the TV and smartphone spheres.

The move into new territory is a practical one. AMOLED capacity is currently in oversupply because of smaller-than-expected panel demand from smartphones, a market where display panels are heavily exposed and almost saturated. In response to softening demand, panel makers are working to develop more AMOLED applications to consume the glut in capacity. This is where automotive comes in. Hsieh remarked:

“With their sup

erior images, AMOLED displays are perceived by consumers to provide higher value for their cars. For car OEMs, AMOLED can provide a slim, bendable form factor, with fast response times and high contrast ratios compared to TFT LCD, which are features highly appreciated in the automotive market, as they provide better display performance and more fluid designability”.

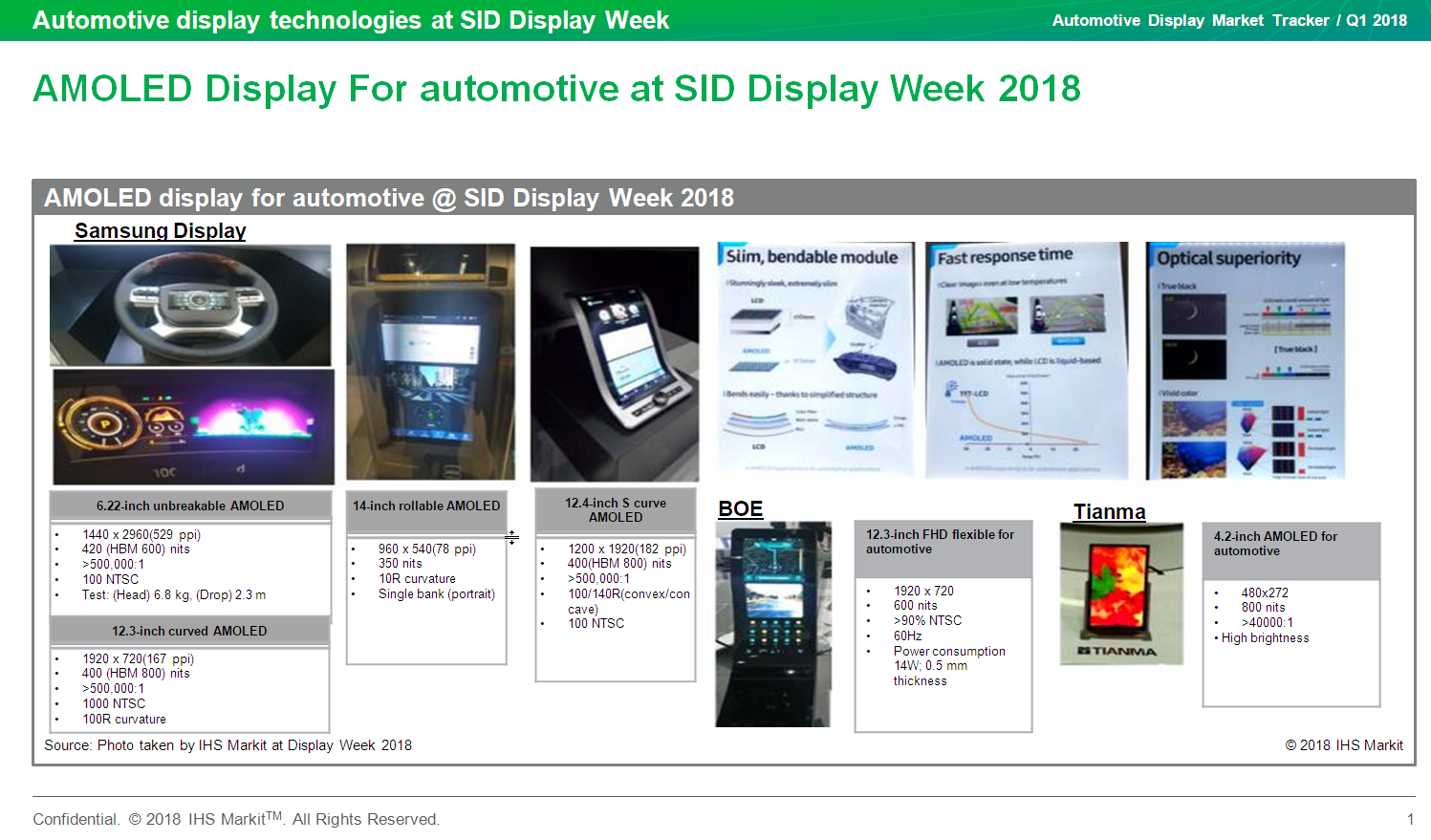

For these reasons, automotive has become a key growing market for the display industry. As seen in the graphic below, display makers showed various AMOLED products targeting the automotive sector.

AMOLEDs at SID Display Week – Click for higher resolution

AMOLEDs at SID Display Week – Click for higher resolution

Several car-makers have shown interest in AMOLED as automotive displays. Among them are Audi, Chrysler, Daimler, GM, Lexus, Mercedes-Benz and Toyota. For instance, in 2017, Audi adopted a 5.7″ full HD display in the A8 as a rear-seat remote display, but the upcoming Audi e-Tron will have two 7″ 1280 × 800 AMOLED display panels as side-mirror displays — both are rigid AMOLED supplied by Samsung Display.

The new interest surrounding AMOLED has not been lost on domestic Chinese automobile brands, which have recently started investigating AMOLED feasibility for future models.

However, automotive displays require higher reliability requirements and a longer development cycle than consumer electronic applications. Among the major challenges faced by AMOLED in the automotive market are colour-shifting over time and in high-temperature environments, as well as low brightness. Moreover, TFT LCD automotive display panel prices are dropping quicker than ever as more suppliers join the market, making AMOLED displays and their higher prices unpalatable in comparison.

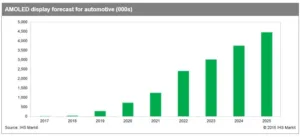

Overall, global shipments of AMOLED displays for the automotive market are forecast to reach 35,000 units this year. By 2021, worldwide shipments will exceed 1 million units, as shown in the chart below. An additional increase in shipments is expected in 2022 as more suppliers join the market.

The current leader in supplying AMOLED panels is South Korea as both LG and Samsung have been promoting AMOLED to auto-makers for many years. Samsung, which provided a small quantity of rigid AMOLED to the automotive sector in 2017 for rear-seat remote displays, is expected to ship side-mirror displays from its 4G A1 rigid AMOLED fab in late 2018. Samsung also plans to produce flexible AMOLED from its A2 fab line for automotive applications, but it doesn’t have any projects in development for now.

LG will be the second panel supplier to produce AMOLED for automotive, but unlike Samsung, LG is only at the development stage for flexible plastic OLED, manufacturing the material at the company’s E2 fab as samples. LG then plans to mass-produce at its E5 fab in the second half of 2019. AMOLED has become important to differentiate LG’s offerings from that of other panel suppliers and win the premium market.

For their part, Taiwanese panel suppliers lack the resources to invest in AMOLED and will focus instead on mini-LED or micro-LED solutions. JOLED, working with Denso, plans to deploy its inkjet printing technology for automotive displays in 2022. Chinese panel-makers are gradually ramping up capacity, aiming to join the small circle of AMOLED manufacturers in 2020. Chinese panel-makers that have shown interest in expanding their AMOLED business to the automotive sector include BOE, EverDisplay, Tianma and Visionox.

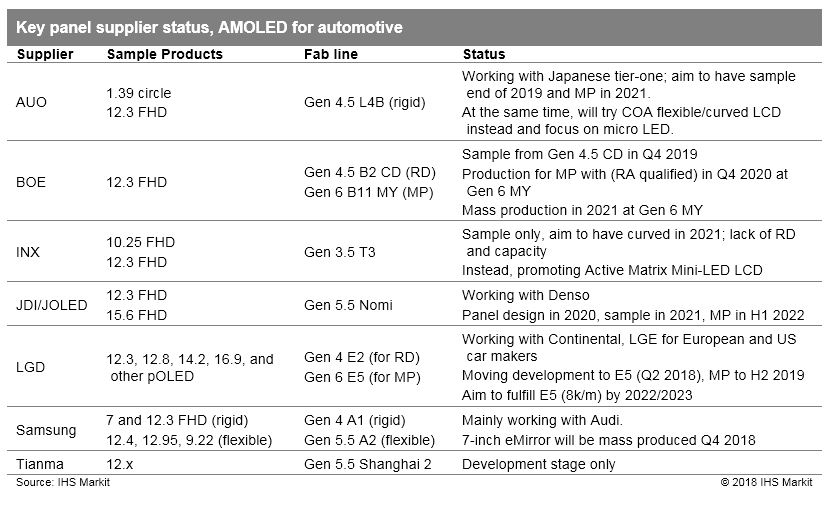

The table below shows the current suppliers of AMOLED products for automotive applications, as well as the fab lines of suppliers and the development status of specific products for use in the automotive sector.